Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Polygon (MATIC)

Polygon MATIC is the first well-structured, easy-to-use platform for Ethereum scaling and infrastructure development. Its core component is Polygon SDK, a modular, flexible framework that supports building multiple types of applications. The MATIC token will continue to exist and will play an increasingly important role in securing the system and enabling governance.

MATIC Price Analysis

At the time of writing, MATIC is ranked the 17th cryptocurrency globally and the current price is US$1.26. Let’s take a look at the chart below for price analysis:

Since its Q1 Highs, MATIC has been in a steady bearish trend – retracing nearly 25% by mid-April. The price found support near $1.20, at the 50.6% retracement level.

Last week’s sharp impulse up might have marked the start of a new bullish swing. If so, higher timeframes suggest that $1.39 near the 61.8% retracement, and the 9, 18 and 40 EMAs, may see interest from bulls. The price could reach lower, near $1.20, and still find support.

Currently, the price is contesting a region between $1.19 and $1.35. Closes over this level could confirm it as new support, leading to a move higher.

However, bulls are contending with probable resistance near $1.44, while $1.53 is also likely to be sensitive with the nearest support and resistance this close together.

2. Hedera (HBAR)

Hedera Hashgraph HBAR is a public network that allows individuals and businesses to create powerful decentralised applications (DApps). It is designed to be a fairer, more efficient system that eliminates some of the limitations older blockchain-based platforms face, such as slow performance and instability. The HBAR token has a dual role within the Hedera public network.

HBAR Price Analysis

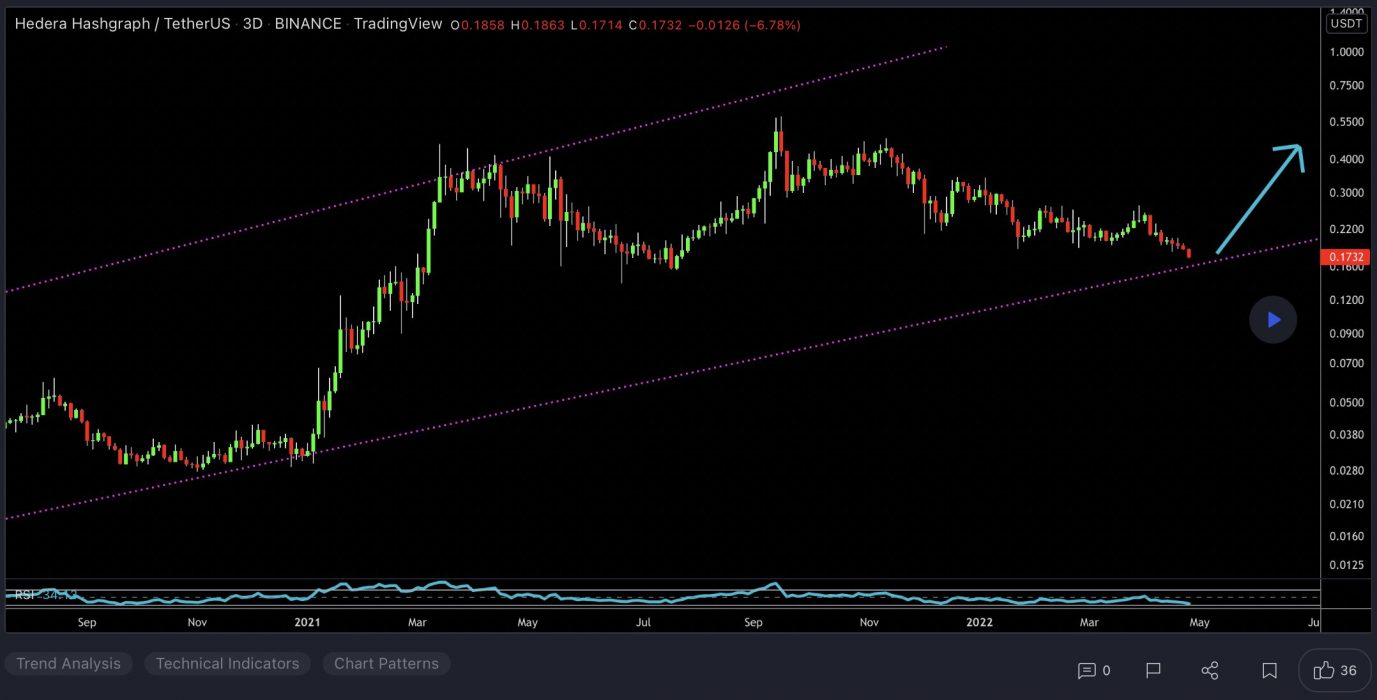

At the time of writing, HBAR is ranked the 36th cryptocurrency globally and the current price is US$0.1691. Let’s take a look at the chart below for price analysis:

HBAR‘s 50% Q1 run retraced almost to its origin, narrowly missing probable support near $0.1695 before bears swatted down the bounce near resistance around $0.1989.

With the daily gap between $0.1812 and $0.1750 almost filled in a single wick, the price may not need to revisit areas below this level. However, the safer entry is still in probable support between $0.1545 and $0.1500, which would also sweep the lows of last week’s bounce.

The relatively equal highs near $0.2256 provide a likely first target on lower timeframes. However, the resistance beginning at $0.2435 may initially suppress a further move up.

A clean break through this resistance will need to contend with the next resistance near $0.2692, under the last swing high. This swing high at $0.2770 gives a reasonable take-profit area before a possible move to the 1.0 extension near $0.2956.

3. Gala (GALA)

GALA aims to take the gaming industry in a different direction by giving players back control over their games. Gala Games’ mission is to make “blockchain games you’ll actually want to play”. The project wants to change the fact that players can spend hundreds of dollars on in-game assets and countless hours playing the game, all of which could be taken away from them with the click of a button. It plans to reintroduce creative thinking into games by giving players control of the games and in-game assets with the help of blockchain technology.

GALA Price Analysis

At the time of writing, GALA is ranked the 74th cryptocurrency globally and the current price is US$0.1688. Let’s take a look at the chart below for price analysis:

After setting a low last week, GALA turned into a recovery trend to make the new monthly highs.

The following 60% plummet found support near $0.1679, sweeping under the 40 EMA into the 58.8% retracement level before bouncing to resistance beginning at $0.1930.

This area could continue to provide resistance, possibly causing a retracement to the 9 EMA and 18 EMA near $0.2112, where aggressive bulls might begin bidding. The level near $0.2350, which has confluence with the 40 EMA, may see more interest from bulls loading up for an attempt on probable resistance beginning near $0.2685.

However, if Bitcoin continues its sideways trend, much lower prices could be seen. The old support near $0.1580 could provide at least a short-term bounce. If this level fails, the old highs near $0.1435 might also give support and see the start of a new bullish cycle after retesting these support levels.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link