The Luna Foundation Guard (LFG), stewards of Terra’s UST, are looking to raise over US$1 billion to shore up the algorithmic stablecoin after it lost parity with the US dollar earlier this week.

Just last month, LFG announced it had successfully raised US$1 billion to acquire bitcoin to underpin UST. Yet the stablecoin fell as low as US$0.60 on May 9, amid wider crypto market turmoil, recovering to $0.90 the following day.

Do Kwon Moves to Smooth Ruffled Feathers

Algorithmic stablecoins such as UST are meant to stay pegged one-to-one to the price of an underlying fiat currency such as the dollar, and to this end Terra co-founder Do Kwon quickly took to Twitter in an attempt to calm the market:

The group is now looking to raise fresh capital from some of the industry’s largest investment firms and market makers. The proposed deal offers investors the opportunity to purchase LUNA tokens at a 50 percent discount, with those tokens subject to a two-year vesting schedule.

Up to Four Investors in the Bailout Queue

Jump, Celsius, Jane Street and possibly Alameda are reportedly in talks regarding the deal, though none of the four has confirmed as much. The funding effort is LFG’s latest attempt to regenerate confidence in the market:

Critics say the success of any deal depends on the strength of LUNA’s price and on its key DeFi platform, Anchor, continuing to produce an up to 20 percent yield to incentivise liquidity. However, Anchor has seen its total deposits plunge from a peak of US$14 billion to below $10 billion.

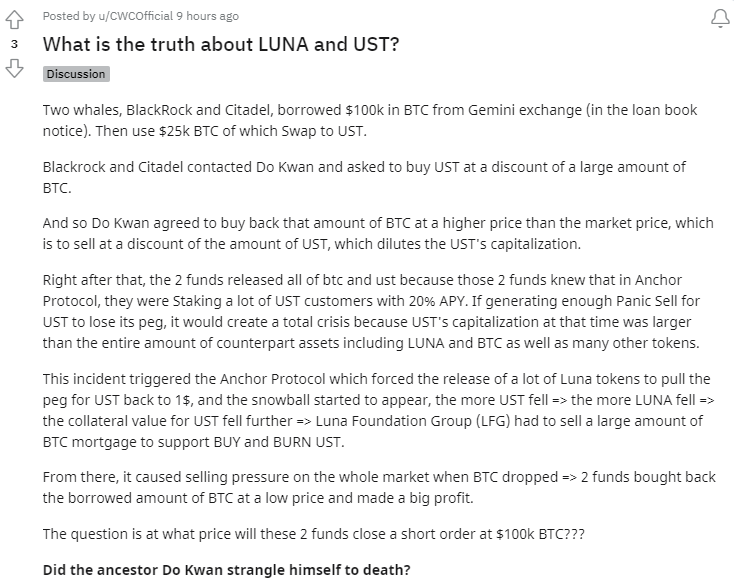

Reddit users are speculating on the background story:

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link