Court filings show that FTX debtor companies have a total cash balance of just $1.24 billion.

News has also emerged that US prosecutors were investigating FTX well before the company collapsed.

A summary of the balances drawn up by business consultancy firm Alvarez & Marsal and filed by Edgar Mosley who supervises the team, details entries by each of the four silos previously identified and reported to the court by FTX CEO John Ray.

The Alameda silo has $400 million; Dotcom silo $255 million; ventures silo $8.6 million; and the WRS silo $86 million.

Total debtor accounts amounts to $751.5 million and non-debtor accounts $487.7 million.

FTX regulated companies have money in the bank

The non-debtor accounts includes FTX Digital Markets, FTX Philanthropy, Embed Clearing, Embed Financial Technologies and LedgerX – all those entities are thought to be solvent according to previous determinations filed at the court by CEO Ray at the weekend.

The exact cash balance overall is $1,239,306,000.

The 134 companies in the FTX group that have filed for Chapter 11 in the US and are estimated to have liabilities in excess of $10 billion.

Among the top 50 creditors alone, $3.1 billion is owed, so the cash shortfall before disposals is way below the amount required to make creditors whole.

FTX has a carryforward Net operating loss of $3.7 billion

Alvarez & Marsal also reported in its court filing that according to FTX and related companies’ tax returns they had a carryover federal net operating loss of a minimum of $3.7 billion, as at 31 December 2021.

FTX’s minimum state net operating loss carryforward was $715 million.

And in an effort to locate funds, FTX has requested that exchanges be on the look out for assets being deposited that are the result of unauthorized transfers, stating that any such assets should be returned to the “bankruptcy estate”:

Crypto prices find their footing

Against the background of mounting contagion fears, crypto prices have calmed following yesterday’s slide.

After falling to as low as $15,500, bitcoin has moved back above $16,000 as of the time of writing.

Ethereum has bounced back a little to, priced at $1,129, up 2%.

Bahamas v US – Who is in charge of sorting out this mess?

A day before the petition for bankruptcy in the US court was made, on 10 November the Securities Commission of the Bahamas (SCB) froze the assets of FTX Digital Markets “and related parties”.

However, despite that freeze, it was suggested in a filing by FTX that Sam Bankman-Fried was able to transfer digital assets to the Bahamas authorities.

The reference to “unauthorized access” could also relate to the hack which is associated with the ‘FTX accounts drainer’ that was yesterday selling ETH, which led to the token’s price sliding around 10%.

On 15 November FTX Digital Markets filed a Chapter 15, which seeks to put the Bahamas court proceedings on the same equal footing as the Delaware court.

But since then, on 17 November, the Bahamas authorities moved all FTX Digital Markets digital assets into wallets under the control of SCB – a move contested by lawyers acting for FTX Trading, which says the SCB is undermining bankruptcy proceedings in the US and breaking established rules that require the US judge to authorise any movements to lift the “stay” or freezing of assets.

“It appears that the automatic stay has been flaunted, by a government actor no less,” the US lawyers claim.

The upshot of all of this is that the joint provisional liquidators appointed by the SCB to run FTX Digital Markets now insists that the FTX Trading had no authority to file the Chapter 11 bankruptcy petition.

FTX Digital Markets is the services company of the group, so the Bahamas authorities do have a point.

In a sign of some movement, the Bahamas court has now agreed to allow its Chapter 15 petition to be heard at the Delaware court.

The dispute between the Bahamas and the US is also given more context by the tweets that have been emanating from Sam Bankman-Fried (SBF), who says he is working to raise funds to bring FTX back from the dead.

In the court filings, FTX Trading lawyers are not making any bones about what they think is going on:

“Mr. Bankman-Fried, the co-founder, and controlling owner of all of the debtors and of FDM [Bahamas-based FTX Digital Markets], appears to be supporting efforts by the JPLs [joint provisional liquidators] to expand the scope of the FTX DM proceeding in the Bahamas, to undermine these Chapter 11 cases, and to move assets from the debtors to accounts in the Bahamas under the control of the Bahamian government.”

Last Friday SBF told CNBC he was still working on a bailout: “I think we should be trying to get as much value to users as possible. I hate what happened and deeply wish that I had been more careful.”

FTX CEO Ray has emphasized that SBF has no “ongoing role” at FTX:

The new CEO of FTX is currently conducting a strategic review of its assets, and in a court filing highlighted that the regulatory entities appear to be solvent, as mentioned earlier in this article:

“Based on our review over the past week, we are pleased to learn that many regulated or licensed subsidiaries of FTX, within and outside of the United States, have solvent balance sheets, responsible management and valuable franchises.”

He added that it was “a priority… to explore sales, recapitalizations or other strategic transactions.”

Judge John Dorsey presides at the first day hearing of the Delaware court today and will need to begin by attempting to resolve the dispute between the Bahamas and the US court.

