Bitcoin (BTC) and several other major cryptoassets initially fell on Monday, before buyers showed up later in the trading day to offer relief. At the same time, the US dollar, gold, and a large number of other commodities continued on a surge higher, as a ban on Russian oil imports seem to be on the table.

At 13:50 UTC, BTC stood at USD 38,950, unchanged for the past 24 hours and up 3.2% for the week. Meanwhile, ethereum (ETH) stood at USD 2,615, down 1% for the day and 0.5% for the week.

The action for the crypto market happened as gold rose above the key USD 2,000 level in morning trading in Europe – its highest level since August 2020. As of press time, however, gold had retraced significantly from its high, trading at USD 1,969.

Other commodities, most notably oil and natural gas also rose higher, with European Brent crude oil reaching highs above USD 130 in early trading, its highest since June 2008. As with gold, however, the oil price also retraced from its high, trading at around USD 124 as of press time.

Meanwhile, stock markets across Europe also recovered after heavy losses earlier on Monday, with the STOXX Europe 600 index down 0.3% for the day, after being down as much as 3.8% earlier. In the US, S&P 500 futures pointed an opening on Wall Street 0.36% lower.

The moves in the market followed news today that Russia and Ukraine will once again meet for cease-fire negotiations in Belarus later in the day. In addition, reports also emerged on Monday that the foreign ministers from Ukraine and Russia will meet for talks in Turkey on Thursday.

