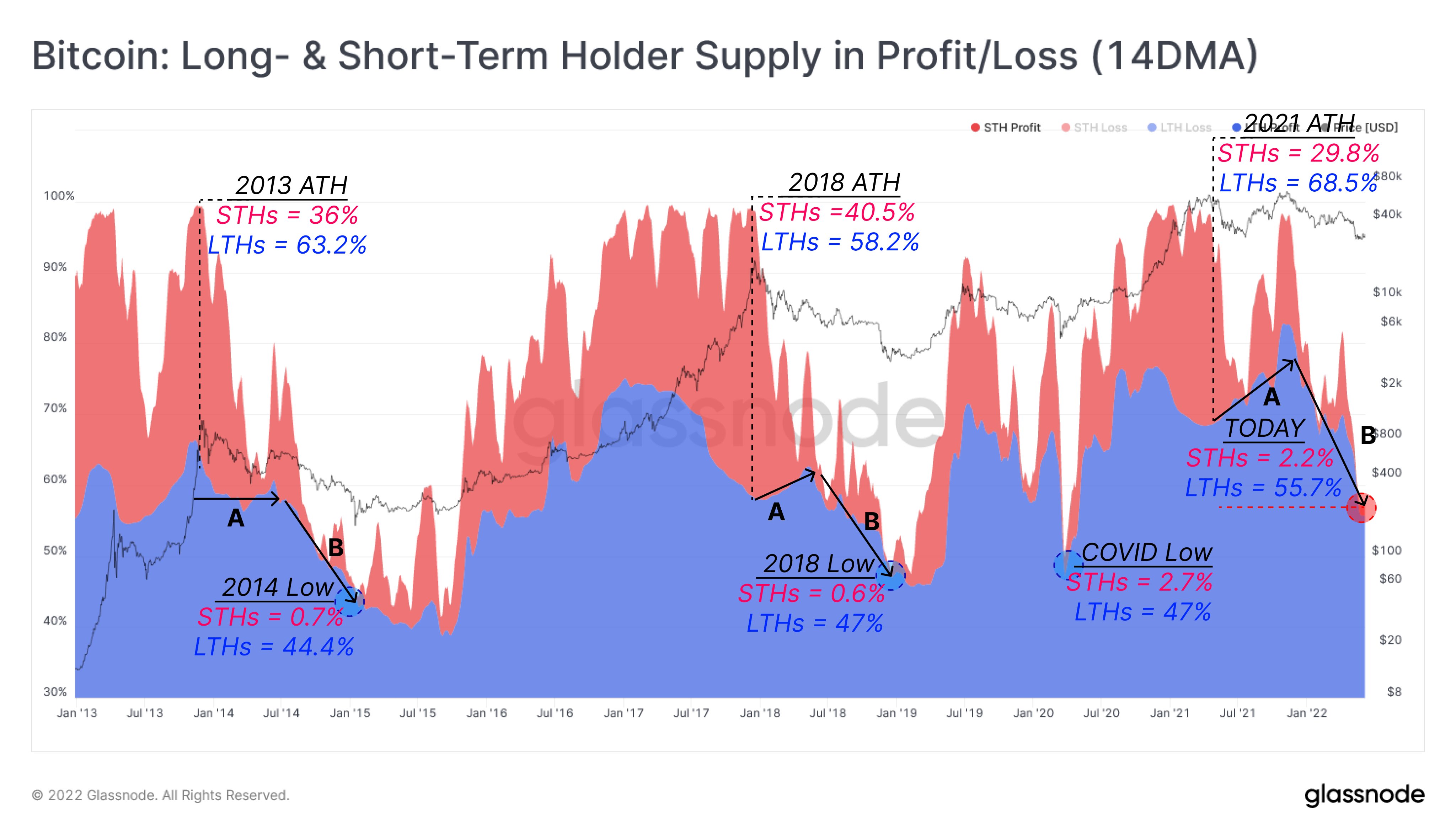

In its latest report, on-chain analytics company Glassnode has revealed that the vast majority of short-term bitcoin holders are in the red, with only 2.2 percent in profit.

Long-Term Holders Dominate

In its report, Glassnode indicated that virtually all short-term holders (STH), or those who have held bitcoin for a period of fewer than 155 days, are underwater. By comparison, just under 56 percent of long-term holders (LTH) are in profit.

While most appear to believe that bitcoin is in the midst of a macro bear market, Glassnode commented that LTHs remained the primary beneficiaries of current market conditions, holding 90 percent of profit, relative to just 10 percent attributable to STHs.

Interestingly, this trend has played out repeatedly in prior bear markets where STHs (most often speculators) are flushed from the market and, as a result, end up holding few coins. LTHs, by contrast, continue to accumulate and dominate circulating supply. According to Glassnode, this trend is caused by two parallel events, namely:

Phase A: Short-Term Holders who purchased near the top are immediately plunged into a loss, reducing their overall Supply in Profit.

Phase B: Long-Term Holder accumulation persists during the bear, despite prices pushing their newly acquired coins into an unrealised loss.

Glassnode report

As a result, Glassnode adds that “STHs have essentially reached a near-peak pain threshold, with almost no unrealised profits held while LTHs [are] dominating the remaining profitable supply”.

