Nasdaq, the premier tech-based stock exchange in the US, announced on Wednesday that it has put its highly anticipated cryptocurrency custody service on hold due to changing regulatory conditions.

Similar to other traditional financial institutions, Nasdaq’s decision reflects a growing reluctance to delve into cryptocurrency ventures amidst increased regulatory scrutiny from US regulators.

In view of the prevailing macroeconomic conditions, what are the best cryptos to buy now?

For some time, Nasdaq has been at the forefront of traditional financial markets in its pursuit to craft a crypto solution that could cater to the needs of its institutional clientele.

However, plans to unveil custody services for cryptocurrency, a key feature of the digital asset division launched last September, have been shelved due to mounting regulatory ambiguity.

Nasdaq’s chief executive, Adena Friedman cited this regulatory uncertainty as the key reason for their decision during an earnings call on Wednesday, .

She stressed the company’s preference for operating within clearly delineated regulatory frameworks, noting that recent shifts in both the market opportunity and regulatory landscape contributed to their decision to postpone the launch.

According to Charley Cooper, ex-chief of staff at the CFTC, the Nasdaq move implies a significant hitch.

“The industry needs credible custodians, and Nasdaq, with its widespread recognition and regulatory respect, dropping out will make it more challenging for smaller players hoping to establish their own custody services,” he explained.

Though Nasdaq had plans to provide safekeeping services for Bitcoin and Ether, the two leading cryptocurrencies, by the end of June, this goal will now be redirected to assist clients with potential exchange-traded funds tied to crypto assets.

As it stands, several fund managers, BlackRock included, are vying for approval for ETFs based on Bitcoin’s spot price.

With the current state of the cryptocurrency market, Flex Coin, Evil Pepe Coin, Stellar, Burn Kenny, and Cardano are some of the best cryptos to buy now, thanks to their strong fundamentals and/or favorable technical analysis.

FLEX hits new year-to-date high: what’s next for the cryptocurrency

With Flex Coin (FLEX) hitting a new year-to-date high of $4.761 earlier today, it’s clear that it’s a player worth watching.

In spite of registering an intraday low of $4.014 following selling pressure, FLEX is showing signs of a comeback, trading at $4.651, marking only a 1.85% decline so far.

The 20-day EMA, a tool frequently used to spot short-term price trends and reversals, currently sits at $3.448.

This is notably above the 50-day EMA at $2.765 and the 100-day EMA at $2.077, hinting at a positive price trend for FLEX.

Further evidence for the bullish trend is provided by the RSI, a popular momentum oscillator.

While it has slightly decreased to 67.68 from yesterday’s 69.10, it’s still well above the typical ‘overbought’ threshold of 70.

While this could signal potential overvaluation, it can also suggest a strong bullish momentum in the near term, especially when combined with the other indicators.

One of the most compelling signals for a bullish case comes from the Moving Average Convergence Divergence (MACD) histogram.

With a reading of 0.045 from yesterday’s -0.008, we’re witnessing a newly formed bullish MACD crossover.

This crossover is often considered a strong buy signal, suggesting that upward momentum may continue in the immediate future.

However, even with these bullish indications, traders must also consider resistance and support levels.

FLEX has established today’s intraday high (and new all-time high) of $5.029 as an immediate resistance level. This suggests that breaking above this level may require significant buying pressure.

On the flip side, the immediate support is found at the Fibonacci 0.236 level at $3.588, followed by the trailing 20-day EMA at $3.448.

If FLEX can hold above these levels, it reinforces the strength of the current uptrend. If not, we might see a pullback.

The technical indicators suggest that FLEX has maintained a bullish momentum, despite today’s minor dip.

Traders should carefully watch these indicators and support/resistance levels for possible entry and exit points in the coming sessions.

This analysis does not replace individual research and risk assessment, but it gives investors a clearer picture of the short-term outlook for Flex Coin.

Evil Rising: Pepe Coin’s Sinister Sibling, A Potential Best Crypto to Buy?

Call it sinister or audacious, but the hype surrounding Evil Pepe Coin is infectious.

Surpassing the $120,000 mark in its presale, this intriguing meme coin has caught the eye of crypto enthusiasts expecting substantial returns.

Evil Pepe Coin wants to replicate the success of Pepe Coin, which was the most successful meme coin of 2023.

To achieve this, Evil Pepe Coin plans to raise $1.996 million by selling 90% of the total $EVILPEPE token supply during its presale.

The team behind Evil Pepe Coin is no stranger to success in the crypto sphere. With their previous tokens, Thug Life Token ($THUG) and SpongeBob ($SPONGE), they have already demonstrated a knack for achieving impressive gains, a record they hope to sustain with $EVILPEPE.

Drawing attention towards itself, Evil Pepe Coin is being covered by prominent crypto news websites, causing quite a stir in the industry.

