The cryptocurrency market has been experiencing a lot of turbulence lately, with both Bitcoin and Ethereum struggling to gain momentum.

Bitcoin is currently facing bearish pressure and struggling to stay above the $27,750 support level, leading many traders to speculate whether more sell-offs are on the way.

Meanwhile, Ethereum has failed to break above the $1,850 resistance level, leaving investors wondering if there’s more downside ahead.

In this price prediction, we’ll take a closer look at the current state of both Bitcoin and Ethereum and provide some predictions on where the market may be heading.

Bitcoin Price Falls for Fourth Consecutive Day as Binance Withdrawals Cause Blockchain Congestion

According to CryptoQuant, a research firm, Binance, the largest cryptocurrency exchange, moved over $4 billion worth of Bitcoin between its crypto wallets.

This high volume of transactions resulted in congestion on the blockchain, causing Binance to halt BTC withdrawals twice in 24 hours.

The congestion also led to a surge in transaction fees, which surpassed the block rewards for the first time since 2017.

Typically, miners receive a reward equal to approximately 6.25 bitcoin, but the congestion increased the fee to 6.7 bitcoin, surpassing the block reward for the first time in six years.

On Monday, the Bitcoin Mempool reached about 98% capacity, leading to congestion, and higher transaction fees, and halted BTC withdrawals.

The Mempool is where unconfirmed transactions on the Bitcoin blockchain network are stored before being confirmed by miners.

Miners typically prioritize transactions with higher fees, resulting in larger transaction sizes and lower fee transactions being left in the Mempool for longer periods of time, leading to congestion.

The negative news and FUD surrounding Binance caused the price of Bitcoin to drop by approximately 4.5% in just three days, falling below the $28,000 mark.

Bitcoin Price

On May 9th, Bitcoin’s price continued to drop for the fourth day in a row, reaching $27,626, which is a decrease of nearly 2% over the past 24 hours.

From a technical standpoint, Bitcoin is facing a major hurdle of around $27,750.

If it falls below this level, Bitcoin could form a Doji candlestick pattern, which suggests that the bullish bias is weakening and sellers may dominate the market, especially if Bitcoin closes below the support level in the two-hourly timeframe.

On the other hand, Bitcoin’s immediate support level remains around $27,226. If the downward trend continues, Bitcoin’s price could potentially drop to $26,500 and $26,000.

Buy BTC Now

Ethereum Price

The current price of Ethereum is $1,845, and it experienced a slight decline of nearly 2% in the past 24 hours.

On the technical front, Ethereum is facing resistance around the $1,850 level and is currently trading with a slight bearish bias after failing to break above this particular level.

At the moment, it is forming bearish candles on the two-hourly timeframe, which suggest a bearish dominance in the market.

On the lower side, immediate support for Ethereum prevails around the $1,820 level, and a break below this level has the potential to lead the prices towards the next support level of $1,800.

The 50-day exponential moving average is also suggesting a bearish trend in the market.

At the same time, the RSI and MACD indicators, which can be seen on the two-hourly timeframe, are also indicating bearish dominance in the market for Ethereum today.

Buy ETH Now

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself updated on the newest ICO projects and alternative coins by frequently browsing through the professional-recommended roster of the 15 most potential cryptocurrencies to keep an eye on in 2023, carefully chosen by industry experts from Industry Talk and Cryptonews.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

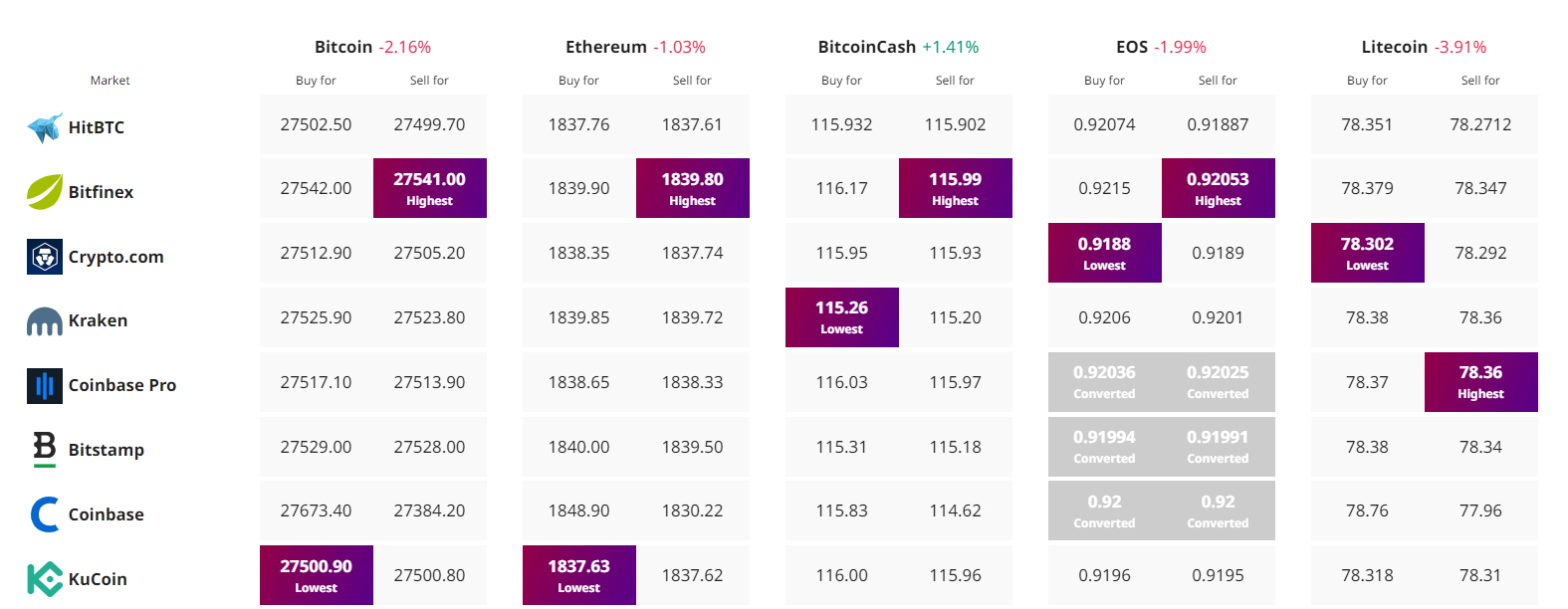

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link