Major US-based crypto exchange Coinbase is taking a swing at both traditional payment companies and crypto-native competitors with the introduction of Coinbase Pay. The new solution, however, differs from existing payments solutions from competitors like Binance, for example, as the former is a way to fund Coinbase’s browser-based wallet with fiat, while the latter is a way for users to fund accounts with fiat and send crypto to others for free.

Let’s take a look at what these two solutions are exactly.

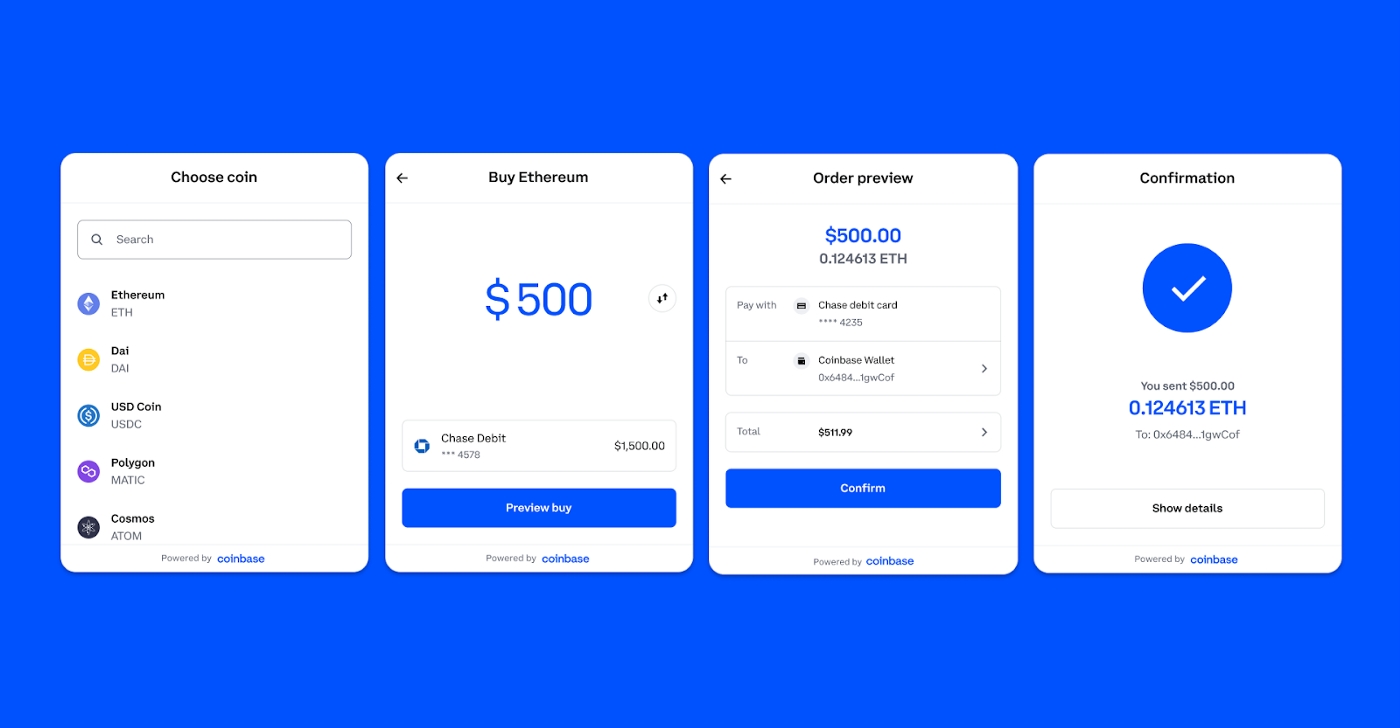

According to an announcement from Coinbase earlier this week, its new payments service is a browser extension for the Chrome web browser meant to make it “easy and intuitive for anyone” to participate in decentralized finance (DeFi) or to trade non-fungible tokens (NFTs).

Taking part in both of those areas normally requires users to fund and use non-custodial browser-based wallets such as MetaMask — which Coinbase described as “a cumbersome process that involves multiple steps” and has a high potential for user error.

To solve this problem, Coinbase offered its own payments solution that it says makes it easier to fund its existing browser wallet, the Coinbase Wallet, with either fiat or crypto from other wallets.

This differs from other wallets such as MetaMask, which cannot be funded directly with fiat currency from a debit or credit card.

The integration of the payment system into Coinbase’s wallet thus removes the need to switch between different apps and websites in order to fund the wallet, making the process “faster, easier, and more secure than ever before,” according to the exchange.