Once launched, this token’s current market cap of $2 million is projected to escalate.

Evil as it may seem, the $EVILPEPE team prioritizes its community. A significant 90% of its token supply is available in the presale.

The remaining 10% will be locked for a month post-launch to facilitate smooth trading conditions on the Ethereum blockchain, eliminating the risk of large token dumps by the team.

With ambitious goals and a clear vision, Evil Pepe Coin strives to achieve a market cap of $100 million.

With a vibrant community and a penchant for pushing boundaries, this token might prove to be a worthy contender in the meme coin arena.

So, while the presale is on, consider if $EVILPEPE might be the best crypto to buy for your portfolio.

Visit Evil Pepe Coin now

Bullish Signals Abound for Stellar’s Xlm

Stellar’s native cryptocurrency, XLM, is currently demonstrating a dynamic shift in market sentiment.

After a consolidation period above the current swing-low support range of $0.1245 and $0.1275, and multiple rejection at the Fib 0.618 level at $0.1343 from July 14 to July 18, XLM is experiencing an assertive breakout.

With an impressive 20.47% upward move so far today, it currently trades at $0.1595, generating a sense of enthusiasm among market watchers.

The exponential moving averages (EMA) – 20-day EMA at $0.1184, 50-day EMA at $0.1050, and 100-day EMA at $0.0988, all indicate a bullish momentum. These averages are now significantly beneath the current price, signifying a strong uptrend.

The RSI has also spiked to 72.38, up from yesterday’s 63.41. This suggests that buying pressure is increasing, potentially pointing to a continuation of the current uptrend.

Additionally, the MACD histogram has risen to 0.0039 from yesterday’s 0.0025. This upward tick in the MACD histogram signifies the presence of bullish momentum, providing further confirmation of the current positive trend.

The dramatic surge in market capitalization and trading volume also provides essential corroboration to the technical analysis.

With the market cap reaching $4.315 billion, up by 24.05% so far today, and the trading volume exploding to $705 million, an increase of 346.76%, it’s clear that investor interest in XLM has spiked.

Yet, traders should keep a keen eye on key resistance and support levels. The immediate resistance is the Fib 0.236 level at $0.1735, a price point that could prove challenging to overcome.

Meanwhile, support is at the Fib 0.382 level at $0.1586, followed by the Fib 0.5 level at $0.1465. These will serve as crucial levels for traders to watch for signs of a potential reversal or continuation of the current bullish momentum.

XLM’s recent uptick and the bullish signals from multiple technical indicators suggest a favorable short-term trading environment.

Ashes to Assets: Burn Kenny Rises as the Next Best Crypto to Buy

Burn Kenny ($KENNY) has emerged from the shadows of its South Park-themed counterpart, Mr. Hankey Coin, ready to carve out its own success story in the crypto universe.

Drawing on the meteoric success of Mr. Hankey Coin, which recorded a 174% return from its presale price, Burn Kenny seeks to take center stage.

With its presale set for Thursday, 20th July, at 6 pm CET, Burn Kenny is rumored to outperform its predecessor, predicting a sell-out within just 5 hours.

The token’s unique burn mechanism is expected to ignite the market, with a 30% burn of the total token supply set to take place over the course of three days post-listing.

40% of the token supply is slated for presale, with an additional 30% of the total supply secured for liquidity.

Once Burn Kenny is listed on the Uniswap DEX, this liquidity provision will enable seamless execution of trades.

The reason for Burn Kenny’s popularity is not limited to its deflationary design alone.

The token also derives advantages from its affiliation with South Park, a widely acclaimed animated comedy series with a long-standing fan base, making it one of the most successful shows of its kind in history.

To take part in Burn Kenny’s presale, you’ll need to have Ethereum. To get started, head over to Burn Kenny’s website and connect your wallet.

Once connected, you can select the number of tokens you wish to purchase. After completing these steps, you’ll be ready to dive into the exciting world of Burn Kenny.