The news comes just weeks after bitcoin experienced a record eight consecutive weeks in the red, resulting in crypto’s flagship asset sinking to price levels below US$30,000, last seen in 2020.

Green Shoots

Against a backdrop of monetary tightening and a broader macro risk-off sentiment, bitcoin has endured a rather difficult time since hitting its all-time high of US$69,000 in November last year.

As of last month, bitcoin had declined 50 percent from its previous high, albeit less than the vast majority of other cryptocurrencies. At times like these, Bitcoiners would do well to visit other metrics to assess the overall health of the network – and two metrics stand out in particular.

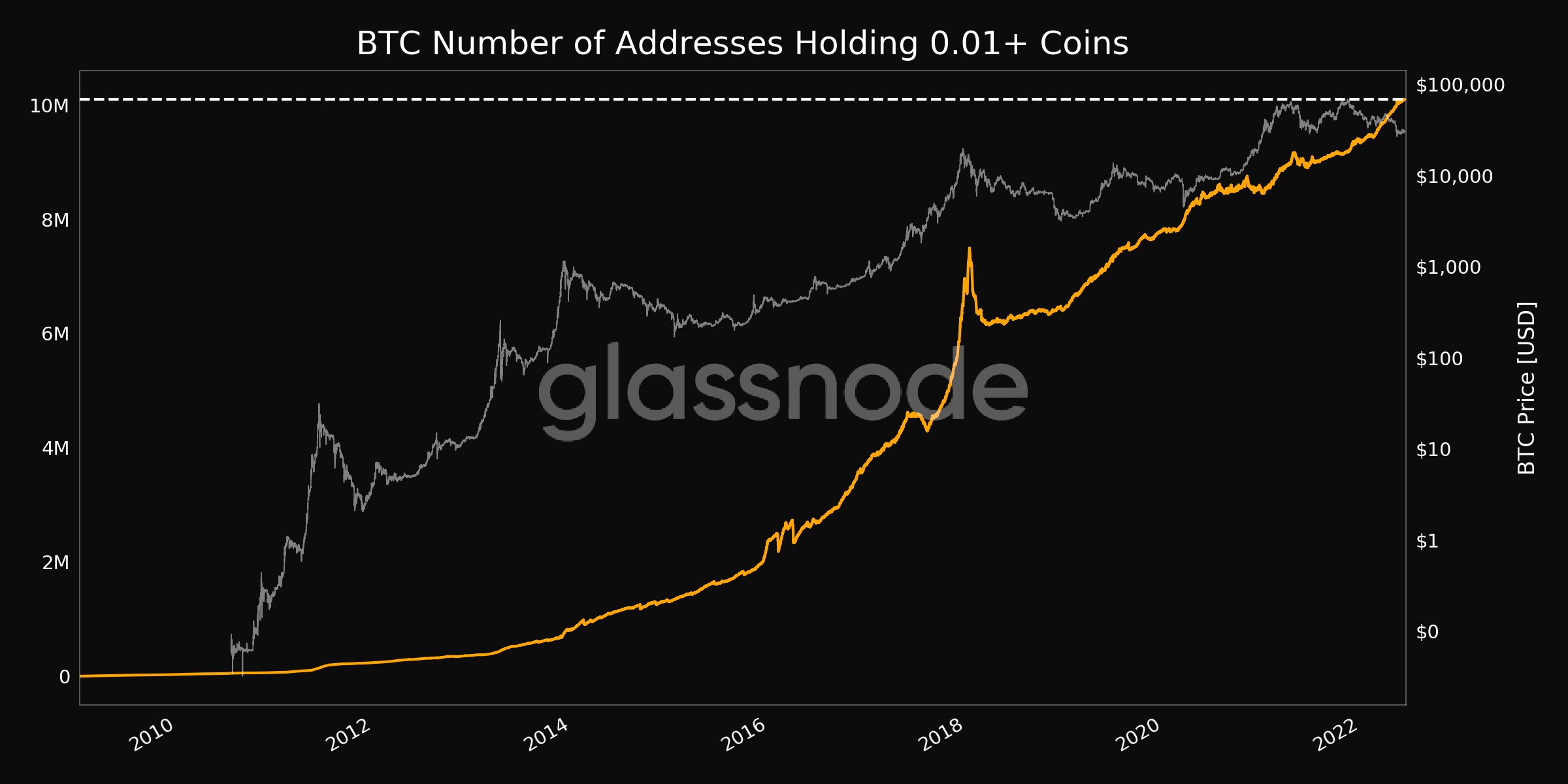

The first relates to BTC addresses with balances exceeding 0.01 (US$30). This recently hit an all-time high, suggesting that new retail investors continue to enter the market, despite current market conditions.

The other relates to Bitcoin’s hashrate – the amount of computing and process power being contributed to the network through mining. It recently hit an all-time high of 240 exahashes per second, which, roughly speaking, provides an illustration of the network’s overall security and robustness.

These insights, together with HODLing data suggesting that over 60 percent of BTC hasn’t moved in a year, give the impression that despite languishing price action, Bitcoin remains in good shape, all things considered.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link