Unlike bitcoin (BTC), ethereum (ETH)’s recent all-time high (ATH) was driven by a smaller prior demand, according to an analyst.

“This week’s all-time high ethereum price of [USD] 2,151 was some way above a large level of support, and suggests that the peak was driven by a relatively small amount of demand. This is in contrast to bitcoin, which had greater prior demand across high price levels,” Philip Gradwell, Chief Economist at US-based blockchain analysis company Chainalysis, said in his Market Intel report this week.

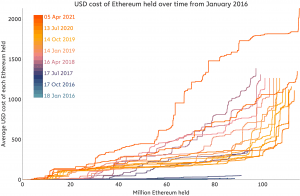

He analyzed the cost of acquisition across the ethereum supply – the ETH 115m held by 1,525 groups of entities. Per Gradwell, this data shows how much is held by those willing to buy and hold at least at their cost of acquisition, which then shows how much prior demand there has been at different price levels, indicating the support for each price level.

After looking at the USD cost of acquisition of ETH held on April 5, the Chief Economist found that “a very large amount” of this cryptoasset is held by entities that acquired it at around USD 1,800.

On the other hand, relatively little ETH, some 700,000, has been acquired above USD 1,850, costing a total of USD 1.4bn.

Gradwell, however, stressed that there are caveats to this analysis, such as that the data only describes crypto that moves on-chain, and that the cost of acquisition is calculated as a weighted average of an entity’s ETH, some of which may be acquired at a low cost and some at a high cost.

What he also observed are ETH cost curves. Similarly to BTC, these cost curves since November 2020 show that the ETH market has changed “radically” in recent months. He noted that the rapid price increase from January until April – from USD 737 to the ATH – was accompanied by “significant acquisition of Ethereum across many entity groups.” This further led to “a substantial increase” in the cost of acquisition for ETH 50m out of the ETH 115m supply.

“So while an ethereum price of more than [USD] 2,000 has limited support, a price of more than [USD] 1,500 now has strong support, with 33.3 million ethereum acquired above this level at a total cost of [USD] 58 billion,” Gradwell said.

Furthermore, the cost curves from November and December 2020 suggest that a small amount of ETH was acquired for a much higher cost than the rest of the supply – which can also be seen in cost curves from earlier periods.

This phenomenon, wrote Gradwell, is a result of small amounts of ETH bought at previous ATHs, mostly in the late-2017 bull run, that continued to be held even as prices dropped.

“It is remarkable to me that most Ethereum holders that acquired in late 2017 capitulated, except for a small number who finally saw their losses reversed in early 2021,” concluded the economist, adding:

“The persistence of a small, but very bullish, cohort of ethereum buyers supports my concern that the highest Ethereum prices tend to have a narrow base of support, at least compared to bitcoin.”

As reported, last week Gradwell analyzed the amount of bitcoin held by different entities, as well as certain cost curves, finding that the market has changed radically in recent months. Additionally, the cost basis for many BTC is now “radically higher” than just a few months ago, “demonstrating that a broad swath of market participants are willing to buy and hold at much higher prices than previously.”

At 10:21 UTC, ETH trades at USD 2,099 and is up by 5% in a day and almost 7% in a week. At the same time, BTC trades at USD 58,147. The price increased by 3% in a day, trimming its weekly losses to less than 1%.

___

Learn more:

– Coinbase Listing Won’t Help Bitcoin Price – Analyst

– Bitcoin Evolves From Tulips Into A Geopolitical Weapon As US Warned Again

– Mark Cuban Praises Ethereum and Keeps Buying Bitcoin

– Traders Issue Warnings as Altcoins are Booming and Bitcoin Consolidates

– Bitcoin to Be Worth Millions by 2023, ETH Above USD 2K by 2022 – Kraken CEO

– ETH ‘Insanely Cheap,’ DeFi To Rally, BTC Dominance to Drop – Pantera Capital CIO

Credit: Source link