It was a historical moment for cryptocurrency enthusiasts on Monday when the global crypto market capitalization crossed $2 trillion. What’s more interesting is that it only took a few months for the crypto market to reach the second $1 trillion than the initial time, which took close to a decade.

The growth of the cryptocurrency market results from the recent increases in the market value of top cryptocurrencies since the beginning of the year, including Bitcoin (BTC) and Ether (ETH).

Bitcoin Accounts for Over 50% of Crypto Market Cap

There are over five thousand cryptocurrencies that made up the $2 trillion market capitalization on CoinGecko. However, the first-ever cryptocurrency, Bitcoin (BTC), accounts for over 50 percent of the entire market. During press time, BTC had a total valuation of US$1.057 trillion.

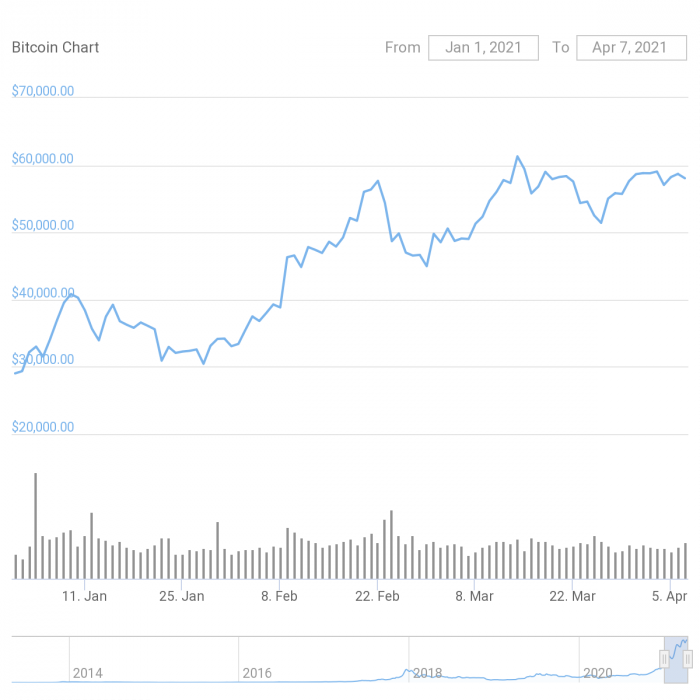

BTC has seen an exponential kind of increase since the start of 2021. A market 2021 quarter one report by Crypto News Australia informed Bitcoin was the best-performing asset with over 100 percent increase in value.

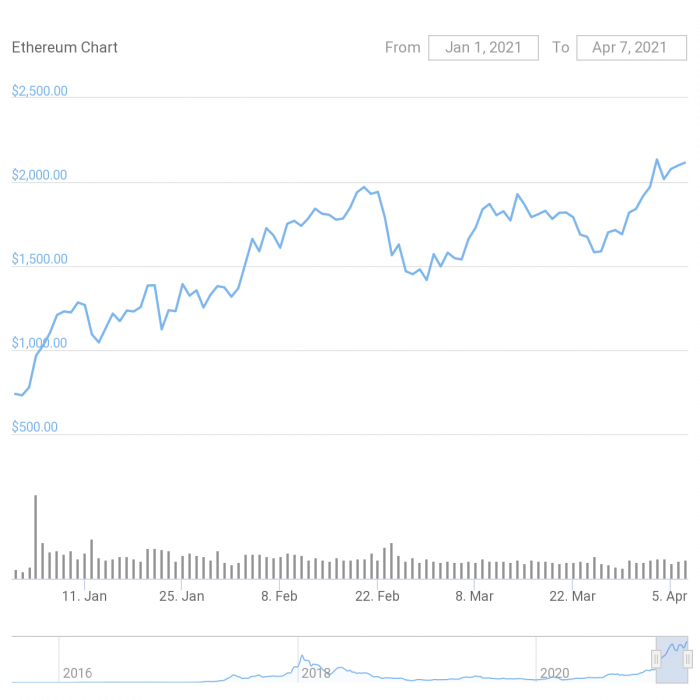

The price of Ether, which is the second-largest cryptocurrency by market capitalization, increased by over 170 percent on a year-to-date (YTD) chart. ETH has a market capitalization of $229 billion, which represents 12.4 percent of the entire crypto market cap.

A few other major altcoins to note are Bitcoin Coin (BNB), Polkadot (DOT), Cardano (ADA), and Ripple (XRP), all of which have seen a massive increase in value since 2021.

Institutions are investing in crypto

The swift growth of the cryptocurrency market is indicative of active institutional players. It’s worth mentioning that institutions played a significant role in recent rallies in the crypto market. Last year, Bitcoin skyrocketed as big-name companies, including MicroStrategy, Square, MassMutual, etc., allocated part of their cash reserve to it.

In 2021, more institutions and deep-pocketed investors began flooding into the market, especially in BTC, such as Tesla. The growth in crypto investment products like Grayscale’s Trusts indicates the interest of risk-minded investors in the market.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link