Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Eos (EOS)

EOS is a platform designed to allow developers to build decentralised apps. The project’s goal is relatively simple: to make it as straightforward as possible for programmers to embrace blockchain technology and ensure the network is easier to use than rivals. As a result, tools and a range of educational resources are provided to support developers who want to build functional apps quickly. EOS also aims to improve the experience for users and businesses. While the project tries to deliver greater security and less friction for consumers, it also vies to unlock flexibility and compliance for enterprises.

EOS Price Analysis

At the time of writing, EOS is ranked the 40th cryptocurrency globally and the current price is US$1.45. Let’s take a look at the chart below for price analysis:

EOS has plummeted nearly 75% from its April 2022 highs and almost 90% from its May 2021 all-time high.

The closest resistance overlaps with the 8 EMA near $1.60, where the daily chart shows inefficient trading. This level rejected the price’s first retest on May 13.

Slightly higher, $1.78 offers the next noteworthy resistance. This area was inefficiently traded and overlaps with the last significant swing low in mid-March.

Last week, the price bounced from support near $1.30, which could provide support again. This level shows inefficient trading on the monthly chart and is near the midpoint of September 2017’s accumulation.

If this support breaks, bulls could find support near $1.24. This level is at the bottom of an inefficiently traded area on the monthly and weekly charts. It’s also the high point of October 2017’s accumulation range. However, eager bidders should be cautious as a move this low may be targeting bulls’ stops under the swing low at $1.12.

2. Enjin Coin (ENJ)

Enjin Coin ENJ is a project of Enjin, a company that provides an ecosystem of interconnected, blockchain-based gaming products. Enjin’s flagship offering is the Enjin Network, a social gaming platform through which users can create websites and clans, chat, and host virtual item stores. Enjin Coin is a digital store of value used to back the value of blockchain assets such as non-fungible tokens (NFTs).

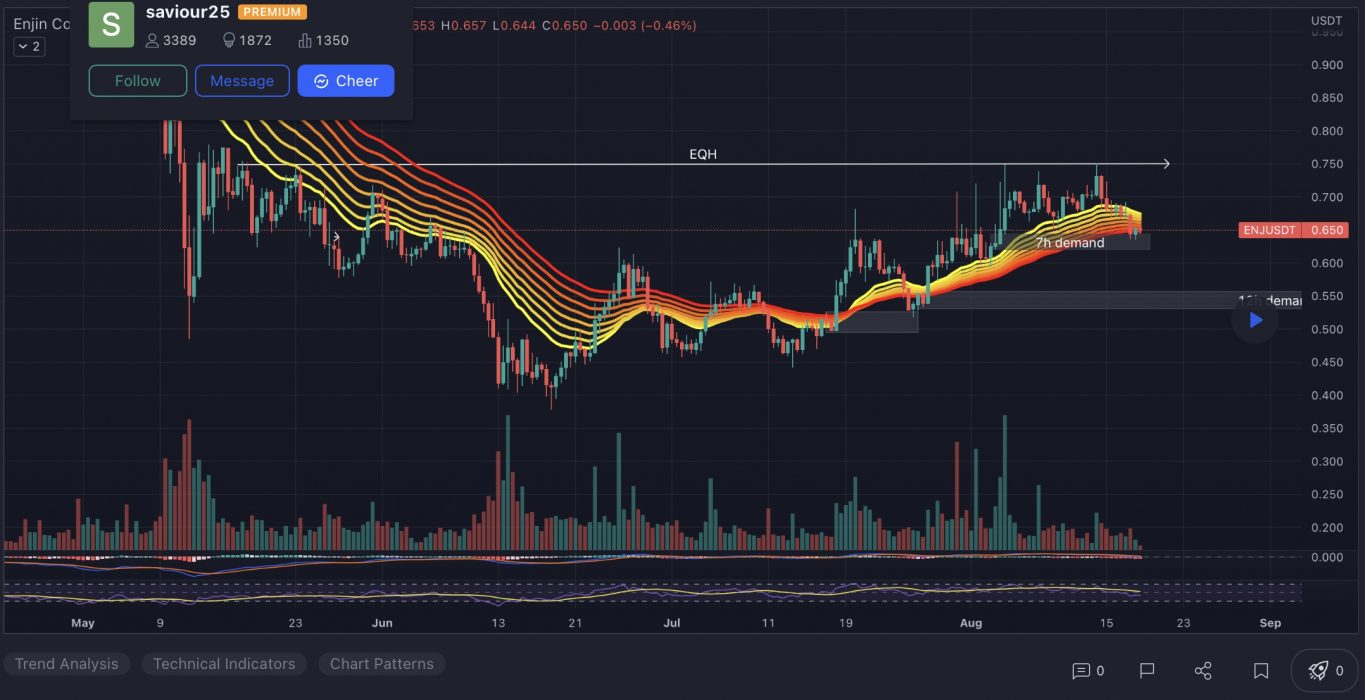

ENJ Price Analysis

At the time of writing, ENJ is ranked the 75th cryptocurrency globally and the current price is US$0.6509. Let’s take a look at the chart below for price analysis:

ENJ spent Q2 ranging between 31% over and 23% below. The price is currently consolidating between adjacent resistance and support at $0.6045 with no clear higher-timeframe trend. A strong move over the monthly open could signal a run to resistance beginning near $0.7295.