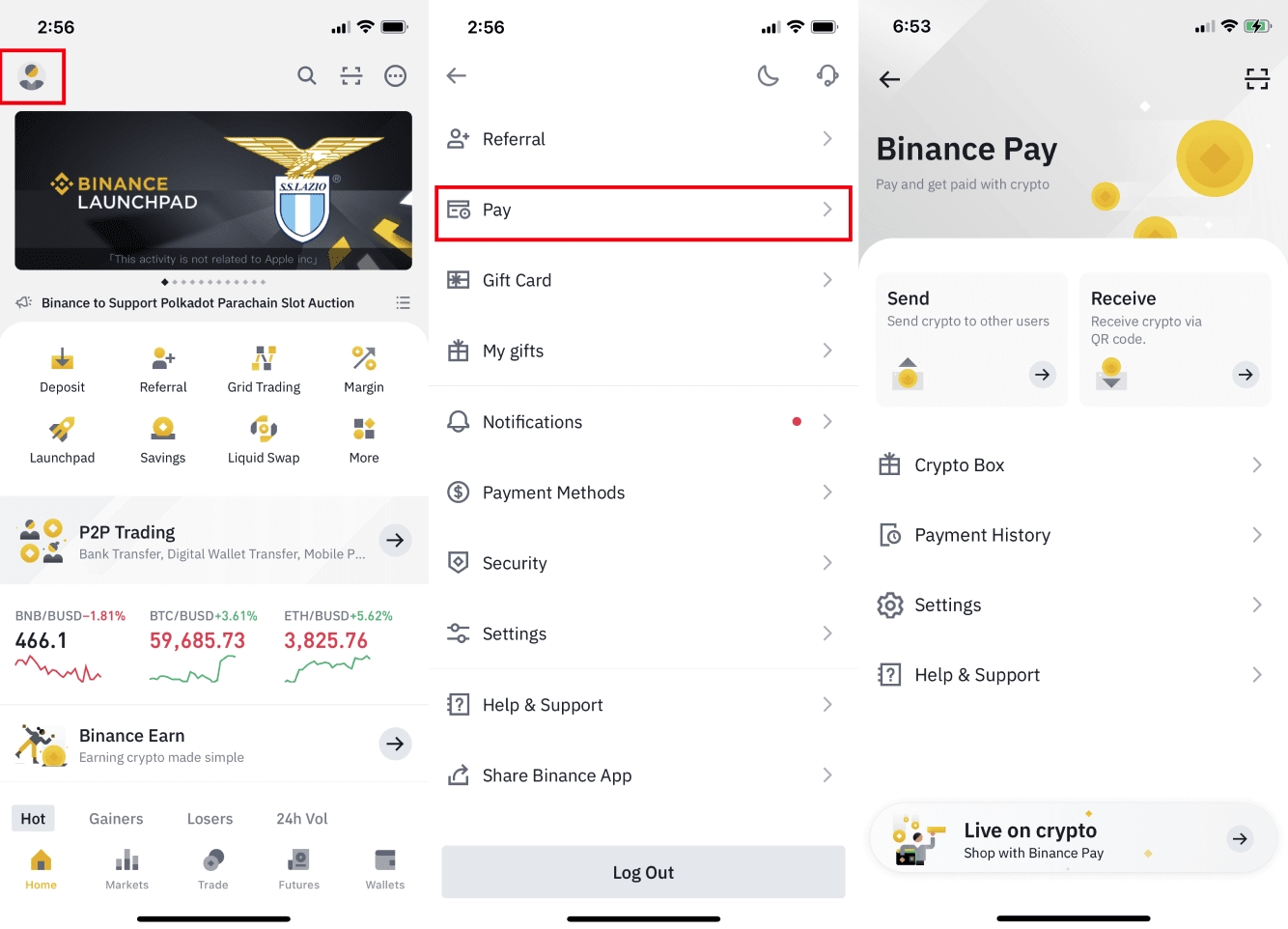

Meanwhile, Binance Pay, the payments system rolled out by rival crypto exchange Binance last year, is based on the exchange’s mobile app rather than any browser extension, and is mainly designed to make payments between Binance users easier.

Notably, Binance Pay only works between users who have a Binance account with completed identity verification, and is in this sense not a traditional crypto payments system that can transfer funds to anyone.

The move by Binance followed a similar move by the competing trading platform Bitfinex one month earlier.

Ahead of the official roll-out last year, Binance said in its announcement that travel booking site Travala, which is owned by the exchange, had become the first merchant to integrate the new payments solution. Since then, other merchants such as CryptoRefills and Coinsbee have been added through the Binance Marketplace portal.

In order to send a payment to someone via Binance Pay, a user needs to either scan the recipient’s QR code or paste their “Pay ID” in the form of a username. This differs from Coinbase Wallet that Coinbase Pay works with, which still requires users to know the recipient’s full wallet address in order to make a payment.

Further, Binance calls its payment solution “instantaneous,” although it admitted that “compliance requirements” meant that funds would not be usable for 24 hours after payments have been received. Payments are also processed without any fees from Binance’s side.

Worth noting is that transactions made via Binance Pay to other users are not recorded on-chain, which is the reason why the payments can be made instantly and free of fees.

For now, Binance Pay supports more than 40 cryptoassets. The payments solution does not support direct fiat payments, but fiat can be used to top up a user’s Binance Pay balance by going through Binance’s standard options for funding an account.

____

Learn more:

– Binance, FTX Expand To Arab Gulf States With New Licenses

– Binance’s Crypto Payments

– Coinbase Launches Subscription-Based ‘Zero-Fee’ Trading in Beta

– Block, Coinbase Release Positive Q4 Results Amid Growing Market Uncertainty

– Crypto Exchanges Facing ‘Fork in the Road’ Over Russia Sanctions – London Stock Exchange Group CEO

– Two Crypto Lawsuits to Watch: Meta and Coinbase Enter New Legal Battles

Credit: Source link