Amidst the dynamic crypto landscape, Bitcoin currently trades at $25,787, reflecting a subtle rise of 0.04 percent on Thursday. However, a confluence of factors has spurred speculations on its future trajectory. Notably, the ‘historic’ heatwave has taken a toll on the crypto mining industry, leading to a significant 9% drop in Marathon’s Bitcoin production.

Adding to the complexity are the alleged wallet addresses for Grayscale Bitcoin Trust, recently disclosed by Arkham. Meanwhile, in a bid to bring clarity to the financial markets, FASB has issued recommendations on marking cryptocurrency assets at their present values.

Amid these developments, financial commentator Peter Schiff has raised alarm bells, warning of a potential dollar collapse. He emphatically argues that the US can ill afford to distance itself from China in the current economic landscape.

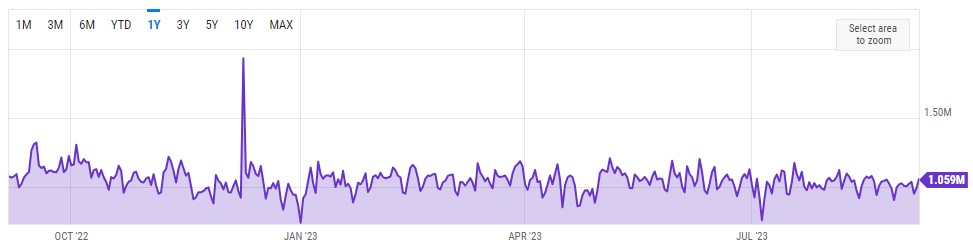

With Ethereum’s trading volume surging, one can’t help but ponder – is the reign of Bitcoin as the undisputed crypto leader under threat?

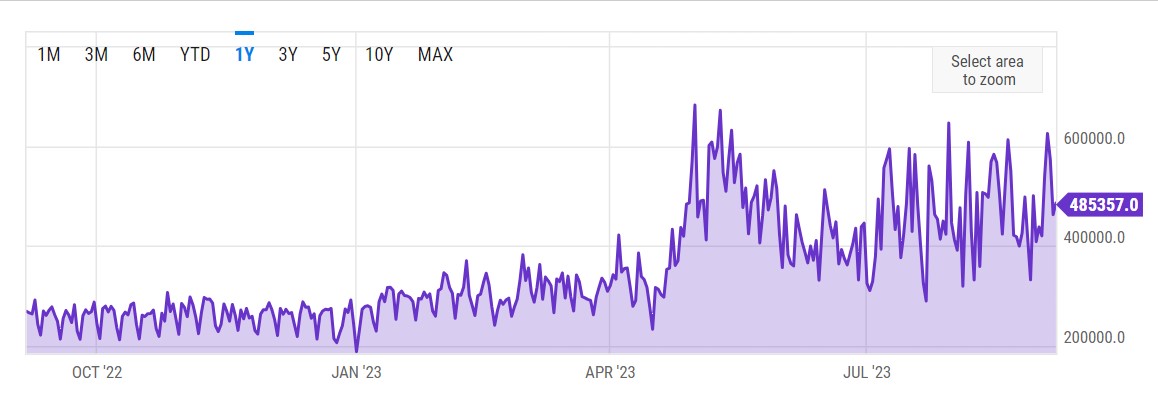

BTC Daily Trading Volume Falls Below Ethereum

Currently, Bitcoin’s daily transactions have reached 485,357, marking an increase of 5.03% from the previous day and a substantial 81.02% surge from the same time last year.

However, while Bitcoin’s transactions are growing, Ethereum seems to be gaining the upper hand in sheer volume.

Ethereum’s daily transactions stand at an impressive 1.059 million, although this is a 6.53% increase from yesterday, it’s down by 1.67% compared to last year.

As Bitcoin’s transaction count continues to rise but remains below that of Ethereum, a looming question arises: Could Ethereum’s trading volume eventually surpass that of Bitcoin, challenging its dominant position?

It’s essential to remember that trading volume is just one metric, and the broader cryptocurrency market’s sentiment and external factors will also play decisive roles in this evolving narrative.

Let’s take a look at other fundamentals impacting BTC.

Heatwave’s Impact: Marathon’s Bitcoin Production Dips by 9%

Marathon Digital, a leading US-based crypto mining firm, experienced a 9% decrease in Bitcoin production in August 2023 due to shutdowns in Texas caused by extreme heat. However, they still produced a commendable 1,072 Bitcoin (BTC), marking a fivefold increase from the previous year.

