According to on-chain analysts Glassnode, there are growing signals that the bottom may be in. Most recently, the firm revealed that over 80 percent of US dollar-denominated investments have not moved in three months, suggesting that holders are increasingly unwilling to sell any lower:

Bear Markets Look Alike

Glassnode argues that its “Realised Cap HODL Wave” metric clearly shows similar patterns to the bear markets of 2012, 2015 and 2018.

In brief, the metric intends to illustrate the relative economic weight stored by bitcoins of various holding times, and changes arising from holding and spending behaviour. For a more complete explanation, this useful overview is instructive.

Bottom In?

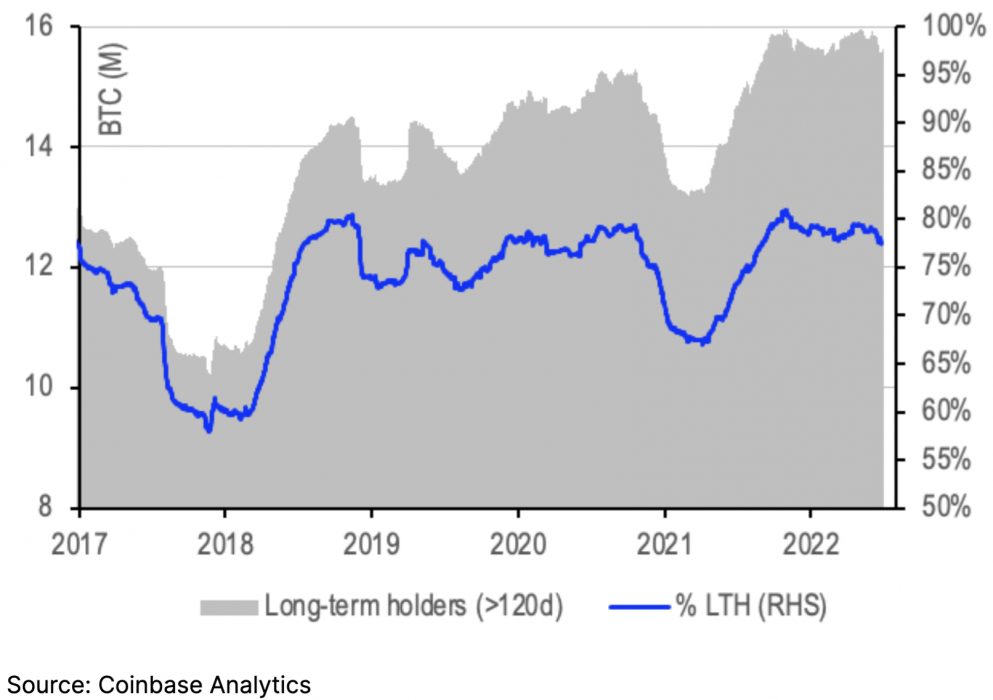

Concurring with an earlier Glassnode assessment, Coinbase’s head of institutional research noted in its report that on-chain data revealed recent selling was “almost exclusively” short-term speculators. Long-term holders (in excess of six months), by contrast, were not found to be selling.

In fact, these HODLers were found to represent 77 percent of coins in circulation, which although down from 80 percent earlier this year, was viewed as a “positive sentiment” suggesting that holders were less likely to sell.

Amid ongoing pressure of a negative macro and crypto environment, bitcoin’s price has remain subdued, recently slipping below US$19,000 on news of the US’ highest inflation print in 40 years.

Bitcoin has since somewhat recovered, and at the time of writing was trading at US23,300, above its 200-week moving average (MA) of US$22,600. Notwithstanding, technical analysts suggest that a definitive and sustained breakout above the 200-week MA is necessary to reverse the bearish trend.

Of course, we’ll only know in hindsight whether bitcoin bottomed out at US$17,500. However, from a Bitcoiner’s perspective, the fundamentals remain unchanged and if anything it’s offered a priceless opportunity to stack more sats for less.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link