Visit Burn Kenny Now

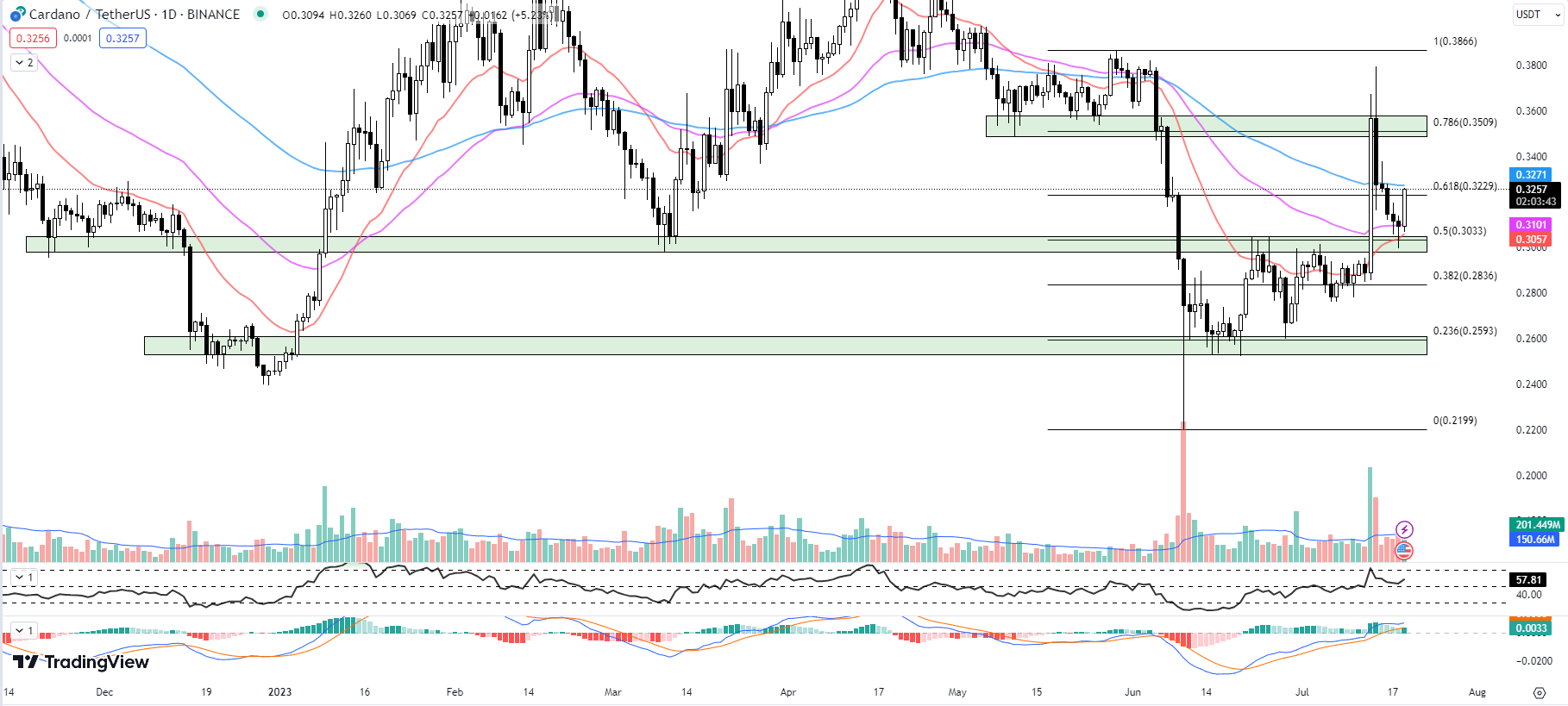

Cardano (ADA) Shows Signs of Bullish Momentum After Four Days of Losses

Following a week of bearish sentiment, Cardano (ADA) now seems to be in recovery, as it trades up by 5.23% so far today at $0.3257.

After four consecutive days of losses, the cryptocurrency appears to be bouncing off crucial support levels defined by the 20-day and 50-day EMAs, suggesting an evolving short-term bullish bias.

The 20-day EMA, currently standing at $0.3057, along with the 50-day EMA at $0.3101, have acted as substantial support for the ADA.

It is imperative for traders to monitor these levels as they have successfully halted the crypto’s decline, potentially sparking a trend reversal.

In particular, the price lift above the 50-day EMA highlights the changing market dynamics, which are gradually tilting toward the bulls.

Additionally, the RSI has risen from yesterday’s 52.63 to today’s 57.81, indicating a surge in buying pressure.

This rise signifies an increasing bullish momentum and underscores the growing interest in ADA.

The MACD histogram is also providing some optimistic clues, moving slightly upwards to 0.0033 from yesterday’s 0.0032.

This marginal increase indicates that buyers are gaining strength, but the battle is far from over.

Traders should keep an eye on this key momentum oscillator for any sign of an increase in buying power.

However, ADA’s recovery is not without hurdles. It faces immediate resistance from the 100-day EMA at $0.3271.

The cryptocurrency’s price will need to break and consolidate above this level to confirm its bullish trajectory.

On the downside, robust support lies between $0.2981 to $0.3050, a zone that aligns with the Fib 0.5 level at $0.3033 and the 20-day EMA.

This area is crucial for ADA, as a break below could lead to further losses.

ADA’s current technical indicators suggest a newly forming bullish trend.

However, traders should remain cautious and consider both the potential upside and downside.

The imminent test of the 100-day EMA as resistance, and the strength of the identified support zone, will play a crucial role in shaping ADA’s immediate future.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Credit: Source link