Researchers from the Federal Reserve Bank of Boston and MIT are conjuring what might be a major disruption to the financial services industry by creating a digital dollar.

According to James Cunha, head of the digital dollar project at the Boston Fed, there are already at least two prototype platforms that allow users to store and make transactions using the currency.

It’s not clear whether the platform uses blockchain as its underlying technology. However, back in August 2020 when the Fed-MIT collaboration was discussed, Federal Reserve Board Governor Lael Brainard said that the code will be open-source, meaning others will be able to see and build on it after it’s completed.

Creating a Central Bank Digital Currency (CBDC) Could Disrupt The Financial Industry

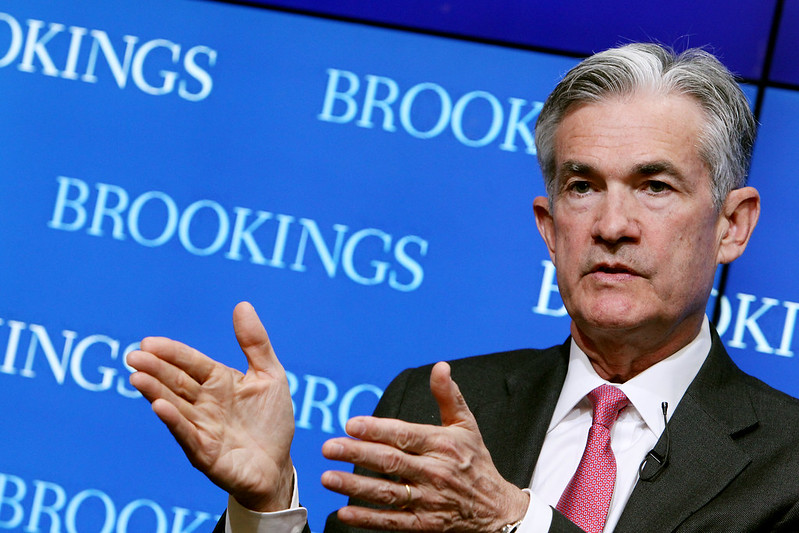

Jerome Powell, chairman of the Federal Reserve, also recently stated that the COVID pandemic had made clear that there are shortcomings with the current “arrangements”. He also said that there is a need to investigate ways in which speed and security in monetary systems around the world can be increased.

The potential that the central bank could cut banks out of their middleman role in the lucrative U.S. payments system is causing angst among banks.

Senator Sherrod Brown, the new chairman of the Senate Banking Committee, is urging the Fed to move quickly to create digital-currency accounts for Americans who can’t easily access the financial system and have been forced to deal with payday lenders who charge higher fees and interest rates. Those without bank accounts sometimes must pay high fees to cash paychecks or transfer money to relatives. These new systems could benefit disenfranchised citizens in many ways.

Everyone is afraid that you could disrupt all the incumbent players with a whole new form of payment.

Michael Del Grosso, analyst at Compass Point Research & Trading

However, this virtual currency could still be years away since it has not yet been approved by U.S. Treasury Department, Federal bank, or lawmakers. It also has not been decided how it will be incorporated into the current system. Still, the U.S. and other countries seem committed to digitizing their currencies enough to make financial industry executives nervous.

The Move to Digital Currency

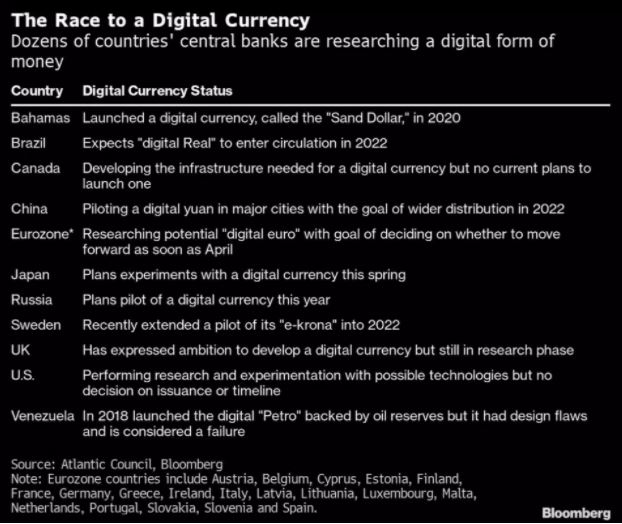

A few countries have seen the potential of digital currencies and have started creating pilot projects to determine the range of applications.

We think it’s important that we not wait for the policy debate because then we’ll be a year or so behind. This will take significant outreach to the industry and serious debate.

James Cunha, head of the digital dollar project at the Boston Federal Bank

It looks like some countries are aiming to make some serious strides towards the adoption of digital currencies or at least to pilot projects to determine the benefits it could hold.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link