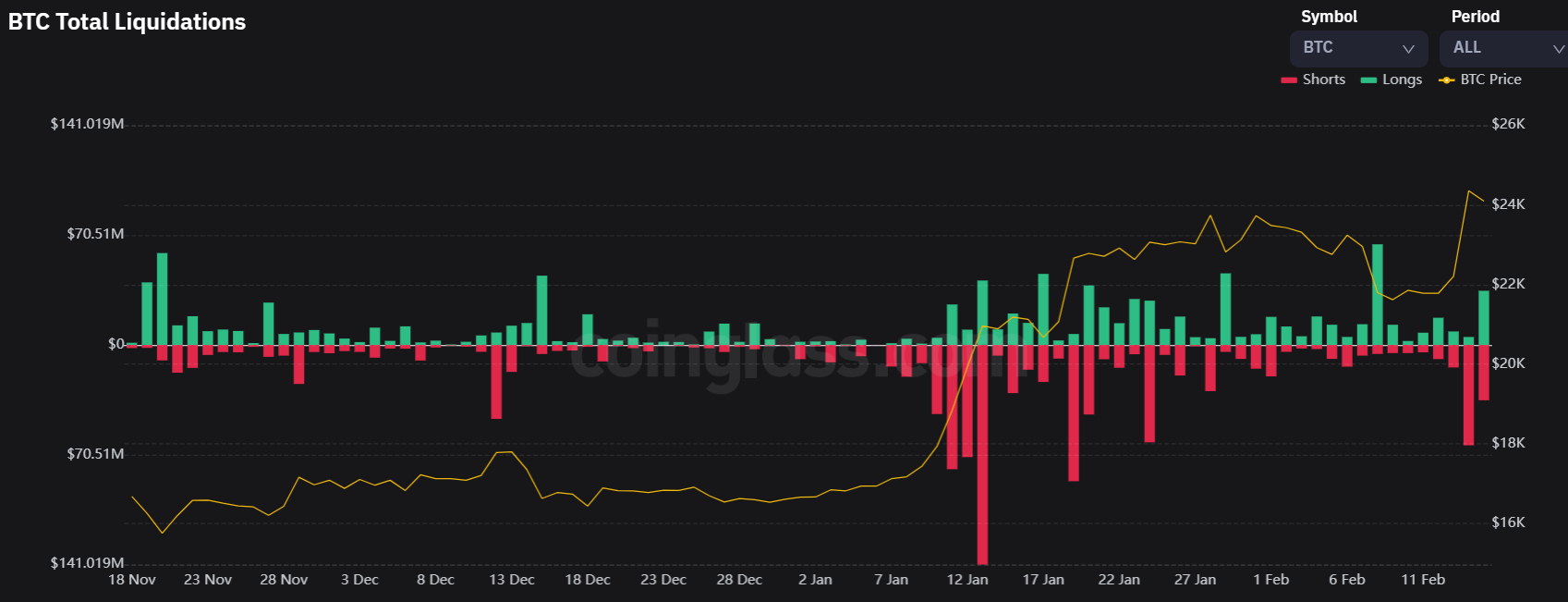

Bitcoin short-sellers have taken a battering in the past two days. That’s according to data presented by crypto derivative analytics website coinglass.com, which shows liquidations in short Bitcoin future positions worth around $100 million across major exchanges over the past two sessions, during which time Bitcoin has gained an impressive 8.5%.

