Next week, US-based major crypto exchange Coinbase might provide more details about the status of the crypto market in the first quarter of this year as it aims for a direct listing of its shares on April 14.

On April 6, the company will hold a conference call to discuss its first quarter 2021 estimated results and will provide a financial outlook for 2021.

Therefore, investors will have another week to evaluate them and prepare for the direct listing of shares. The company said that it anticipates that its Class A common stock will begin trading on the Nasdaq Global Select Market under the ticker symbol “COIN” on April 14.

Unlike the traditional initial public offering (IPO), in a direct listing, the company sells shares directly to the public without getting help from intermediaries. Coinbase previously said it will not raise any new capital during this listing. As reported, it was valued at around USD 90bn during its final week of trading on Nasdaq’s private market.

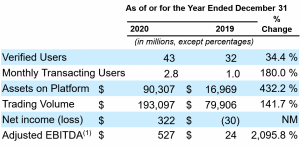

According to Coinbase, they had 43m verified users last year and 2.8m monthly transacting users. Also, they claim that they work with 7,000 institutions and 115,000 ecosystem partners in over 100 countries.

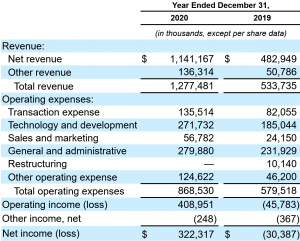

Previously announced results of Coinbase

Consolidated statement of operations data

___

Key business metrics

____

Learn more:

– Coinbase Listing Has Largest Impact On Price Among 6 Exchanges – Messari

– Coinbase Announced ‘Business Presence’ in India With New Local Hires

– Coinbase Says It Aims to Improve Customer Service, Integration with Pro

– Coinbase Aims For USD 1B Direct Listing, Reveals Results and Plans

– Coinbase Apologizes To European Users For Missed Higher Profits

Credit: Source link