Recent market data shared by Glassnode, a cryptocurrency on-chain analytics platform, suggests the Bitcoin (BTC) has reached its top for the cycle yet, given that the rate of BTC accumulating is still increasing especially amongst Long Term Holders (LTHs) and miners.

Bitcoin’s Top is Not in Yet

Over the past few days, some people had panic-sold their Bitcoin following the recent drop of Bitcoin’s price below the $50,000 USD. Since the correction, the cryptocurrency is yet to reclaim the $60,000 USD level, which spurred some sentiment that Bitcoin’s top is in. However, Bitcoin’s LTH accumulating rate and miners’ net position change suggest otherwise.

In a tweet on Thursday, the analytics platform noted that Bitcoin accumulated back in 2020 is still increasing and that the BTC supply held by the long-term holders is up by over 67 percent. The Bitcoin positions of LTHs need to decline significantly in order to put the top in for the leading cryptocurrency, according to Glassnode.

Miner Are Not Selling Either

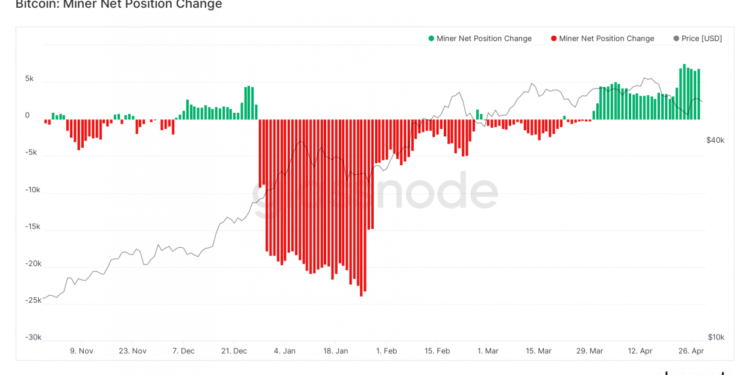

A separate data from Glassnode also confirmed that Bitcoin miners have been accumulating Bitcoin. Despite the recent dip, the accumulation rate for miners increased even further, as seen in the net position change below.

Miners were known as sellers, as they needed to sell their Bitcoin mining rewards to cover expenses incurred during operation. However, they have been HODLing their rewards for the past month. This trend somewhat indicates that miners are still bullish on the cryptocurrency over the long term.

Another cryptocurrency analytics platform, Santiment, confirmed this growing rate of accumulation among BTC whale investors, precisely BTC addresses HODLing at least 10,000 BTC. About 90,000 BTC has been added to these addresses since April 5.

Join in the conversation on this article’s Twitter thread.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link