To offer the best option for all investors from traditional securities to cryptocurrency investment.

1. Berkshire Hathaway, a Magnate Unequal to Retail Investors

Berkshire’s investment practice is full of initiative. It makes use of its sensitive business sense to take the initiative and always maintains the professional quality of discovering value targets, Of course, every investment of Berkshire is in line with the long curve growth trend.

● Anxiety of Retail Investors

Berkshire’s record or Buffett’s charm makes people want to exchange all their chips for more because everyone wants to earn more. However, from a personal stance, we have to admit that such a threshold will block us out. Berkshire’s high return on investment belongs to institutional investors and has nothing to do with retail investors! So how can individual investors choose a good way of investment?

2. Grayscale Fund, Filling up Old Bottle with New Wine, Engaging in Cryptocurrency of Wall Street

Before introducing Grayscale, we should learn about the encryption magnate, Digital Currency Group (hereinafter referred to as DCG), which is called by its founder as the Berkshire Hathaway of the encryption world. Its scale has already exceeded US $10 billion. Including investment in Coinbase, the world’s largest exchange, Decentraland, the leader of metaverse concept, etc. Its Grayscale, CoinDesk and Genesis are particularly famous.

Holding Coca-Cola alone is enough to shock ordinary investment institutions. In 1988, Buffett bought 593 million US dollars of Coca-Cola stock. In 1989, the amount increased significantly to 1.024 billion US dollars. In 1994, the total investment reached 1.299 billion US dollars, which has remained unchanged since then. This is amazing. Of course, every investment of Berkshire is in line with the long curve growth trend.

● Only-In-No-Out, Rising Unilaterally

From the perspective of operation mode, the trust fund of Grayscale can be regarded as an ETF. It was investigated and dealt with by the SEC in 2014. Therefore, since then, Grayscale deliberately stopped the “redemption” function on the grounds that the SEC would not approve it and did not strive for it anymore, which led to the ETF becoming a multi-currency encrypted capital pool with multiple encrypted currencies led by bitcoin. With no channels for getting back the digital currency, the investors could only cash in the OTC market with the Grayscale trust and the currency holding of the Grayscale fund would only rise unilaterally. This is why the price of Grayscale trust has always been at a premium.

● No Alternative for Retail Investors

Up to now, the Grayscale trust has held a total of 13 currencies, which are successively the leading projects of subdivided projects such as BTC, ETH, LINK, FIL and MANA. Although investors do not have to worry about the risk of return-to-zero, the optional power for them still lacked diversity. Grayscale, as a cryptocurrency trust, has the same over-centralized management as that of Buffett’s Berkshire. At the same time, the door of the Grayscale fund is not open to individual investors. Like Berkshire, it is a hotbed for institutional investors, which still discourages some individual investors.

So it seems that the Grayscale fund fails to give a better solution to personal investment!

3. BlackHoleDAO, Integrating with Various Advantages

Superior Protocol Mechanism

BlackHoleDAO is an upgraded version based on Olympus DAO, but such a description may be too narrow. To be exact, BlackHoleDAO constructed a brand-new standardized model based on DeFi 3.0, with a burn mechanism that solved the imbalance between high inflation and deflation based on the principle of splitting and merging of the traditional stock market. Moreover, the credit loan service of DAOs is launched in the new mechanism. It can be interpreted simply as a service protocol for enterprise asset management, which includes the splitting and merging function while providing the unsecured credit loan services based on itself. So it is like a loan business of a bank.

● No Risk of Inflation

BlackHoleDAO also cleverly uses and upgrades the principles of stack and bond in Olympus. In order to solve the original high inflation problem of Olympus, BlackHoleDAO enabled the deflation mechanism on the premise of determining the total amount of tokens, which solved the problem while making passive gains.