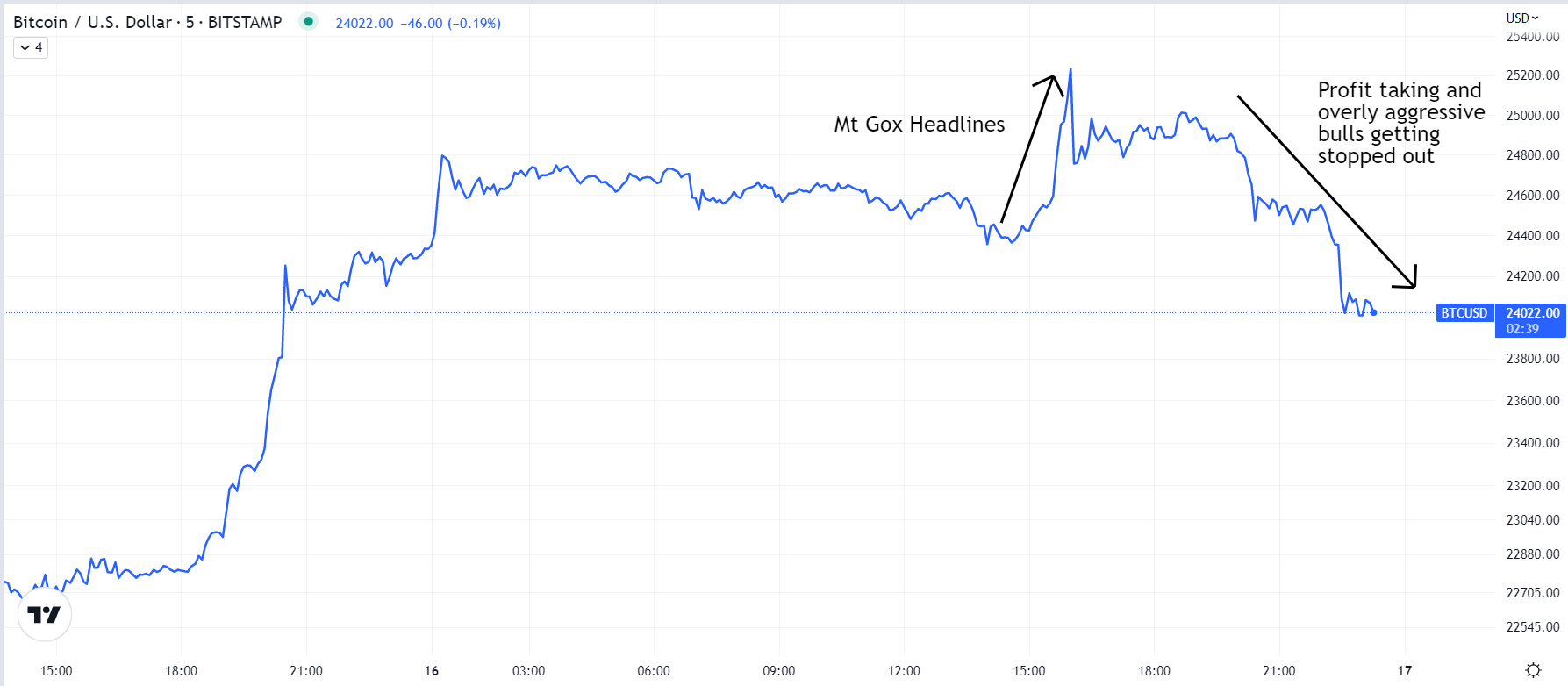

At current levels in the $24,100 region, Bitcoin is trading just under 13% above earlier monthly lows in the low $21,000s. Bearish calls last week for Bitcoin to fall back towards the $20,000 level ultimately proved wrong, with Bitcoin instead managing to notch a new high since June 2022 on Thursday at $25,270. News that two of the largest Mt Gox creditors will receive most of their payout in BTC, rather than fiat, helped spur Thursday’s spike.

Mt Gox was one of the earliest Bitcoin exchanges, but lost most of its funds due to a hack back in 2014 that caused the exchange to fold, with creditors engaged in lengthy asset recovery proceedings ever since. The Mt Gox-fuelled intra-day rally was, however, short-lived and seems to have caught out some short-term bullish speculators betting on a push to the upper $25,000s, as evidenced by a spike in long position liquidations on Thursday.

According to coinglass.com, long positions worth around $35 million have been liquidated on Thursday, following long position liquidations of only around $5 million on Wednesday. Profit-taking in wake of the recent rally and a stop-run on those who had gotten overly aggressive chasing the upside might well send Bitcoin back below $24,000.

Bulls Remain in Control in the Near-Term

But the recent resurgence from earlier weekly lows means that Bitcoin is still up around 45% this year, despite having now pulled back around 5.0% from earlier session highs. Bulls remain in the driving seat, despite the rally in recent weeks in the US dollar and US bond yields on expectations for additional interest rate hikes from the Fed this year in wake of a string of much stronger/hotter-than-expected major US data releases.

Some analysts are saying that Bitcoin has performed so well in 2023 because it got so oversold last year in wake of the collapse of FTX. Others say that Bitcoin is doing well because, although more Fed interest rate hikes are expected, the end of the hiking cycle and a better macro environment is in sight. Others point to various technical and on-chain metrics, such as Bitcoins recent rally above its 200DMA and Realized Price, improving network activity, improving Bitcoin market profitability and “weak hand” seller exhaustion as all suggestive that the worst of the 2022 bear market is now behind us.

Upside Price Risks Remains Despite Incoming Macro Risks

Traders will be monitoring the release of US flash Services PMI data, GDP figures and Core PCE inflation data, as well as the minutes of the Fed’s latest meeting next week, with macro traders monitoring the outlook for US growth, inflation and monetary policy. But Bitcoin and the broader crypto market has been remarkably resilient to what would normally be interpreted as macro headwinds.

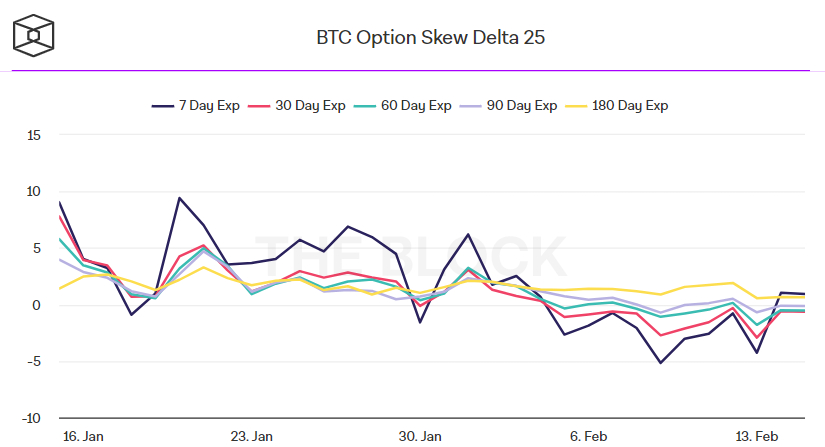

Price risks may remain tilted towards the upside in the short term, though, in fairness, this isn’t the message being sent by Bitcoin options markets. According to The Block, the Bitcoin 25% delta skew of options expiring in 7, 30, 60, 90 and 180 days are all currently around zero, suggesting investors are putting a roughly equal premium on respective put and call options.

Credit: Source link