Increased crypto fund inflows

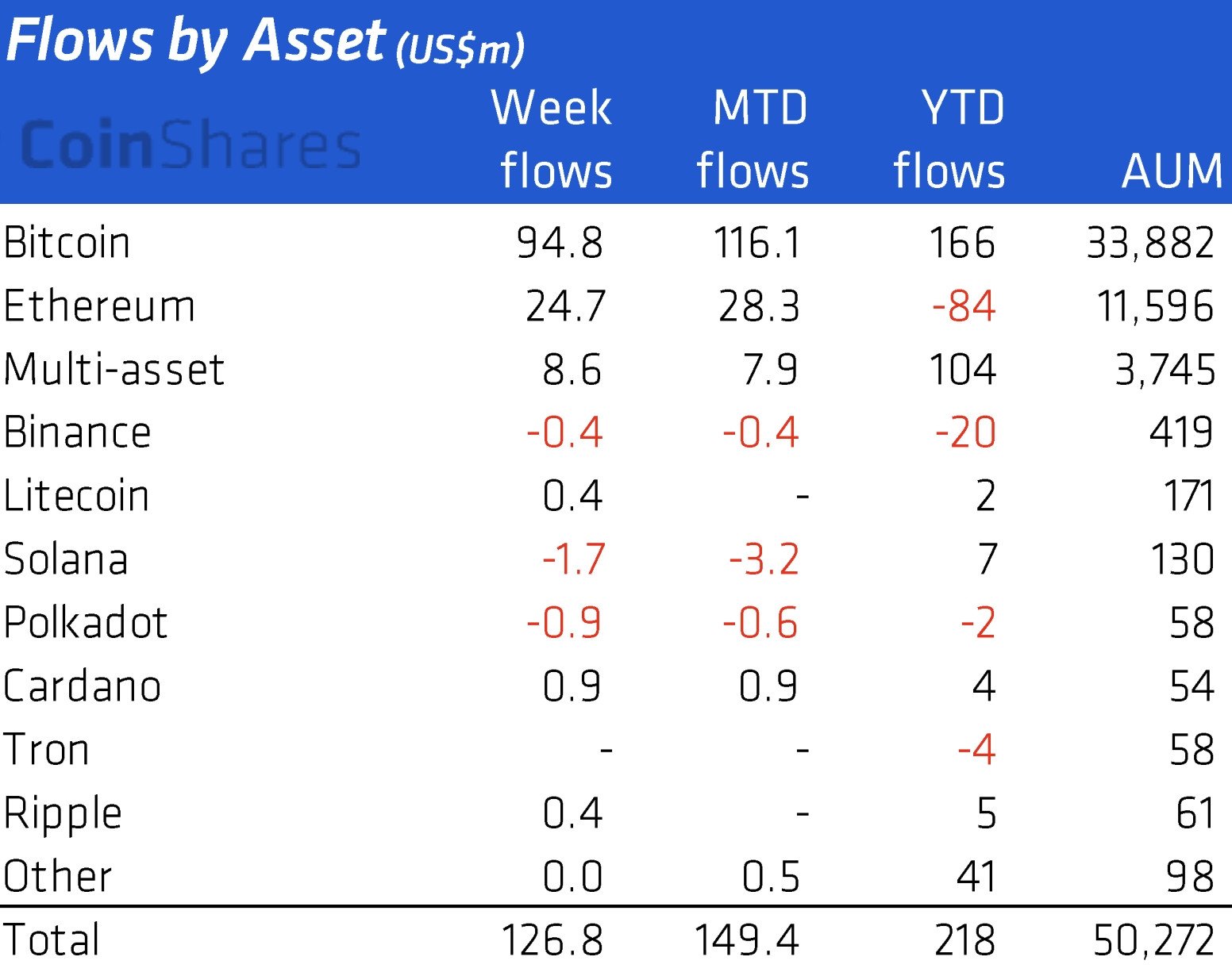

Despite prices currently indicating a stronger appetite for traditional safe havens than for crypto, data from the crypto research and investment firm CoinShares showed that digital asset investment products saw inflows of USD 127m last week, up significantly from USD 36m the week before.

Out of the USD 127m seen flowing into all crypto products, USD 94.8m went into bitcoin-backed investment products, CoinShares’ data showed.

The increase suggests that “investors remain supportive of digital assets despite the recent geopolitical events,” the firm commented in its latest weekly report.

A crypto safe haven?

With capital for now flowing back into the more traditional safe havens, bitcoin’s status as digital gold and a new safe haven has again come under debate.

Among those who appeared skeptical of the crypto market’s ability to serve as a useful safe haven from the current chaos in the fiat world was the former Goldman Sachs CEO Lloyd Blankfein. Writing on Twitter last night, Blankfein said that he’s “not seeing” crypto prices reflect any of its safe haven properties at the moment.

Responding to the tweet, Michael Saylor, the well-known bitcoin bull who turned his company MicroStrategy into one of the world’s largest bitcoin holders, said that bitcoin suffers from tension between those who hold it for fundamental reasons and “conventional traders.”

“Over time, the HODLers will win,” Saylor argued.

Similarly, crypto exchange Bitfinex’s trading desk also commented, saying that an inflating US dollar and governments blocking back accounts and payment methods will drive bitcoin higher.

“Those voicing skepticism over the performance of the cryptocurrency market might be better advised to take a longer-term view, given an inflating US dollar and the actions of governments to block bank accounts and payments,” the statement from Bitfinex said.

The trading team added that bitcoin in the last 10 years has gone from something used only by a small group of technologists to an asset traded by institutions.

This demonstrates the existence of “significant liquidity and market interest to continue to support the long-term price appreciation of the currency,” the team further said.

A similar sentiment was also shared by crypto researcher Messari, which wrote in its latest newsletter that bitcoin has “seemingly uncoupled from the S&P 500.”

This is “hinting at the possibility that the Russia–Ukraine conflict has driven demand for the digital gold alternative […],” the firm added.

Strong Russian appetite for BTC, USDT

Meanwhile, as Cryptonews.com reported before the weekend, BTC and tether (USDT) trading using Russian rubles (RUB) and Ukrainian hryvnia (UAH) fell markedly after seeing a peak right around the start of the war in Ukraine.

As of 13:50 UTC on Monday, however, trading volumes on crypto exchange Binance in BTC and USDT using Ukrainian hryvnia remained subdued, while volume with Russian rubles once again rose to a level near its peak from February 24.

The 7-day moving average of Binance’s BTC/RUB trading volume reached 244 BTC over the past 24 hours — its highest since a major bitcoin sell-off in late May last year.

Bitcoin price and trading volume in Russian rubles:

For the USDT/RUB pair, the trading volume was down slightly today, although it remained at significantly higher levels than what has been usual over the past year. As of press time, the 24-hour trading volume was at USDT 26.37m, while the 7-day moving average sat at USDT 18.55m, down from a high of USDT 22.34m reached on Saturday.

Binance is among the exchanges that have taken a clear stance against blocking all Russian users from its platform, as some argued that crypto exchanges should do in light of sanctions placed on Russia.

“There is a group of investors that do see [BTC] as a risk-on asset, just like they would see stocks or anything else,” Brett Munster, a portfolio manager at hedge fund Blockforce Capital told Bloomberg in a comment.

“In the long run, I think the store of value narrative wins out,” Munster added.

____

Learn more:

– Bitcoin Falls Below USD 40,000 on Stronger Dollar as War in Ukraine Rages On

– Crypto Trading Volumes in Ukraine, Russia Fall After the Early War Spike

– Bitcoin vs Gold Debate Continues as Both Assets Rise Following Ukraine War

– Bitcoin Pushes Higher Again with Ukraine War Turning into ‘Great Test Case’ for BTC

– Bitcoin Is Helping Both Sides in Ukraine War, But It Won’t Wreck Russian Sanctions

– Devs Publish Bitcoin, Ethereum Donation Guidelines for Russians Who Support Ukraine

Credit: Source link