Amidst the dynamic and ever-changing landscape of the cryptocurrency market, Bitcoin’s recent performance has been under scrutiny.

Currently trading at 29,890, the world’s leading digital currency has experienced a slight decrease of nearly 0.25% on Sunday.

However, what has drawn significant attention is the notable drop in its trading volume, which has now fallen to $5 billion within 24 hours.

In this Bitcoin price prediction, we will explore the factors contributing to this decline in trading volume and its potential implications for Bitcoin’s future price predictions.

Additionally, the UK court’s acceptance of Craig Wright’s appeal in the Bitcoin rights dispute and the anticipation surrounding the halving event further add complexity to the current state of Bitcoin’s market.

UK Court Accepts Craig Wright’s Appeal in the Bitcoin Rights Dispute

On July 20, a British court made a significant decision by upholding an appeal that allows Craig Wright to pursue his claim that the Bitcoin file format is eligible for copyright protection.

Craig Wright has been asserting since 2016 that he is the creator of Bitcoin. He alleges copyright infringement on the Bitcoin white paper, its file format, and database rights related to the Bitcoin blockchain in his complaint.

The defendants in the lawsuit include 13 Bitcoin Core developers and various businesses, such as Blockstream, Coinbase, and Block.

The decision to permit Wright’s arguments to be heard in court has raised concerns, not only within the crypto community but also worldwide.

The Bitcoin Law Defense Foundation (BLDF) expressed its worry over the situation, stating that it could set a dangerous precedent for open-source software development.

According to the BLDF, allowing developers to be sued for modifying the file format of open-source software based on someone else’s claim of authorship poses a significant threat to the principles of collaborative development and innovation in the technology industry.

However, the potential of such legal disputes has created uncertainty and negative sentiment in the crypto community, influencing BTC market behavior and keeping its value under pressure.

Bitcoin’s Declining Prices Amidst Anticipation of Halving Event

The declining prices of BTC can be attributed to the upcoming block reward halving event, scheduled to occur in less than 280 days.

During the fourth reward halving event, the Bitcoin network’s block subsidy will be reduced from 6.25 BTC to 3.125 BTC.

Reward halving events occur approximately every four years, aiming to create scarcity in Bitcoin by cutting the number of newly issued Bitcoins to miners in half.

As a deflationary asset, the limited total supply of 21 million Bitcoins is one of the factors contributing to its value.

The halving event poses several implications for miners and the network.

With reduced block rewards, some miners may find their operations becoming less profitable or unprofitable, leading to a potential decrease in network security and stability as miners may exit the network.

To continue securing the network and maintain revenue, miners may prioritize transactions with higher fees as transaction demand rises and Bitcoin gains wider acceptance.

However, a delicate balance exists as excessively high transaction fees could deter everyday users, limiting Bitcoin’s adoption as a medium of exchange.

The anticipation and speculation surrounding the halving event also impact market sentiment and prices.

As investors and participants anticipate the effects of the halving on Bitcoin’s price, it can lead to increased attention and pressure on miners.

Bitcoin Price Prediction

As of Sunday, Bitcoin is currently displaying a lack of volatility, resulting in choppy movements within its trading range.

On the daily timeframe, Bitcoin is in a consolidation phase, confined within a narrow range. Resistance is identified at approximately $31,400, while support is found around $29,600.

A crucial factor to watch is whether Bitcoin can close decisively above the $29,600 level, as this could potentially trigger a bullish move for the cryptocurrency.

However, if there is a clear break below $29,600, Bitcoin might find support around $28,450, and possibly even lower towards $27,450.

For upward movement, surpassing the $31,350 level would set the stage for the next significant target at around $32,500.

Given these price levels, it is essential to closely monitor the $29,600 level as a pivotal point for today’s trading activities.

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself updated on the latest developments in initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our meticulously curated collection of the top 15 digittal assets to watch in 2023.

This thoughtfully compiled list has been crafted by industry experts from Industry Talk and Cryptonews, guaranteeing professional recommendations and valuable insights.

Stay ahead of the competition and uncover the potential of these cryptocurrencies as you navigate the dynamic landscape of digital assets.

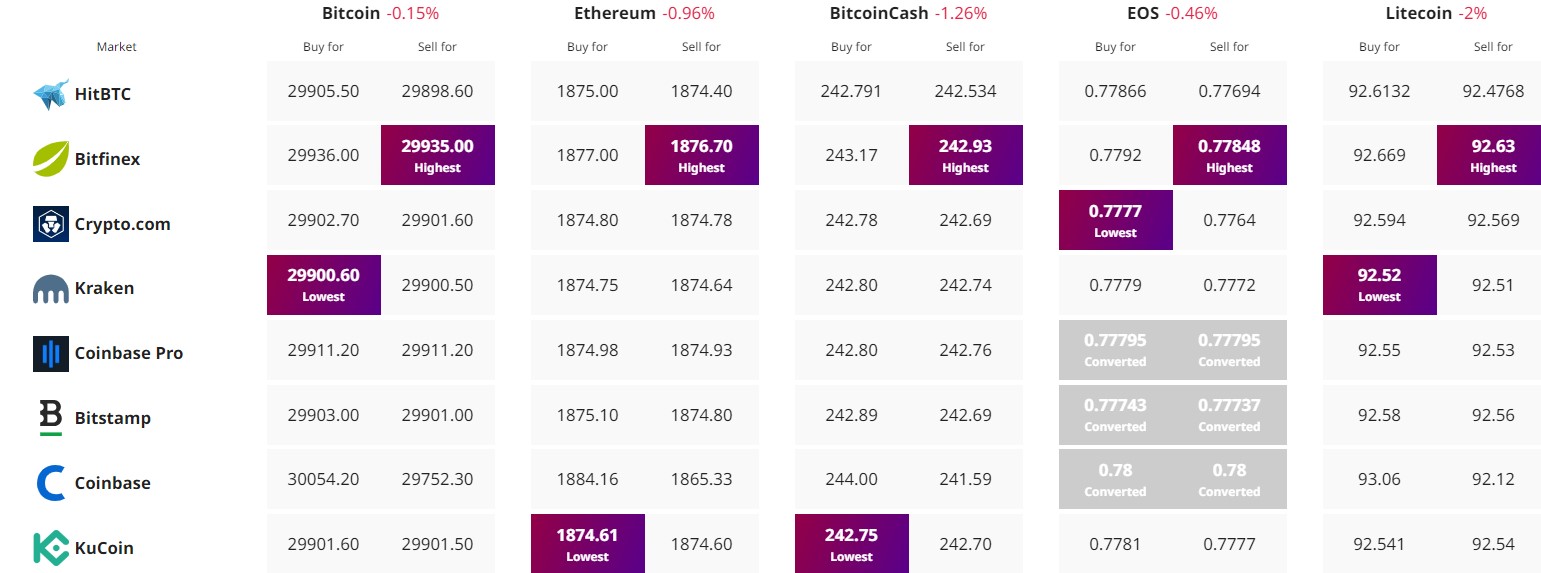

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Credit: Source link