This Thursday has been quite an eventful day for the most popular smart contract platform, Ethereum (ETH), as its Berlin upgrade went live, its native token, ETH, hit a new all-time high, gas dropped lower, and the CME Group revealed the records reached by their ETH futures offering.

On April 15, ETH hit another all-time high of USD 2,488 (per Coingecko), as Ethereum took a step towards solving the high fee issue plaguing the network – with its Berlin upgrade today. At 11:55 UTC, ETH is trading at USD 2,432. It’s up by 1% in a day and 22% in a week.

It introduced four Ethereum Improvement Proposals (EIPs) to the network related to gas costs, reducing them for certain transaction types, and including a new transaction format, ‘envelope’, which enables clients to interpret a transaction based on its type.

Following the upgrade, however, issues appeared.

Etherscan said that there are syncing issues related to OpenEthereum – popular multi-network Ethereum client, formerly known as Parity. The tweet stated that “it appears that there is a consensus error at block 12244294. And as far as we know it only affects Openethereum Nodes, the core devs are diagnosing the root cause.”

The website announcement stated that new block data will not be available on Etherscan until a fix is released.

There are reports that a number of services using the client have been affected, such as BitGo, which stated that they have issues processing ETH transactions, while Bitstamp and Coinbase announced that withdrawals and deposits of ETH and ERC20 tokens are currently paused.

while Geth is the mainstream ETH protocol implementation, OpenEthereum is more often used for analytics. This issue knocked out @etherscan, @coinmetrics and many others.

— Antoine Le Calvez (@khannib) April 15, 2021

Eric Conner, EthHub co-founder and EIP-1559 co-author, said that the network is “still moving due the multi-client nature of Ethereum,” but that some sites may be stuck or users’ transactions may fail if they’re using an OpenEthereum node.

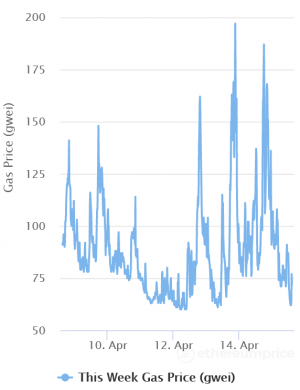

Meanwhile, Ethereumprice.org shows that the gas price (in gwei, a measure of gas prices.) dropped further today, to 62, compared to 187 gwei on April 14.

Berlin follows the Istanbul and Muir Glacier upgrades, and had first been deployed on the testnets during March. The next upgrade will be London, which would include the hotly debated EIP-1559, and which is estimated to happen in July.

Meanwhile, as ETH rallied in Q1, hitting several all-time highs along the way, CME ETH futures saw “rapid growth” in customer interest and participation since their launch on February 8.

Ether futures reached two new records on April 7: volume at 2,247 contracts (ETH 112,500 equivalent) and open interest at 1,822 contracts (ETH 91,100 equivalent).

In two months since the launch, more than 34,000 total contracts were traded (ETH 1.72m equivalent), averaging 820 contracts traded daily (ETH 41,000), while 36% of overall volume came from outside the US.

“Market participants have increasingly turned to Ether futures to hedge against ether price movements, as indicated by the growing around-the-clock trading activity,” CME said.

___

Learn more:

– Ethereum Fees Decline as Analysts Point to Bots as Cause

– Unlike Bitcoin, Ethereum’s ATH Was Driven by Relatively Small Demand – Analyst

– Mark Cuban Praises Ethereum and Keeps Buying Bitcoin

– ETH ‘Insanely Cheap,’ DeFi To Rally, BTC Dominance to Drop – Pantera Capital CIO

– No Optimism For Ethereum In March – L2 Scaling Solution Delayed

___

(Updated at 12:53 UTC with a section about OpenEthereum issues.)

Credit: Source link