Bitcoin and other cryptocurrencies took a major tumble this past weekend, accelerating into the week, following the release of the latest official US inflation data which revealed the fastest annual increase since December 1981:

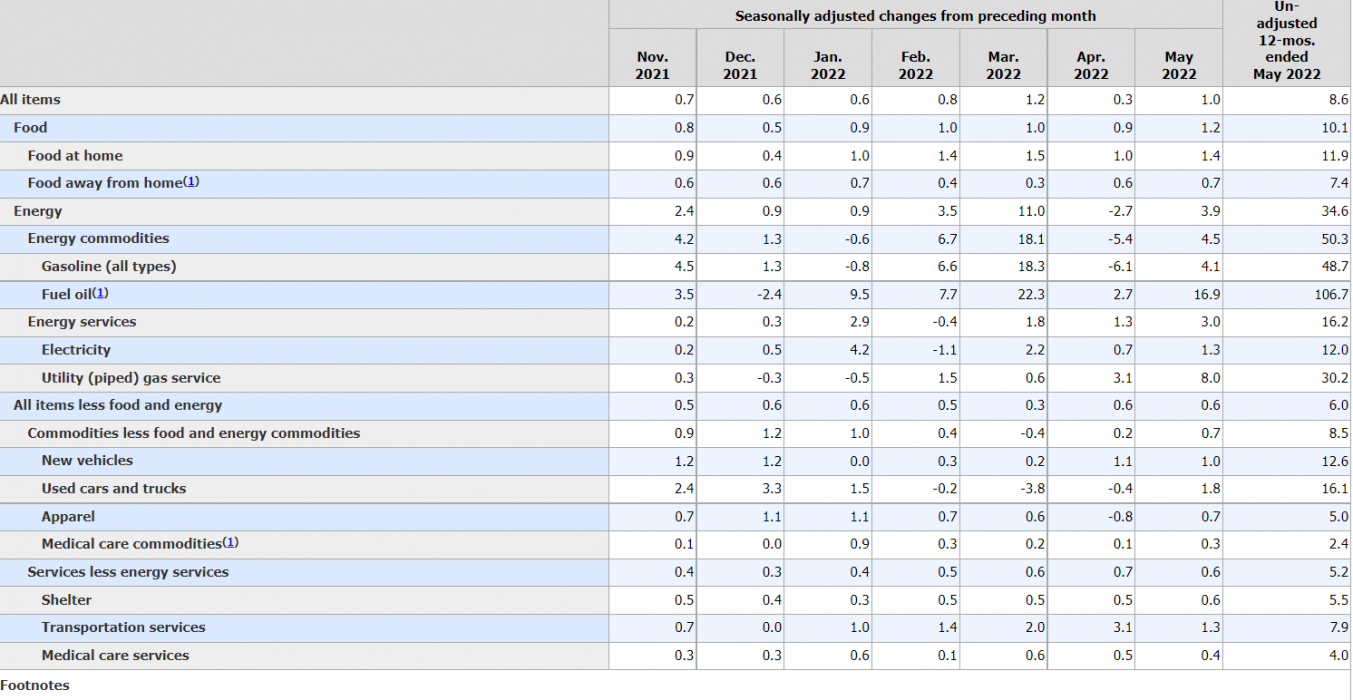

Consumer Price Index (CPI) Up 8.6%

According to the US Bureau of Labor Statistics, CPI rose 8.6 percent for the 12 months through to May, the largest increase in over 40 years.

The index, long deemed unreliable by hard money advocates, purports to track the movement of a broad range of goods and services in an economy, including food, shelter and energy.

Among the largest increases were energy (34 percent), used cars and trucks (16 percent), and food (10 percent). However, few in the crypto community believe official CPI figures, with most suggesting that in reality it ought to be in the double-digits:

It’s well documented that the definition of CPI has changed over time, always resulting in a reduction in CPI (quite conveniently).

ShadowStats.com tracks the original definition used in the 1970s and, applying it to today, suggests an 18 percent increase:

Investors Flee Crypto on Inflation Fears

In theory, the higher inflation rises, the more likely that the Federal Reserve will hike interest rates. And if that does indeed come to pass, all risk assets (including crypto) tend to get sold off as investors flee to relative safe haven assets such as bonds.

As news broke on June 10 of the highest US inflation levels in 40 years, investors expressed fears that it could trigger more aggressive action by the Federal Reserve. And then just yesterday, news emerged that Fed officials were contemplating a 0.75 percent increase, up from the 0.5 percent expected by the market.

