As BlackRock, one of the world’s largest asset management companies, files for a spot Bitcoin exchange-traded fund (ETF), speculation arises about the potential impact on Bitcoin’s price.

The anticipation of regulatory authorities’ approval for such an ETF has led to discussions among investors and analysts regarding the possibility of Bitcoin reaching the significant milestone of $100,000.

In this Bitcoin price prediction, let’s delve into the factors driving this speculation and examines the potential implications for Bitcoin’s price if the spot Bitcoin ETF is approved.

BlackRock Files for Bitcoin ETF: Potential Breakthrough in Regulatory Approval for Crypto Investments

BlackRock, the largest asset manager globally, has filed for a bitcoin exchange-traded fund (ETF) in a move to provide investors with exposure to the cryptocurrency.

The filing with the US Securities and Exchange Commission (SEC) reveals that BlackRock’s iShares Bitcoin Trust plans to use Coinbase Custody as its custodian.

However, the SEC has yet to approve any applications for spot bitcoin ETFs, and the cryptocurrency industry has faced increased scrutiny from regulators, as seen in recent lawsuits against major exchanges Coinbase and Binance.

BlackRock’s filing is seen as a potentially positive development in the quest for regulatory approval, reflecting continued public interest in crypto.

The Impact of BlackRock’s Bitcoin ETF Filing on the Price of Bitcoin

The filing by BlackRock for a Bitcoin ETF can have a significant impact on the price of Bitcoin.

If the ETF is approved by the US Securities and Exchange Commission (SEC), it would open up a new avenue for investors to gain exposure to Bitcoin.

This could attract more institutional investors and funds, leading to increased demand for Bitcoin.

The increased demand, coupled with the limited supply of Bitcoin, could potentially drive up its price.

Bitcoin Price Prediction

Bitcoin is gaining momentum after finding support around the $24,750 level. The formation of a hammer candlestick pattern suggests that selling pressure is weakening.

The relative strength index (RSI) and moving average convergence divergence (MACD) indicators are both in the oversold zone, indicating a potential reversal in price.

On the four-hour timeframe, Bitcoin has completed a 61.8% Fibonacci retracement around the $25,850 level.

A downward trendline near the $26,000 level may act as resistance. The RSI crossing above the 50 levels and the MACD closing above zero suggest a shift from bearish to bullish sentiment.

Additionally, the crossover of the 50-day exponential moving averages further supports an upward trend.

If Bitcoin breaks above the $26,000 resistance level and closes candles above the downward trendline, it could target the next resistance levels at $26,200, $26,600, or even higher towards $26,800.

On the other hand, if Bitcoin breaks below the $25,500 level, it may find support around $25,160 or $24,750.

Today’s pivot point is likely to be around the $26,000 level, and a failure to break above the downward trendline could lead to a bearish trend in Bitcoin prices.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

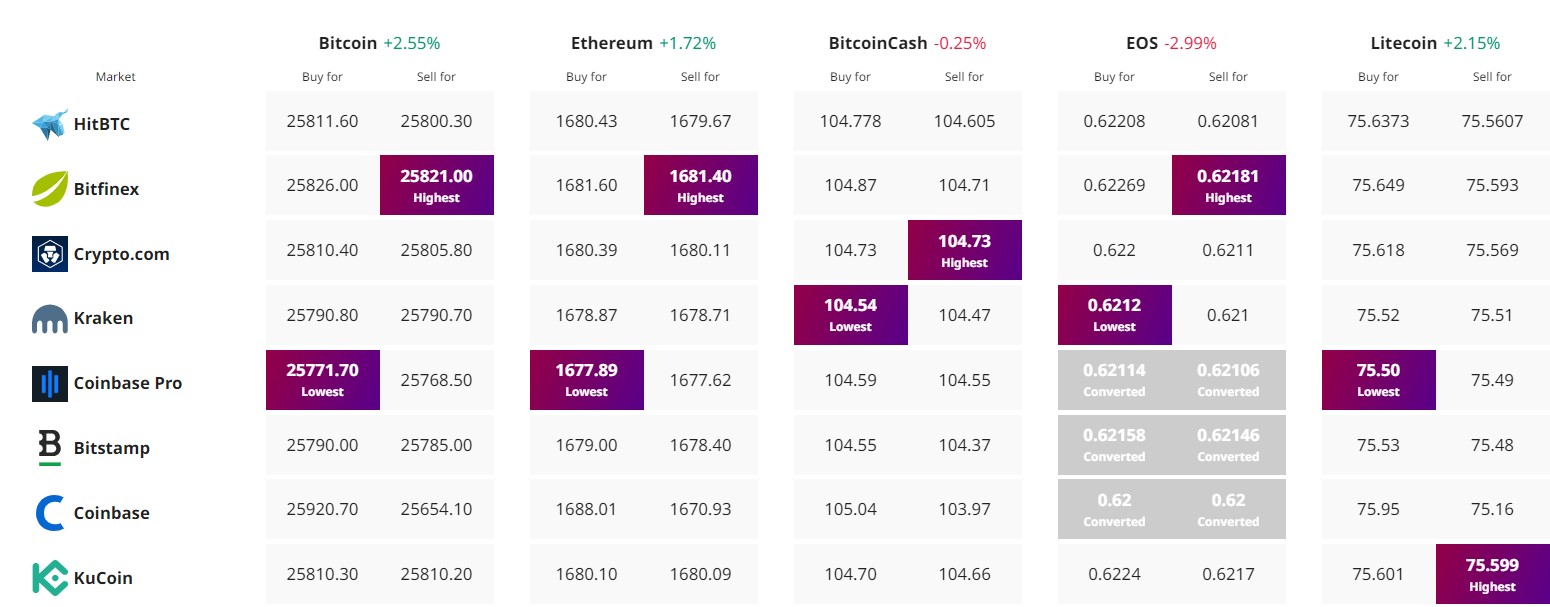

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Credit: Source link