On-chain data shows Litecoin has reached another milestone as the total number of HODLers on the network now exceeds five million.

Litecoin Long-Term Holders Have Continued To Rise In Number Recently

According to data from the market intelligence platform IntoTheBlock, LTC has seen its long-term holder count hit a new record this week. The firm defines “long-term holders” (LTHs) or HODLers as investors holding onto their coins since at least one year ago. Note that this cutoff for the LTHs differs from what some other analytics platforms use, usually around five to six months.

The chart below shows how the number of addresses owned by these LTH HODLers has changed over the past few years.

The value of the metric seems to have been going up in recent days | Source: IntoTheBlock on X

As displayed in the above graph, the Litecoin HODLer count has significantly increased during this period. Since the start of last year, in particular, the indicator has seen exponential growth.

Following this sharp rise, the number of addresses carrying coins since at least one year ago has now broken the five million mark, a new record for the cryptocurrency.

Interestingly, while the LTHs have grown in number during this period, the cryptocurrency price has mostly struggled. This shows that despite the poor price action, there has been growing confidence among a subset of holders who believe that the asset would be a profitable investment in the long term.

This is naturally a positive development for the cryptocurrency, as more LTHs mean more supply that’s locked inside the wallets of these resolute hands, which in turn implies a lesser possibility of selling occurring in the market.

LTC Price Has Continued To Struggle Recently

Since Litecoin finished its plunge in mid-August, its price has only moved sideways. When writing, the cryptocurrency is trading at around $63.

Looks like the coin hasn't been moving much recently | Source: LTCUSD on TradingView

While the Litecoin HODLers only going up in number through this slide since July is a constructive sign for the asset, it may not mean much in the short term.

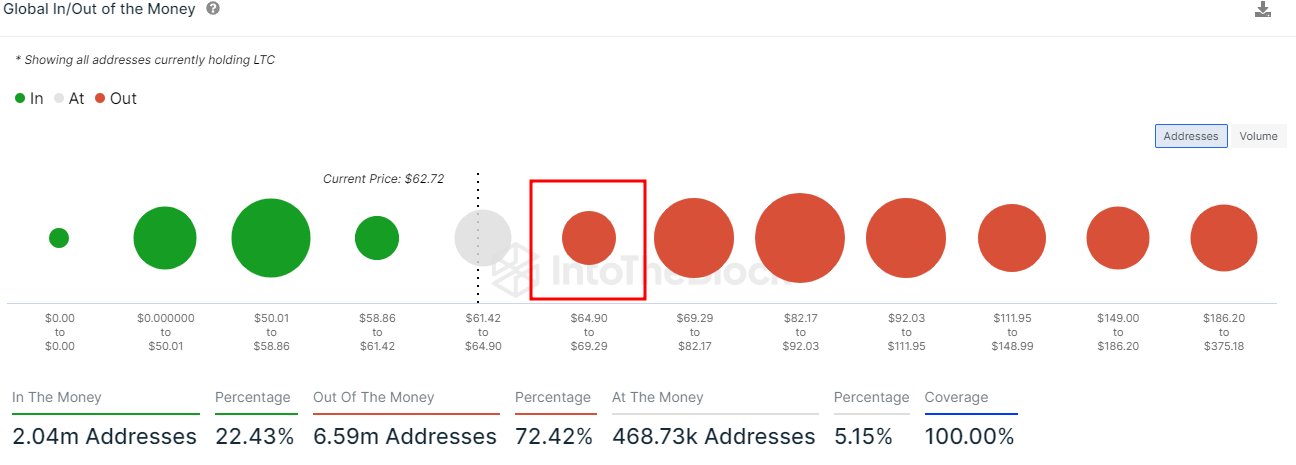

Where the LTC price could go next from here depends on several factors, one of which could be on-chain resistance and support levels. IntoTheBlock has shared the concentration of the investors at the different LTC cost basis price ranges.

Looks like the next range isn't that thick | Source: IntoTheBlock on X

The “cost basis” here refers to the price at which the investors bought their coins. In the above data, the dot for the $64.9 to $69.29 range, for instance, represents the percentage of Litecoin investors who bought at prices lying inside this range.

Generally, when the price surges to cost basis levels with a high amount of investor concentration, there is a chance that the asset could feel some resistance. This is because these investors, previously in losses, come into the green with the surge, which may entice them to sell and exit the market.

The range ahead of the current one looks to be not that concentrated with holders, which may mean that Litecoin wouldn’t find too much resistance if a surge toward the $69 mark has to happen. However, there are notable percentages of holders in the following few price ranges, making a further surge difficult.

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, IntoTheBlock.com

Credit: Source link