● Asset Management with DAOs

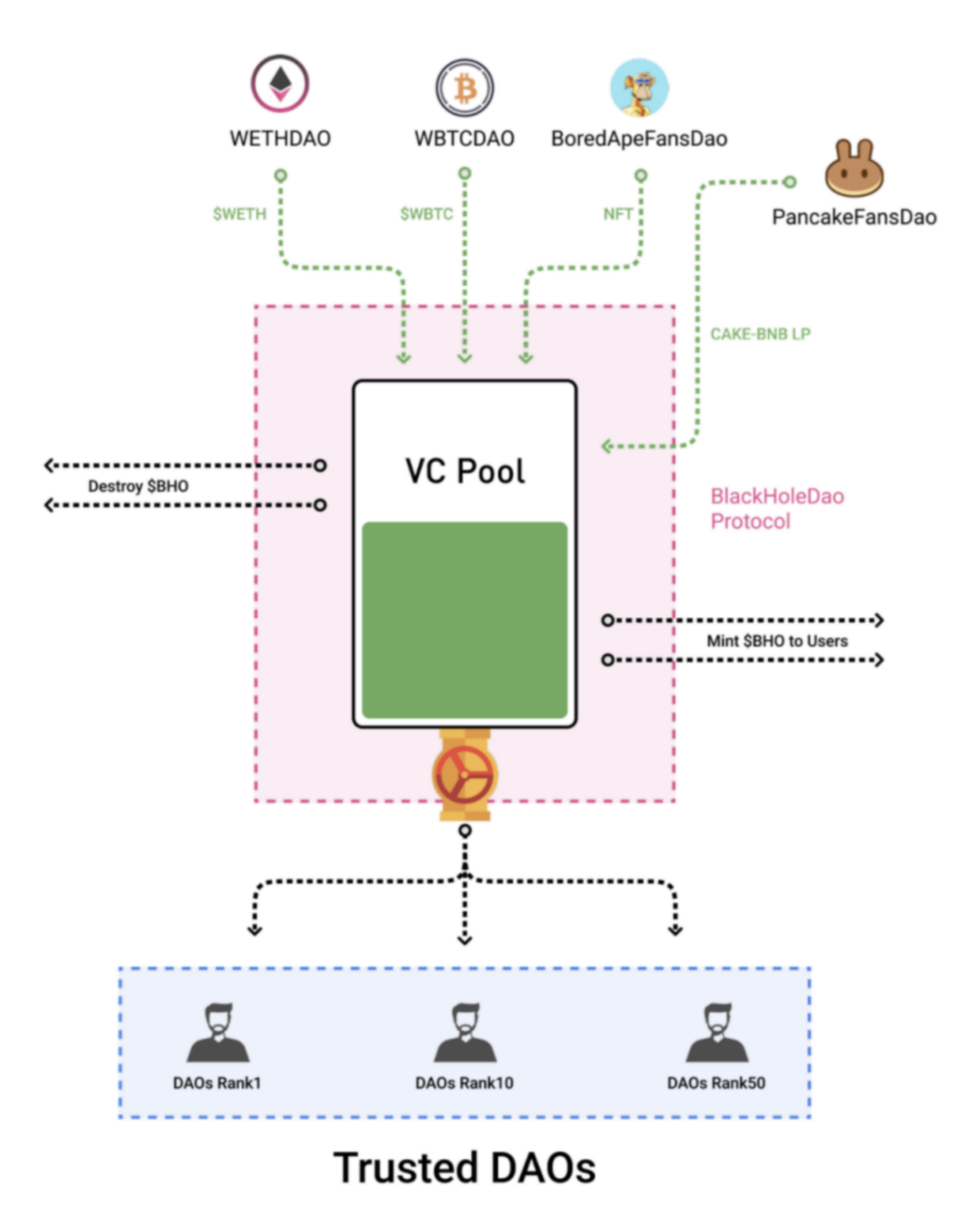

BlackHoleDAO Protocol is supported by the Treasury, with smart contracts to connect VC Pool and Donation Pool. VC Pool supports investment in multiple currencies, part of which is used to burn BHO (BlackHole DAO token) in the liquidity pool, and the rest for credit loan after the successful DAOs investment. Donation Pool receives the BUSD direct investment from investment institutions, DAOs teams and individuals, and finally gives return at twice in BUSD, and Transaction Fee Pool, in turn, provides operational support for Donation Pool, DAOs Community, and Black Hole Reactor.

VC Pool, the most mentionable in the BlackHoleDAO protocol, can be understood as another way to buy Bonds, except that the VC Pool only accepts valuable vouchers such as unstable tokens, NFTs and liquidity LPs. The tokens, NFTs and liquidity LPs online in the VC Pool are the tokens proposed by each DAOs community that are voted through.

● Enhanced Supportive Stock (BHO)

After the VC Pool reaches a certain amount of assets, a certain proportion of different Tokens will be taken out from the liquidity LPs for grouping LPs and providing liquidity and LP loan services for leading products such as Curve, Compound and Aave. All the earnings will enter the VC Pool to support the circulation value of the stock (BHO).

Tokens that can be selected into the VC Pool need to be strictly reviewed and screened by the DAOs community. In this way, the long tail effect on potential assets by malicious behavior can be prevented, thereby avoiding the shrinkage and inflation of stocks (BHO). Such an operation is like the Grayscale fund that is decentralized, which is friendlier to individual investors. There is no doubt that excellent precipitated assets are bound to support the shares of BlackHoleDAO Protocol (BHO) to obtain a beautiful curve of steady rise. So far, a solution that can meet a variety of investment users seems to appear.

Summary

BlackHoleDAO is more like a decentralized Berkshire company. All users invest digital assets in exchange for BHO (similar to stocks), and rely on asset appreciation to provide value support for BHO. The development trend of digital assets is high-speed and upward. BHO converges digital assets of almost all categories and passively manages these assets.

Credit: Source link