FTX Japan withdrawals to start before year end

There were some good news for customers of FTX Japan today, after its executives said that withdrawals would resume before the end of the year.

In an interview with state TV broadcaster NHK, there was no indication from the FTX subsidiary team that the funds were not available to be withdrawn.

Instead the delay in access is because FTX Japan uses the same payment systems as the parent, and that functionality has been suspended.

As a consequence the Japanese subsidiary is in the process of developing its own system to enable customer withdrawals to be re-opened.

On the 10th November when the financial authorities forced FTX Japan to suspend all transactions, the company held 19.6 billion yen in cash and deposits.

According to the cash balance statement filed at the US court, FTX Japan entities have a combined total of $172 million in cash.

As part of the strategic review announced in papers filed in the US court, all members of the FTX groups of companies, including FTX Japan, are being considered for disposal.

In related news, Japanese exchange Liquid has suspended all trading activities. Liquid is owned by FTX.

Genesis needs to raise $1 billion or go bust

According to a report by Bloomberg, Genesis continues to “struggle” to raise $1 billion to avert bankruptcy.

Genesis stopped redemptions and loan origination on 10 November. At that time it also revealed that it had $175 million locked up in an FTX account.

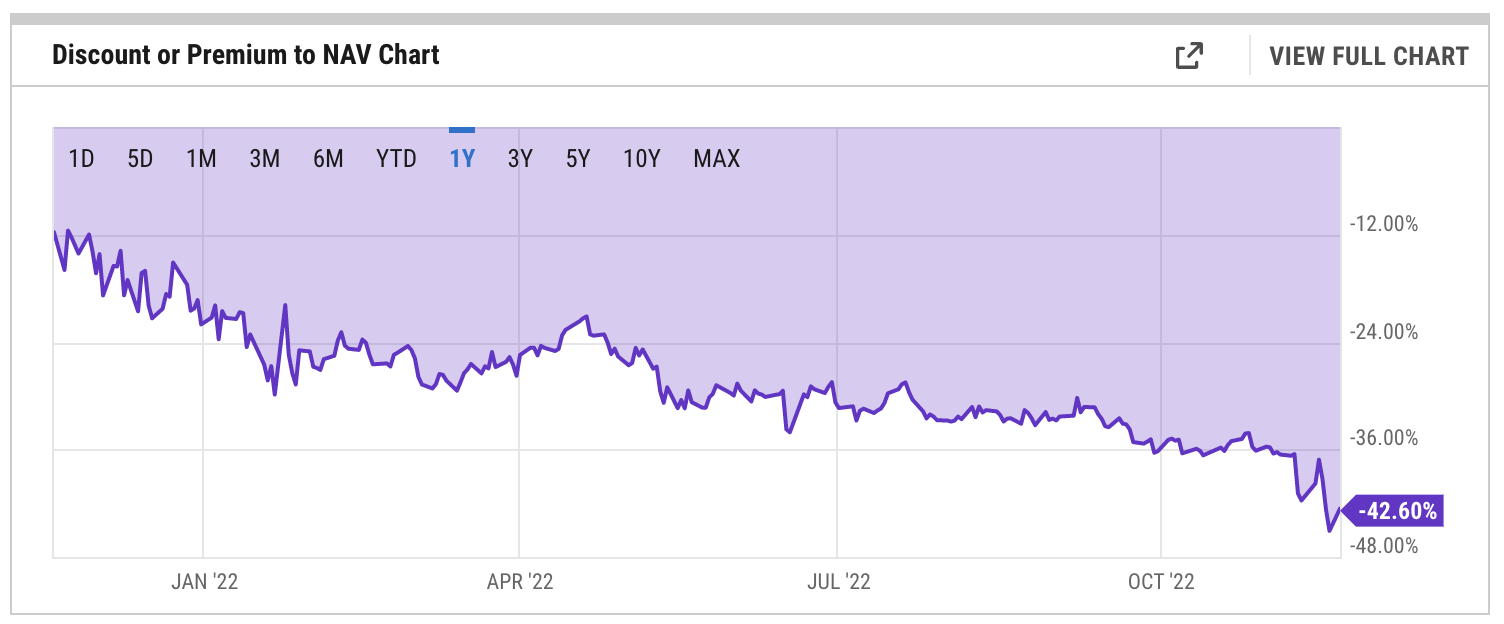

Genesis is owned by the Digital Currency Group, which also owns the Grayscale Bitcoin Trust.

As we reported, Binance is thought to be in talks to secure funding for the crypto lender.

A Genesis bankruptcy would be an enormous FTX contagion event because of the size of DCG, which has investments in as many as 200 crypto companies.

The worries about Genesis have also spread to DCG and GBTC – the latter owns 3.5% of all bitcoin in circulation.

In a sign of how investors nerves are fraying, the GBTC fund is now trading at a discount to its net asset value of 42.6%. GBTC is down 75% year to date.

