Bitcoin’s price has been on a rollercoaster ride over the past few weeks, with sudden spikes and dips causing uncertainty for investors. In a surprising turn of events, the cryptocurrency suddenly blasted up to $28,500 – leaving many wondering what was going on.

With speculation about the reasons behind this sudden surge, investors and analysts alike are eager to make Bitcoin price predictions and determine the potential implications for the cryptocurrency market as a whole.

FOMC and Fed Rate Hike Underpins Bitcoin

The Federal Reserve’s decision to increase interest rates on Wednesday was in line with expectations. The United States Federal Open Market Committee (FOMC) raised interest rates by a quarter point, indicating that the Federal Reserve is concerned about inflation.

After the announcement, Fed Chair Jerome Powell stated that the FOMC is “strongly committed” to bringing inflation back to its target of 2%. As a result, the Committee decided to raise the federal funds rate target range to between 4-3/4 to 5 percent.

However, the FOMC’s statement on Wednesday also acknowledged the recent banking crisis and suggested that it may lead to tighter credit conditions, which could impact economic activity, hiring, and inflation.

As expected, the Federal Reserve’s decision to raise interest rates caused the dollar to decrease, with the US Dollar Index (DXY) trading at a nearly seven-week low of 102.10.

Meanwhile, the cryptocurrency market had been hoping for either no interest rate increase or a more dovish stance from Powell. However, Bitcoin’s price declined after an initial surge earlier in the week when Powell indicated that rate cuts in 2023 were unlikely following the interest rate hike.

SEC’s Action on Coinbase

The US Securities and Exchange Commission (SEC) has been aggressively pursuing cryptocurrency companies, and the latest target of SEC investigations is cryptocurrency exchange Coinbase.

On March 22, the SEC sent Coinbase a Wells Notice expressing concerns about the listed digital assets, staking services, and other issues. The letter essentially warns Coinbase that the SEC may take enforcement action over potential violations of securities law.

Coinbase has expressed confidence in the legitimacy of its assets and services, but the wider cryptocurrency industry is feeling the pressure from the SEC’s case against the exchange. As a result, both BTC/USD and the overall cryptocurrency market have experienced a decline.

Despite weaker new home sales in the US, the BTC price has been rising for the past couple of hours. Let’s take a look at the technical outlook.

Bitcoin Price

As of now, the Bitcoin price stands at $28,690 and has a 24-hour trading volume of $32.3 billion. Over the last 24 hours, Bitcoin’s value has risen by 0.02%. It is currently ranked #1 on CoinMarketCap, with a live market capitalization of $554 billion.

Looking at the technical analysis, the BTC/USD pair is presently displaying a bullish trend, but it may encounter resistance at the $28,950 level.

If the $28,950 resistance level is broken, Bitcoin’s price may rise to reach $29,200 or $30,700. However, if there is a downward trend, the support levels at around $26,600 and $25,200 are likely to provide strong support.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

Industry Talk and Cryptonews experts have listed the top 15 cryptocurrencies to watch in 2023. Stay updated with new ICO projects and altcoins by checking back regularly.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

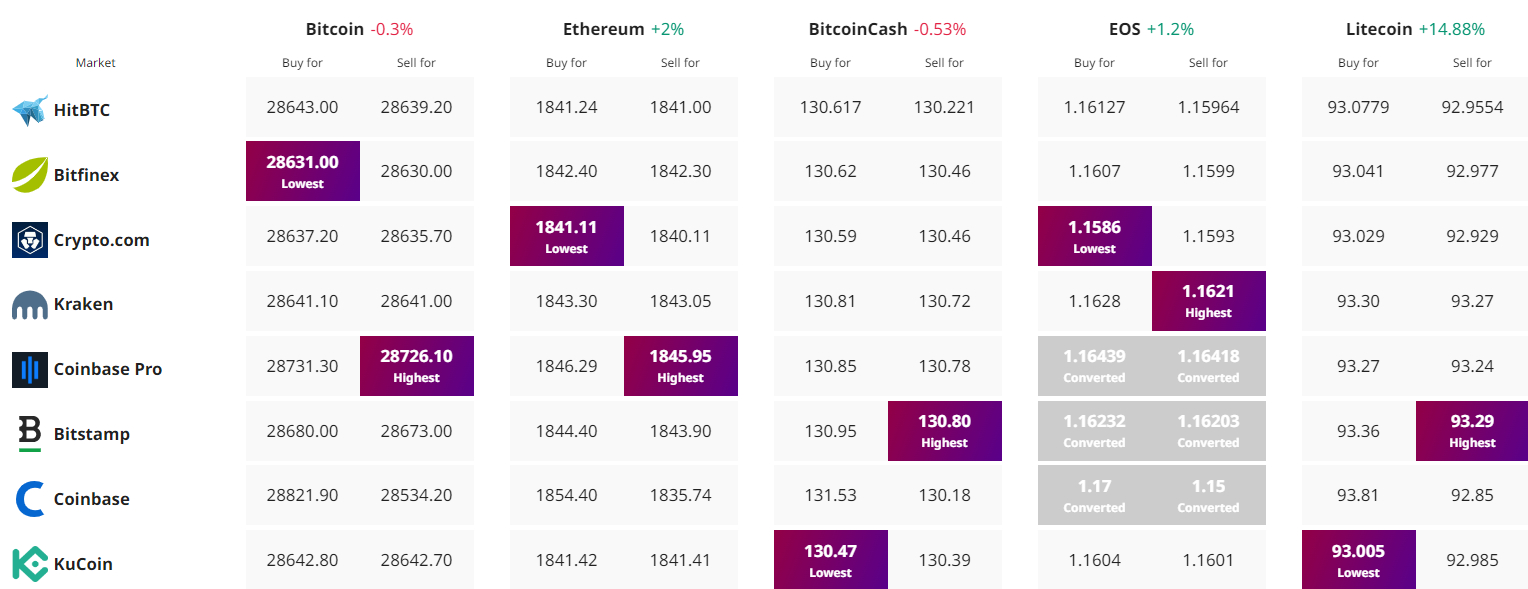

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link