A popular crypto strategist is updating his outlook on Bitcoin (BTC) amid an extended rally and weighing in on Ethereum (ETH) scaling solution Arbitrum (ARB).

Pseudonymous analyst Altcoin Sherpa tells his 194,100 Twitter followers that Bitcoin is likely consolidating around its current price value of $28,278 ahead of an imminent breakout.

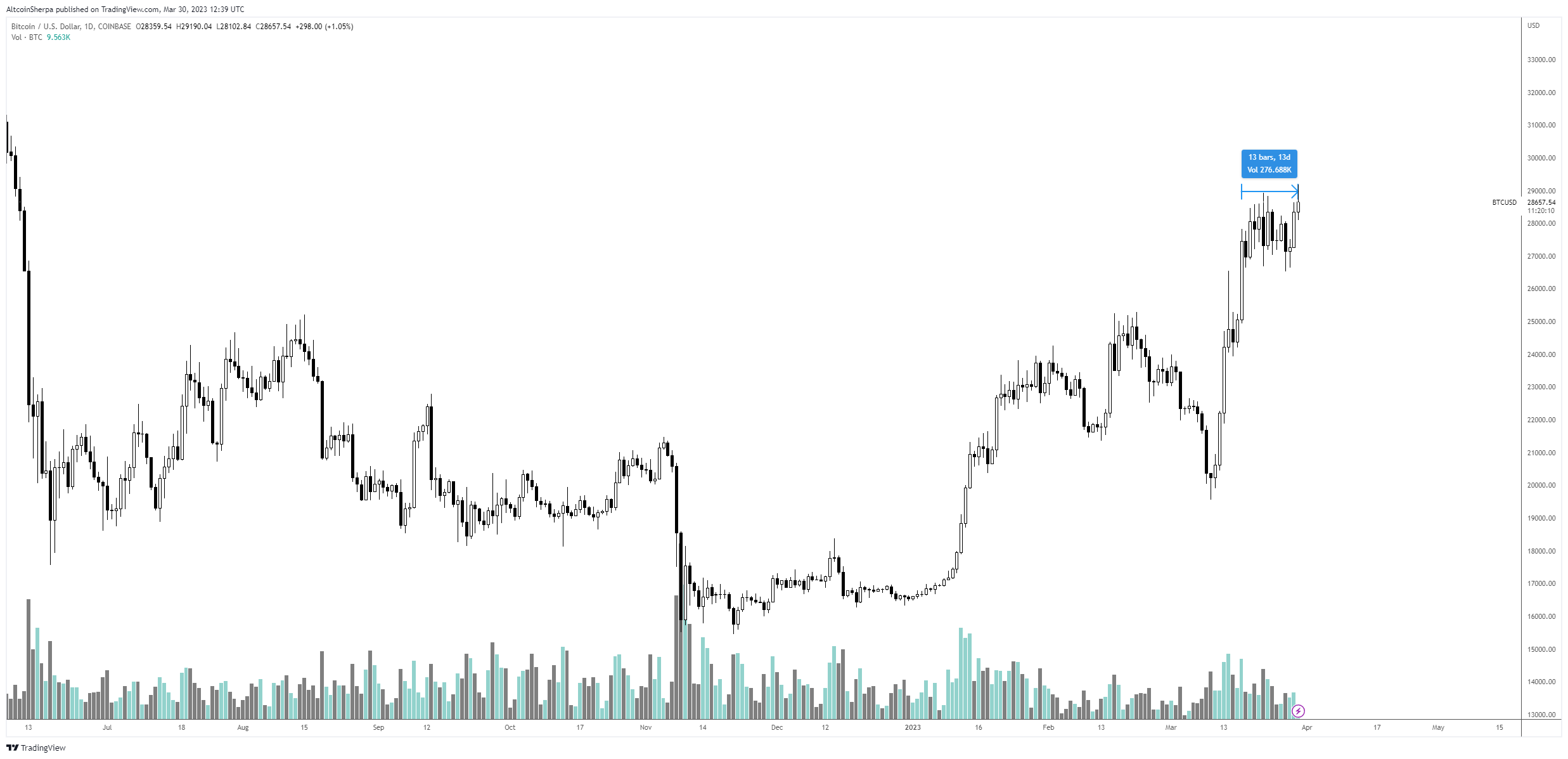

Sherpa shows a chart that illustrates previous periods of consolidations before big surges. He says Bitcoin is likely repeating a similar pattern.

“BTC: Good, solid lows take days and weeks to form. They always feel so choppy/boring while they are going but when you zoom out, it makes sense. These consolidations are healthy. Highs and lows stand out to you on the chart.”

