The rising use of mixers in the crypto space draws public attention. Criminals and their illicit activities are being accused of involving in this situation, according to Chainalysis.

The blockchain analytic firm stated:

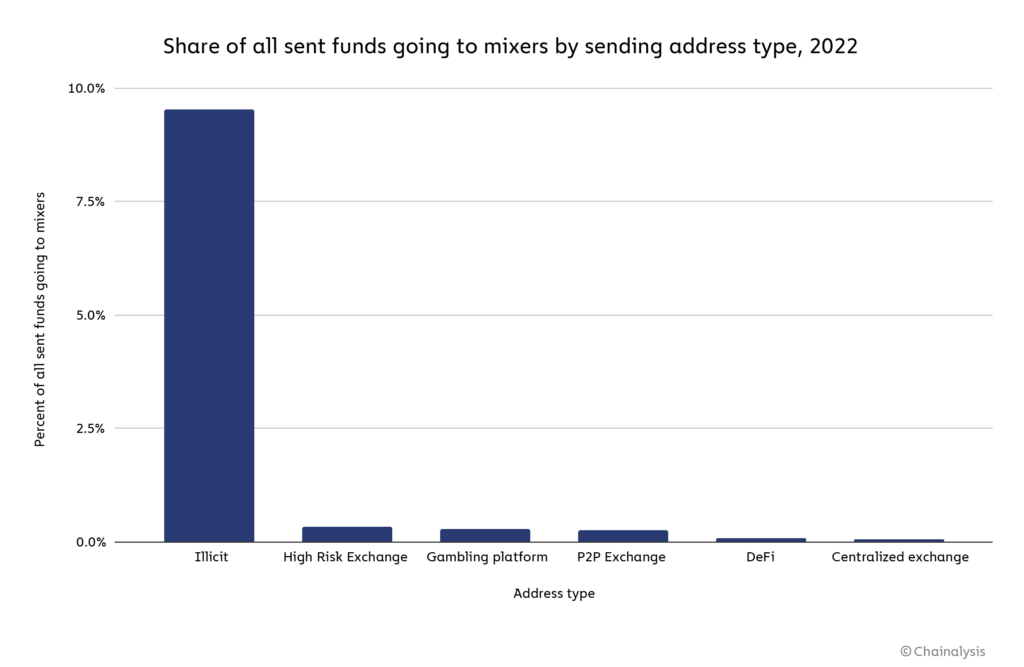

“Nearly 10% of all funds sent from illicit addresses are sent to mixers — no other service type cracked a 0.3% mixer sending share.”

Source: ChainalysisSince mixers render enhanced privacy in crypto transactions, cybercriminals, such as hackers can abuse them when obfuscating the source of funds.

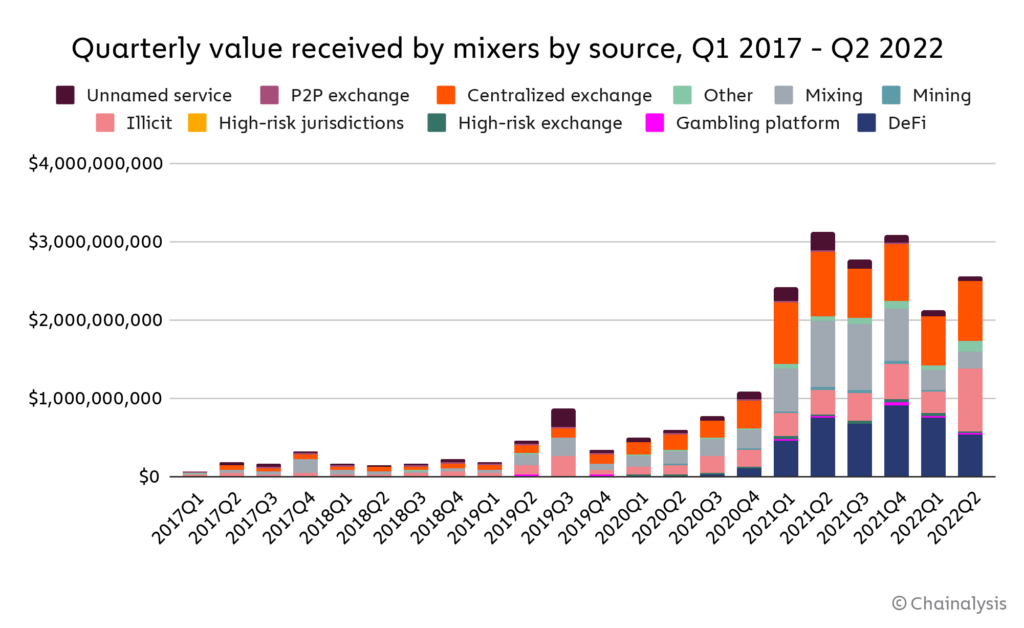

A study researched by Chainalysis pointed out that the demand for mixers hit an all-time high in 2022 based on their aspect of creating a disconnection between the crypto funds deposited and those withdrawn. Therefore, this makes the traceability of the flow of funds difficult because they are pooled together and mixed randomly.

The analytic firm pointed out:

“While value received by mixers fluctuates significantly day-to-day, the 30-day moving average reached an all-time high of $51.8 million worth of cryptocurrency on April 19, 2022, roughly doubling incoming volumes at the same point in 2021.”

Source: ChainalysisThe types of mixers include centralized, CoinJoin (with built-in capabilities), and smart contracts that are legitimately used to boost financial privacy.

Therefore, mixer usage has remained close to historic highs in 2022 based on soaring demand from DeFi protocols, centralized exchanges, and addresses linked to illicit activities such as scams, ransomware, the darknet market, and terrorism financing.

Source: ChainalysisChainalysis explained:

“The increase in illicit cryptocurrency moving to mixers is more interesting, though. Illicit addresses account for 23% of funds sent to mixers so far in 2022, up from 12% in 2021.”

Source: ChainalysisIn 2020, the Financial Crimes Enforcement Network (FinCEN) charged a Bitcoin-mixing operator with a $60 million civil money penalty for violating anti-money laundering regulations.

Larry Dean Harmon was arrested and charged with providing unregistered money services to businesses from 2014 to 2020. He laundered over $300 million in Bitcoin and enabled the trafficking of drugs, guns, and child pornography.

Image source: Shutterstock

Credit: Source link