Binance approached US Securities and Exchange Commission chairman Gary Gensler in 2018 and 2019 to become an advisor for the firm. That’s according to a new bombshell report published by the Wall Street Journal on Sunday, which claims that Binance embarked on a campaign to “neutralize” US authorities out of fear of prosecution, citing messages and documents from 2018 to 2020.

At the time, Gensler was teaching at the Massachusetts Institute of Technology and had previously worked as chairman of the Commodity Futures Trading Commission (CFTC). At the time, a Binance employee said to colleagues that Gensler was likely to move “back in a regulators seat if Dems win the 2020 election”.

Gensler, who became chairman of the SEC in April 2021, declined the offer to become an advisor to Binance. However, Gensler “was generous in sharing license strategies,” with Binance executives, according to Harry Zhou, who met with Gensler in October 2018 alongside at-the-time head of Binance’s venture capital division Ella Zhang.

Gensler also held a video call with Binance founder Changpeng Zhao in March 2019, interviewing him for a cryptocurrency course he would be teaching starting in summer 2019 at MIT.

Binance Fears Regulatory Crackdown

Binance’s efforts to butter up US regulators comes amid fears that the cryptocurrency exchange might fall fowl of a regulatory crackdown in the country. And the US crypto crackdown has been ramping up in recent weeks, with the SEC recently taking action against Kraken over its crypto staking service and accusing USD-backed Binance USD (BUSD) stablecoin issuer Paxos of issuing an unlicensed security.

Meanwhile, according to reports in the crypto press from the weekend, staff at the agency believe that Binance.US, Binance’s US subsidiary, is operating as an unregistered securities exchange. Its important to note that the views of the staff do not necessarily reflect the views of the agency’s five commissioners, a majority of whom would need to sign off if any enforcement action against Binance.US is to take place.

But Commission chair Gensler has in the past said that he thinks the majority of crypto trading platforms should register as securities exchanges, meaning they would be required to follow the SEC’s disclosure and compliance guidelines.

Binance – The Dominant Exchange

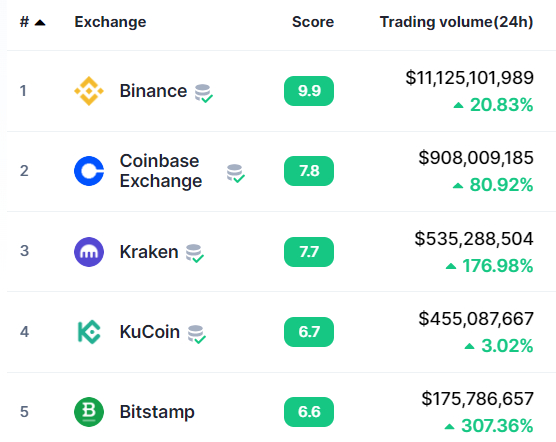

Binance is far and away the largest cryptocurrency exchange in the world. According to CoinMarketCap, the exchange saw trading volumes of over $11.1 billion in the last 24 hours. Coinbase, which came in second place, pales in comparison with under $1.0 billion in trading volumes over the same time period.

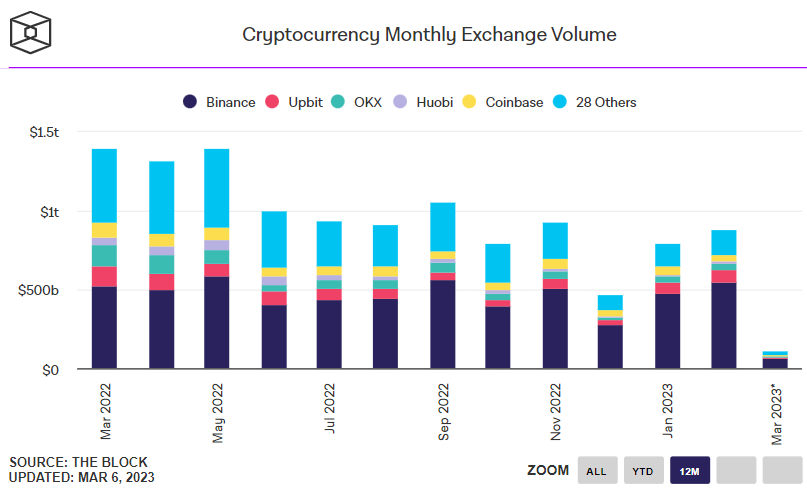

According to the Block, Binance saw a total of $545 billion in trading volumes in February, over 60% of the cryptocurrency market’s total trading volume for the month of $878 billion. But Binance’s dominance may come under threat if its US subsidiary starts facing a higher degree of regulatory scrutiny/enforcement.

But that’s not to say that Binance’s US rivals like Coinbase aren’t facing the same problems. Coinbase is preparing to defend its staking service against the SEC, which views crypto staking services as an unregistered security offering.

Credit: Source link