Disclaimer: The text below is a press release that was not written by Cryptonews.com.

Every time we think that the price of Bitcoin has peaked it just seems to shoot up even more and it is now at an all-time high, having pushed through the 64,000 USD barrier for the first time. Not only has Bitcoin showed incredible staying power over the last 10 years, but the increasing demand and limited supply makes its future seem even rosier. It has been given a recent boost from big names like Square and Paypal, with America’s oldest bank, BNY Mellon, and Mastercard now following in their footsteps, supporting crypto payments. In addition, investors are pouring their capital into BTC in response to COVID 19, while the Federal Reserve has driven down interest rates near zero, weakening the US dollar.

All of this makes BTC an amazing investment opportunity but the risks of such an insanely volatile asset class should not be brushed aside.

What Kind of Risks Are Bitcoin Investors Facing?

In the wake of the recent surge, analysts are advising caution. There is a danger that fear of missing out will lead to over-enthusiastic buying of BTC that is not grounded in market fundamentals.

The last time we saw Bitcoin soar in late 2017, just a brief time after it hit a peak of close to 20,000 USD, it crashed below 4,000 USD. If we are seeing another blow-off-top then the rapid increase in value could be followed by a sudden dramatic drop in price.

One thing we know for sure is that the cryptocurrency market is the most volatile in the world and money can be lost as fast as it is made. We could easily see a scenario where the price suddenly plummets anywhere from 20%-50%, with little to no warning.

Can these Risks Be Reduced without Compromising on Returns?

There is one way in which Bitcoin investors can benefit from huge returns without risking their capital and that is with crypto arbitrage.

Crypto arbitrage does not involve profiting from fluctuating digital currency prices. It works by taking advantage of price inefficiencies. These are instances where, temporarily, a coin is available at difference prices, on different exchanges, at the same time.

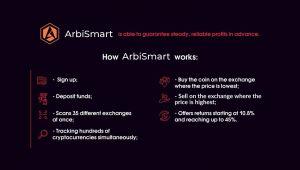

To understand it better, let’s take as our example ArbiSmart, a popular automated crypto arbitrage platform. You sign up, deposit funds in either fiat or crypto and then the platform takes over. It scans 35 different exchanges at once, tracking hundreds of cryptocurrencies simultaneously to identify crypto arbitrage opportunities. When it finds a price inefficiency, it automatically buys the coin at the lowest available price and then instantly sells it for a profit, on the exchange where the price is highest, all before the temporary price inefficiency resolves itself. Each platform offers a different ROI, though ArbiSmart offers returns starting at 10.8% and reaching up to 45%, depending on the size of your investment.

This type of investing offers the advantage of profit predictability. For example, at ArbiSmart, the company’s website lays out, in advance, exactly how much you can expect to make per month and per year, at each account level. There is also a profit calculator that measures how long it will take to reach your profit target, based on a given investment amount, or how much you need to invest to reach your goal, within a specific time frame.

The calculator automatically factors in compound interest, as well as capital gains earned from the rising value of RBIS, the native token of the ArbiSmart platform, which has already gone up by 210% since it was introduced in early 2019.

ArbiSmart is able to guarantee steady, reliable profits in advance because of the fact that crypto arbitrage, unlike other forms of Bitcoin investing does not leave you vulnerable to crypto market volatility, so there is little uncertainty and close to zero risk.

Does this Mean there Is No Danger Involved?

No. Don’t make the mistake of thinking that any kind of crypto investing is risk-free. There is no such thing as a 100% safe investment, particularly when you are entering the barely regulated crypto arena, where there is little oversight as governments struggle to keep up with developments. In addition, the anonymity afforded by decentralized finance has allowed fraudsters and hackers to gain a foothold.

However, you can mitigate your risk by only investing with a fully licensed platform. ArbiSmart, for example, has an FIU license authorizing the company to provide regulated crypto arbitrage services across Europe. This provides safeguards that include the separation of client and company accounts, the maintenance of sufficient operational funds, client capital insurance coverage, regular auditing, implementation of tough data security protocols, as well as Know Your Customer and Anti-money Laundering procedures.

Risks can be further reduced by only using a platform with a solid online reputation across social media, consumer review sites and crypto industry press. If we look at ArbiSmart, it has received positive global coverage, as well as hundreds of excellent reviews for meeting its profit guarantees, providing great service and support and offering rapid, hassle-free withdrawals.

Clearly, when it comes to your capital, the stakes are high, so it really is worth taking the time to do a little research, before diving in, to ensure that you are entrusting your savings to a safe, transparent and reliable platform.

Be smart about being safe and you could be making hundreds of thousands on your Bitcoin at almost zero risk. No matter what happens to the markets and whatever the size of your investment, you can protect and grow your savings with crypto arbitrage, even without any previous market experience.

So, what are you waiting for? Start investing!

Credit: Source link