Grayscale is doing its best to shore up confidence:

Did FTX endorser Tom Brady and others indulge in misrepresentation?

Elsewhere, influencers are being investigated by Texas regulator regarding the payments they received for endorsing FTX US.

Celebrities Tom Brady and Steph Curry are among those being investigated by the Texas State Securities Board, with regulators looking at the nature of disclosures and their prominence.

“We are taking a close look at them,” said director Joe Rotunda.

According to lawyers, celebrities could find themselves in hot water if they endorse a product that they haven’t actually done any die diligence on it, then that could be considered to be misrepresentation.

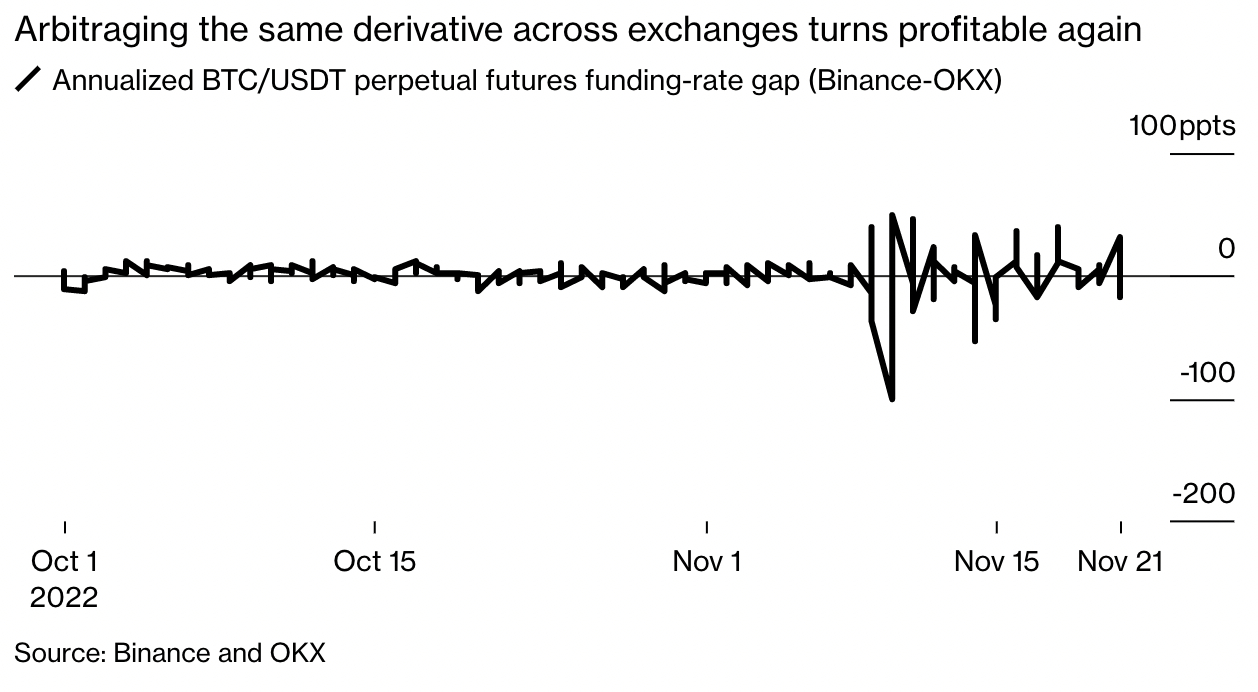

Crypto price inefficiencies return to put easy money back on the table

Chicago trading firms could have hundred of millions dollars, if not billions, locked up in FTX trading accounts, but that doesn’t mean there isn’t money to made.

In fact such is the dislocation in the markets and the effect of the mass exodus of trading desks, there are now huge opportunities to pick low hanging fruit tin a way that hasn’t been possible for a couple of years.

Price differences between exchanges and even between similar assets on the same exchanges are leading to the emergence of sizeable arbitrage trades, as seen in the chart below:

“If you know what you’re doing and you have the confidence to have your money on exchanges, there are very profitable places to trade,” said Chris Taylor, who runs crypto strategies at GSA Capital. Caveat emptor – because trading on exchanges at the moment is a big if.

Beyond FTX – better trading, better metaverse

FTX has certainly set back crypto and is likely to prolong the winter. Nevertheless, even at this juncture there are profitable opportunities for savvy traders and investors.

So if you are looking to add some alpha to your portfolio, a good place to start is in the presale sector, and we have two interesting propositions for your watchlist – Dash 2 Trade (D2T) and RobotEra (TORA).

Dash 2 Trade is the perfect market fit for a post-FTX world – its trading intelligence tools, signals and metrics will help traders and investors to spot the problems and steer clear.

The second project is RobotEra, which could be the next hot metaverse game – it similar toThe Sandbox, but better – you build planets using robots.

Buy Dash 2 Trade in presale

Buy RobotEra in presale

Credit: Source link