The value of Ether (ETH) staked on the Ethereum 2.0 deposit contract has surpassed $12.9 billion AUD (i.e., $10 billion USD), according to the information on Eth2 LaunchPad.

This coincides with the recent increase in the price of the cryptocurrency.

Over 4 Million ETH Has Been Staked

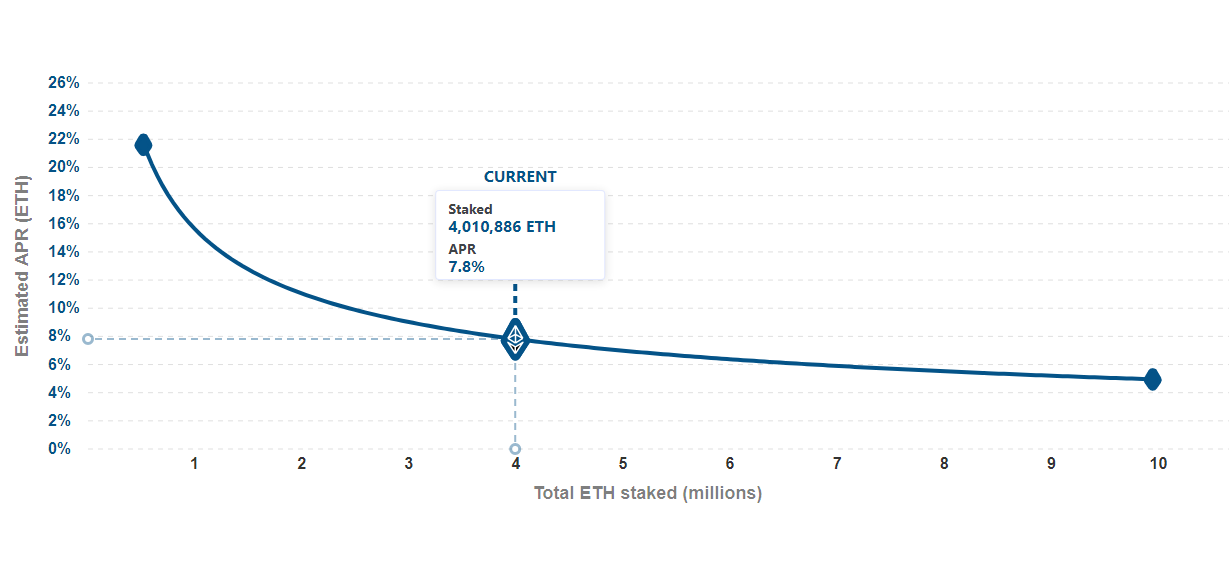

During press time, a total of 4,010,886 ETH was staked on the deposit contract, meaning about 3.46 percent of the total circulating supply of ETH has been locked for Ethereum 2.0. These staked coins are worth over $10.2 billion USD, following the price of Ether at $2,560 USD on Coinmarketcap.

Additionally, the number of validators totaled 122,254, and the current annual percentage rate (APR) for staking on the network is 7.8 percent. The APR decreases as more ETH is staked on the deposit contract.

What’s Behind the Increase in Eth2 Deposit Contract

The increase in the value of assets locked in the deposit contract can be attributed to the massive growth of the value of ETH. On Wednesday, ETH reached another record high of $2,641 USD on Coinmarketcap.

The number of coins staked on Eth2 deposit contracts is also another factor. It increased significantly since the beginning of the year. This shows that many crypto enthusiasts are supportive of Ethereum 2.0 development, which will transition the second-largest blockchain to a Proof-of-Stake (PoS) era, although some might be staking for profit’s sake.

Why More Staking is Bullish For ETH

The coins staked on the deposit contract cannot be withdrawn until the development phase with such functionality is deployed – which might take two years. Hence, more staking on the network reduces the number of ETH supply in the market, thereby creating scarcity for ETH. This is bullish for the ETH holders as scarce assets are more likely to see increases in price, provided there’s high market demand for it.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link