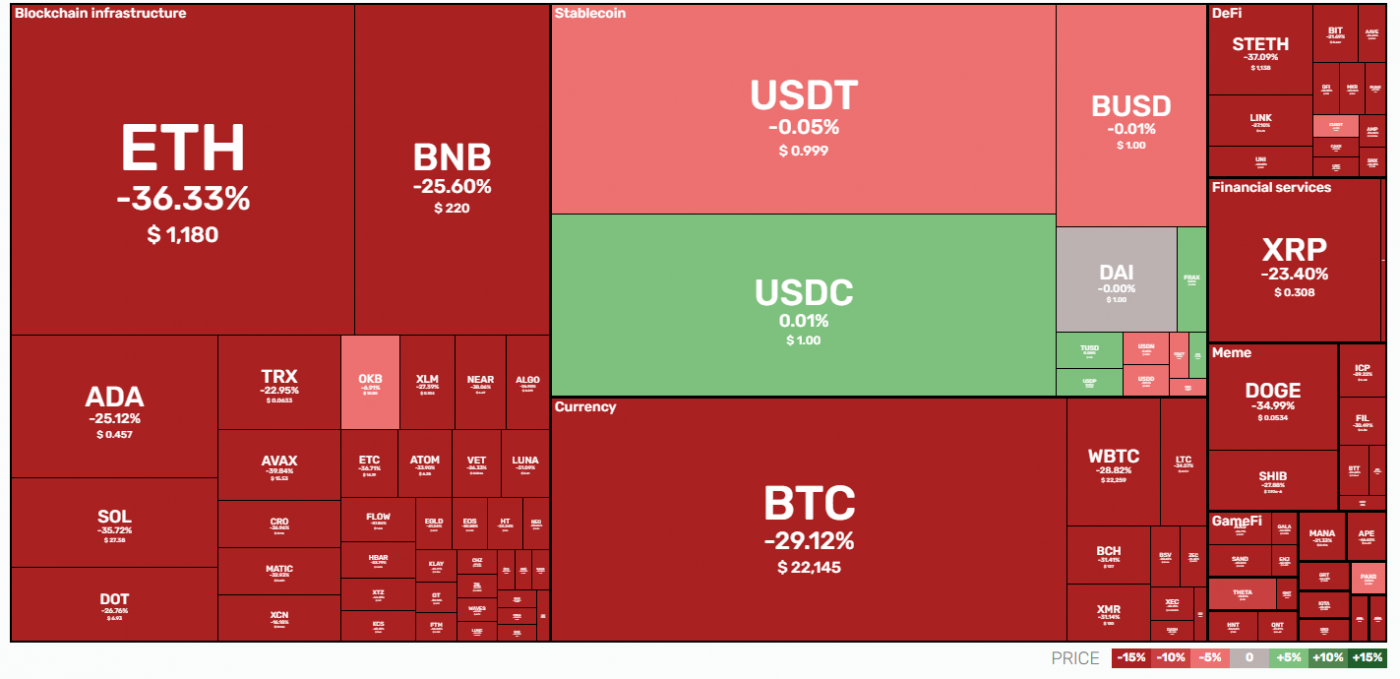

Almost immediately, all risk assets saw dramatic outflows, with the crypto sector being hit especially hard:

Among the top ten cryptocurrencies, ETH was down over 36 percent, BNB by 25 percent and BTC by 29 percent.

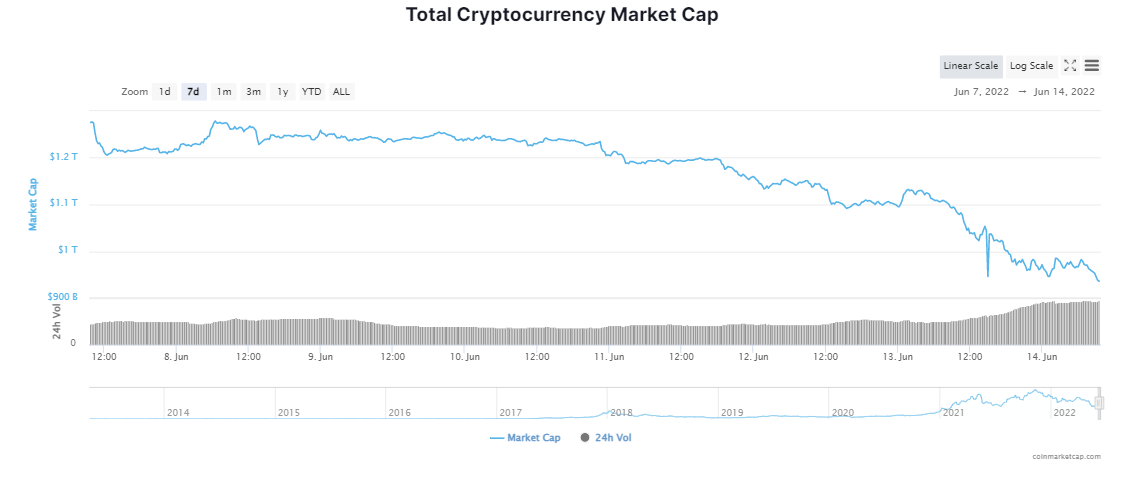

As liquidations continued, the crypto market sank below US$1 trillion for the first time since early 2021.

At the time of writing, the total market capitalisation had slipped to US$933 billion, down from its all-time high of US$2.95 trillion reached in November 2021. Meanwhile, BTC is now trading at US$22,265, with ETH exchanging hands at US$1,440.

This latest sell-off is starting to make May’s downturn look trivial in comparison, and by all accounts there is still some way to go before we hit bottom. One thing is, however, certain – macro and crypto are officially intrinsically linked. Crypto can no longer be said to be uncorrelated with the broader macroeconomic environment, as was the case in years gone by.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link