Rumours circulated some six months ago that BlackRock, one of the world’s most influential fund managers, was moving to offer its institutional clients access to crypto trading. Now, it’s become official:

Driven by Client Demand

The news broke on August 4 when Coinbase announced it had partnered with the US$10 trillion financial heavyweight to offer crypto trading to its institutional clients, starting with bitcoin.

Following the alliance, BlackRock’s proprietary wealth management platform, Aladdin, will integrate directly with Coinbase Prime, such that clients will have access to trading, custody, prime brokerage and reporting capabilities. Aladdin is the gold standard of institutional fund manager platforms, suggesting that the partnership is likely to have far-reaching consequences:

In the true spirit of Bitcoin, it’s worth noting that BlackRock’s move to offer bitcoin arose from the bottom-up, rather than top-down:

Our institutional clients are increasingly interested in gaining exposure to digital asset markets and are focused on how to efficiently manage the operational lifecycle of these assets. This connectivity with Aladdin will allow clients to manage their bitcoin exposures directly in their existing portfolio management and trading workflows for a whole portfolio view of risk across asset classes.

Joseph Chalom, global head of strategic ecosystem partnerships, BlackRock

This represents a dramatic change of tone from years gone by, a fact that didn’t escape Bitcoin Twitter:

Coinbase Soars on the News

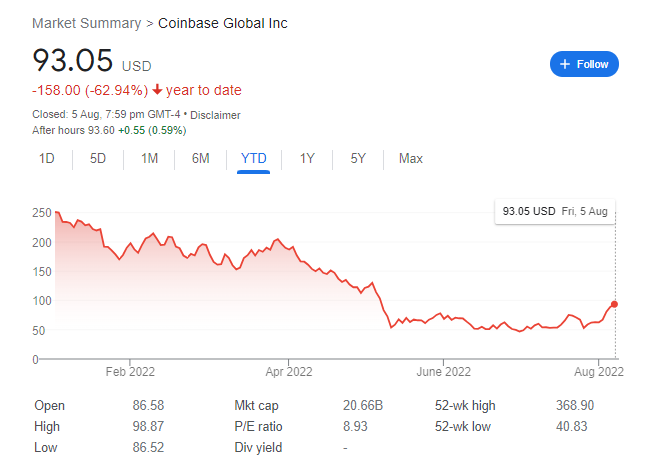

Shortly after the partnership announcement, Coinbase stock, which recently suffered a 20 percent drop amid an unregistered securities probe, rose by close to 40 percent.

Unsurprisingly, the company has not been spared from this year’s bear market of “historic proportions“, impacting both digital assets and related firms alike. For the year to date, Coinbase stock remains down over 63 percent, even after this most recent rally:

While bitcoin’s price remains supressed against a challenging macro backdrop, it’s telling that financial giants such as BlackRock continue with plans to move forward, proving that this asset class is here to stay.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link