In the midst of ongoing market fluctuations, the outlook for Bitcoin (BTC) remains a topic of intense speculation.

As bears exert pressure and keep the price below the critical $30,000 level, traders and investors are closely monitoring the next potential moves.

With the market dynamics at play, the future trajectory of BTC remains uncertain.

However, amidst these developments, it’s worth noting that the recent SEC appeal regarding Ripple’s XRP decision is not perceived as a ‘setback,’ according to insights from a crypto lawyer.

As we delve deeper into the analysis, we aim to shed light on the possible scenarios and factors that could influence BTC’s next moves.

Ripple XRP’s Legal Triumph Unfazed by SEC Appeal, Says Crypto Lawyer

According to cryptocurrency attorney John Deaton, the recent appeal filed by the Securities and Exchange Commission (SEC) in its lawsuit against Ripple Labs does not pose a serious setback to Ripple’s legal victory.

Since 2020, when the SEC accused Ripple of conducting unregistered securities offerings and raising $1.3 billion, the company has been embroiled in a legal battle with the regulatory agency.

Gary Gensler, the chair of the SEC, expressed disappointment with certain aspects of the ruling, which could have far-reaching implications for other tokens facing regulatory scrutiny.

Deaton believes that the 2nd Circuit’s ruling is unlikely to be delivered for another two years. Until then, the “Torres Decision” remains the prevailing law.

In a tweet, Deaton emphasized that the appeal would create greater challenges for the SEC.

He noted that compared to demonstrating a joint business relationship under the Howey Test, proving an expectation of profit from the efforts of others is significantly more difficult for the SEC.

This statement by Deaton helped mitigate further losses in BTC value on Monday.

Bitcoin Price Prediction

The BTC/USD technical analysis indicates that Bitcoin is currently undergoing a bearish correction, with the price dropping to the $28,900 level.

This decline has breached the narrow trading range we discussed during the Asian session, which was between $31,400 and $29,600.

The break below the $29,600 level has created further selling pressure, potentially driving Bitcoin’s price down to the $28,000 level.

If the bearish momentum persists, there is a possibility for Bitcoin to drop even further, reaching the $27,700 level.

On the upside, a bullish breakout above the $29,500 level could open the door for Bitcoin to move toward the $30,300 level. If this bullish momentum continues, Bitcoin may target the $31,150 level.

It’s important for traders to closely monitor these key levels to gauge the potential price movements and make informed trading decisions.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest happenings in initial coin offering (ICO) projects and alternative cryptocurrencies with our carefully curated selection of the top 15 digital assets to watch in 2023.

This comprehensive list, compiled by industry experts from Industry Talk and Cryptonews, offers professional recommendations and invaluable insights.

By regularly exploring this meticulously crafted collection, you can stay ahead of the competition and gain a deeper understanding of the potential these cryptocurrencies hold.

Navigate the dynamic landscape of digital assets with confidence and seize opportunities to maximize your investment strategies.

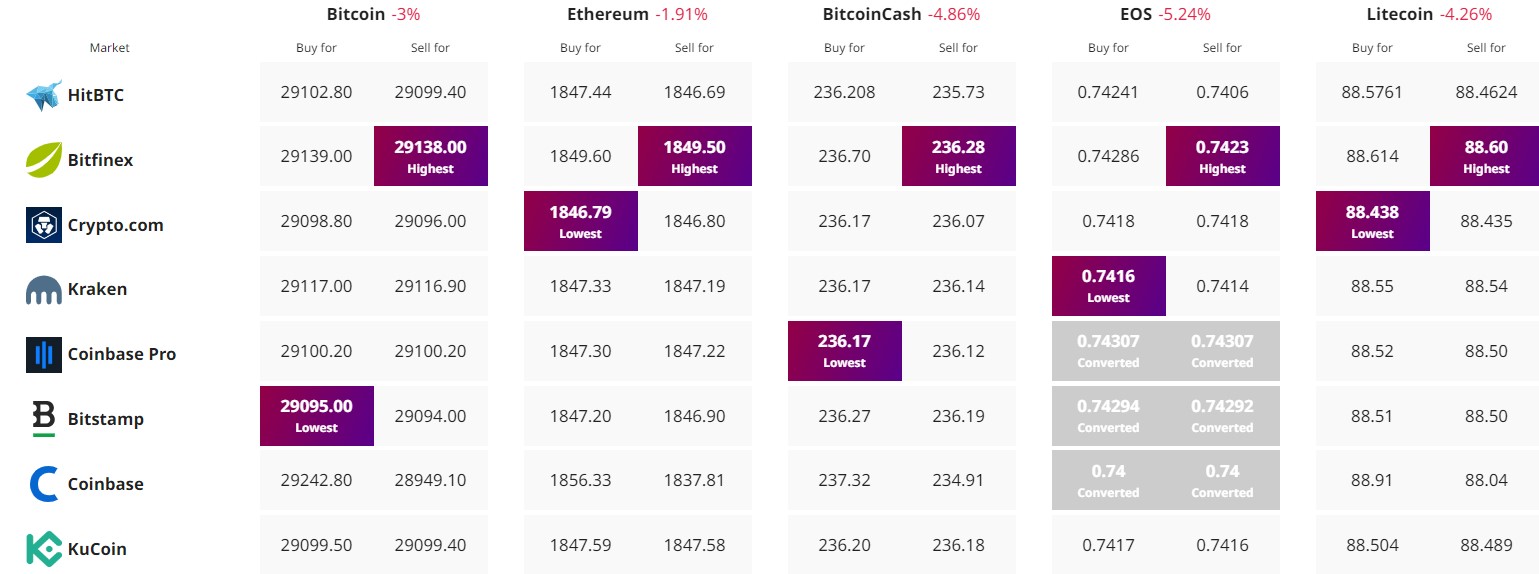

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Credit: Source link