BlockFi, a crypto services provider offering credit facilities to both institutions and retail investors, has for the past year been under persistent investigation by the US Securities and Exchange Commission (SEC) for its high-yield lending product.

In a dramatic turn, BlockFi has now agreed to settle the matter for US$100 million, and crypto Twitter is having none of it:

No Stranger to Controversy

Founded in 2017, New York-based BlockFi has often been in the news, albeit for the wrong reasons. Last year, it suddenly went down and then later it credited 700 BTC to the wrong customers’ accounts.

Much of the recent controversy has surrounded its lending product, as various states issued orders preventing it from registering new customers.

For much of its history, BlockFi was a significant beneficiary of the Grayscale Bitcoin Trust (GBTC) premium – an arbitrage trade that seemingly was able to fund its business. In short, it was able to offer clients attractive yields by taking their Bitcoin deposits, putting them into GBTC for the six-month lock-up period, and then selling them on the secondary market with a premium attached.

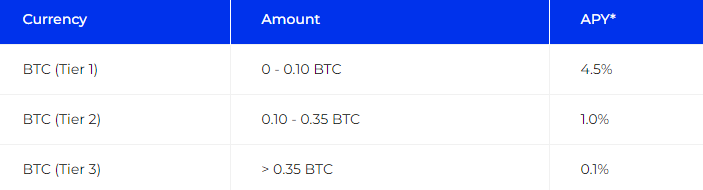

On the back of growing competitive products tracking the spot price of BTC, the GBTC premium has since flipped negative, resulting in BlockFi dramatically reducing yields from above 6 percent to as low as 0.1 percent in some cases:

Understandably, few are interested in risking their stack for such paltry returns:

SEC Targets Lending Product

During 2021, BlockFi was ordered by the states of New Jersey, Texas, Kentucky, Vermont and Alabama to immediately suspend onboarding residents to its lending products.

Drawing on the weight of these orders, the SEC’s position aligns with the views espoused by the states in question, namely that BlockFi’s lending product constitutes an unregistered security.

Although the company has yet to admit as much and come out with a formal statement, insiders say that of the US$100 million settlement, half is going to the SEC, while the balance will be shared by the state regulators.

Contents of the settlement remain unclear, but it is expected that the deal included provision that no additional clients would be onboarded, and that existing account holders would be grandfathered in.

The irony of restricting users from actually generating a yield on their assets was somehow lost on the SEC, which ostensibly exists to provide protection to investors:

Commentators were quick to point out that if the SEC genuinely cared about investor wellbeing, it would instead focus its energy on leveraged products, which are widespread and offered by a majority of major exchanges:

It’s difficult to argue with that sentiment, as few things can wipe out a retail investor’s wealth better than leverage.

This, together with its refusal to approve a spot Bitcoin ETF in the US, suggests that when it comes to the SEC, there are likely other factors at play beyond “investor protection”.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link