This move would likely target the swing high at $0.7612 and relatively equal highs near $0.8349. A sustained bullish trend could reach up to the monthly high near $0.9032.

Bulls may see a sweep of the relatively equal lows near $0.5532 as a chance to buy at a discount. If this level fails to hold, the next significant area for the price to find buyers is likely near the consolidation around $0.4835 and $0.4150.

3. Uniswap (UNI)

Uniswap UNI is a popular decentralised trading protocol known for its role in facilitating the automated trading of decentralised finance (DeFi) tokens. Uniswap aims to keep token trading automated and completely open to anyone who holds tokens while improving the efficiency of trading versus that on traditional exchanges. Uniswap creates more efficiency by solving liquidity issues with automated solutions, avoiding the problems that plagued the first decentralised exchanges.

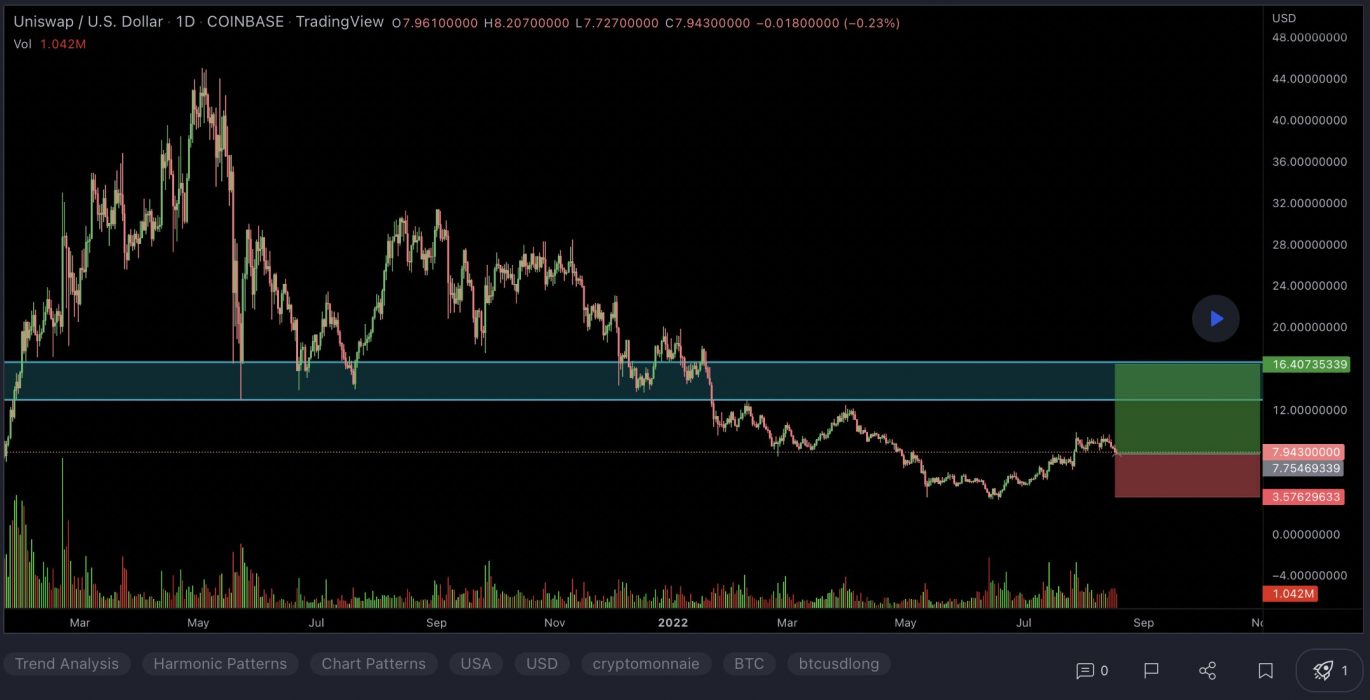

UNI Price Analysis

At the time of writing, UNI is ranked the 17th cryptocurrency globally and the current price is US$7.91. Let’s take a look at the chart below for price analysis:

UNI‘s 70% retracement from its Q2 highs set a low near $4.20 during its consolidation that began in early June.

Relatively equal highs near $8.00 could be the current target if the price breaks through resistance beginning near $8.67. Bullish continuation might reach through the next significant swing high near $9.35 into the daily gap near $10.50.

If bullish strength continues, the zones just below the monthly open near $10.88 and 11.35 could halt any retracement.

A bearish shift in the market might seek the relatively equal lows near $6.90 into possible support near $6.12. If this down move occurs, the swing low near $5.20 and possible support near $4.80 may be the primary objective.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link