In their most recent report, Marathon demonstrated consistent growth, increasing their US operational hash rate by 2% to 19.1 exahashes and their installed hash rate by 1% to 23.1 exahashes, largely attributed to equipment upgrades. Having achieved 23 exahashes domestically, their target now stands at 30 exahashes. They intend to procure two exahashes from international facilities and secure the remainder through contracts.

While the firm showcases promising growth, they’re not without challenges. A pending class-action lawsuit and a recent sell-off of Bitcoin miners could impact Marathon’s financial trajectory, especially since they depend on Bitcoin sales to offset expenses. The company is poised at a pivotal juncture, needing to navigate growth, environmental concerns, and legal complexities in the upcoming months.

Arkham Reveals Suspected Wallet Addresses Linked to Grayscale Bitcoin Trust

Blockchain analytics firm Arkham Intelligence has reportedly unveiled that the wallet addresses associated with the Grayscale Bitcoin Trust makes it the world’s second-largest BTC entity. According to Arkham, these addresses comprise over 1,750 wallets holding a combined total of more than $16 billion worth of Bitcoin (BTC).

This revelation comes after much speculation within the Bitcoin community about where Grayscale stores its substantial BTC holdings. Grayscale has previously declined to disclose its wallet addresses, citing security concerns. Some critics have questioned the trust’s actual BTC holdings. Let’s have a look at Bitcoin’s price prediction.

Bitcoin Price Prediction

Bitcoin struggles to regain its position above the $26,200 threshold. Even though it tried to rally from $25,350, the digital currency failed to breach this critical level, hinting at a bearish outlook.

Currently, BTC’s price hovers below the $26,000 mark, and a notable bearish trend line exists, with resistance close to $25,650.

The significant barriers lie at $26,000 and $26,200. A successful surge past $26,200 could set sights on levels around $26,500 and $27,000.

On the flip side, if Bitcoin doesn’t cross the $26,000 mark, it might face a downturn, with strong support found at $25,350 and $25,000. A descent beneath $25,000 might see the price gravitating towards $24,500.

Top 15 Cryptocurrencies to Watch in 2023

Explore our meticulously chosen collection of the top 15 digital assets to watch in 2023 to stay updated on the latest initial coin offering (ICO) projects and alternative cryptocurrencies.

This list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

As you navigate the ever-changing world of digital assets, stay ahead of the game and discover the potential of these cryptocurrencies.

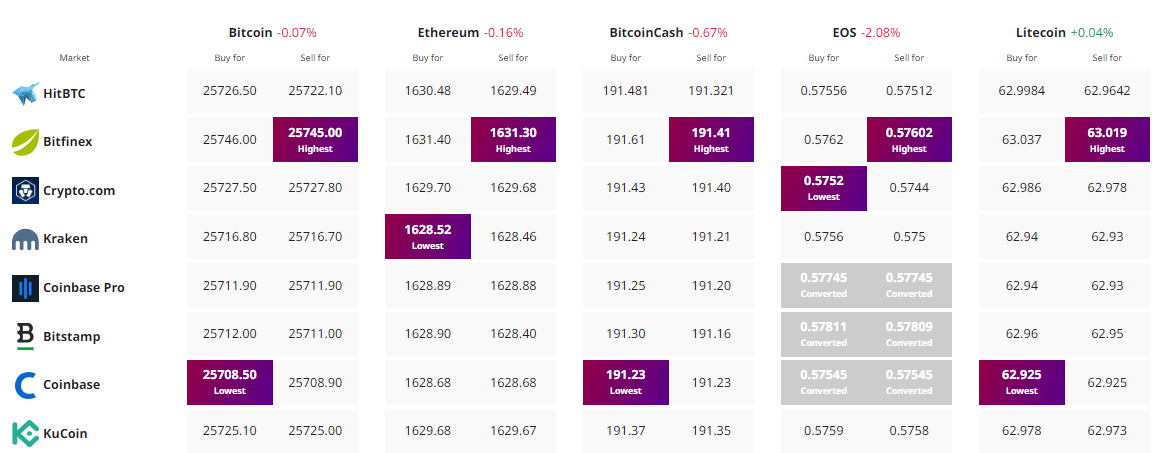

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Credit: Source link