According to Sherpa, Bitcoin is currently in a two-week consolidation phase and urges patience before a possible big breakout move. The seven previous consolidation periods he highlights in 2020 and 2021 range between 25 and 63 days.

“We’re currently in a two-week consolidation period right now, to be determined if we leg up or not. Patience…”

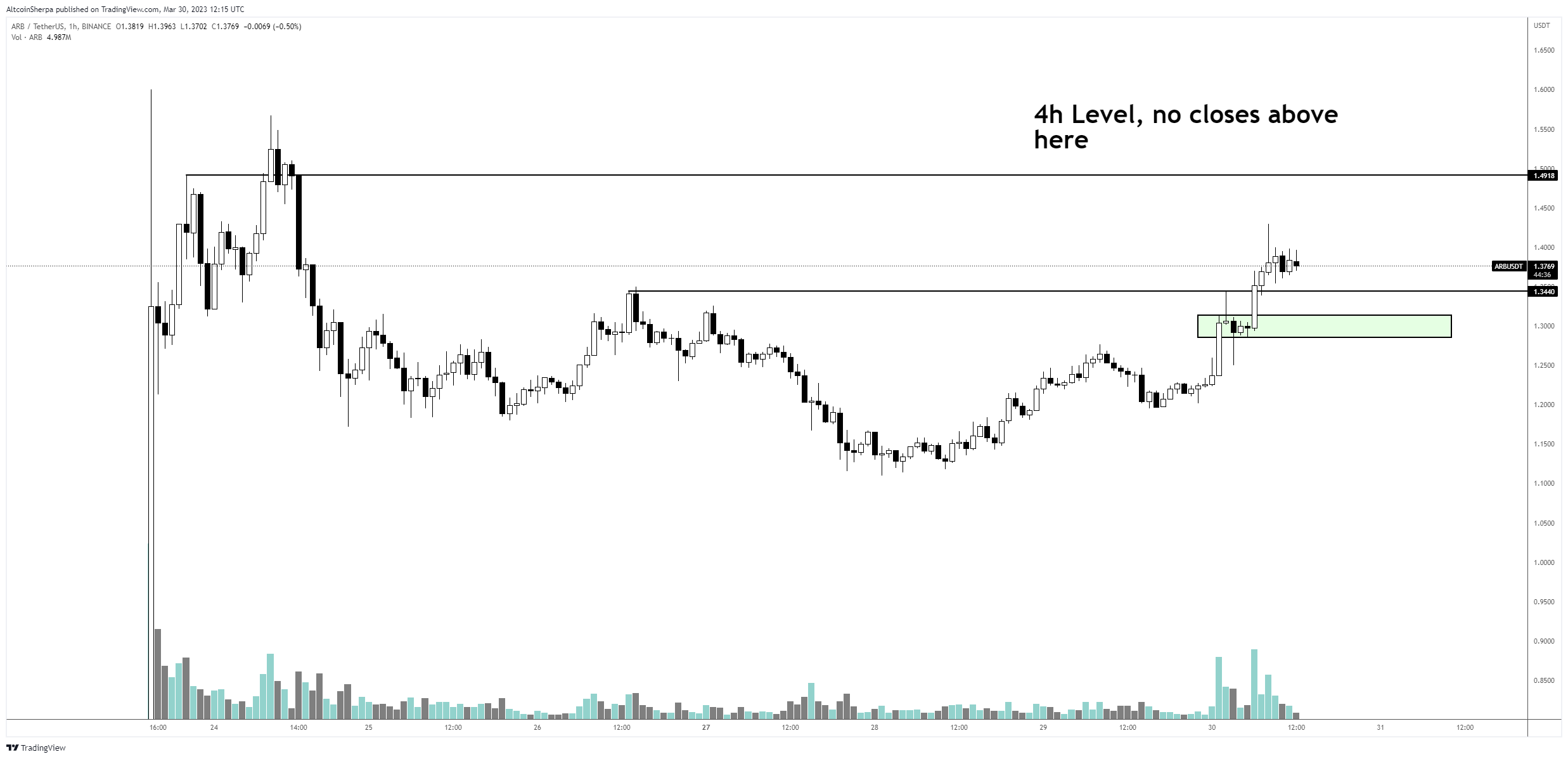

Next, Sherpa looks at Polygon (MATIC)-rival Arbitrum and sets a near-term range between $1.30 and $1.50.

“ARB: I think that the next significant resistance area is $1.50, we haven’t seen any 4h closes above that area. Buy the dip spot would probably be around $1.30. Still think this one looks pretty decent overall.”

Arbitrum is trading for $1.33 at time of writing, up 10.3% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Oleksandra Klestova/Konstantin Faraktinov

Credit: Source link