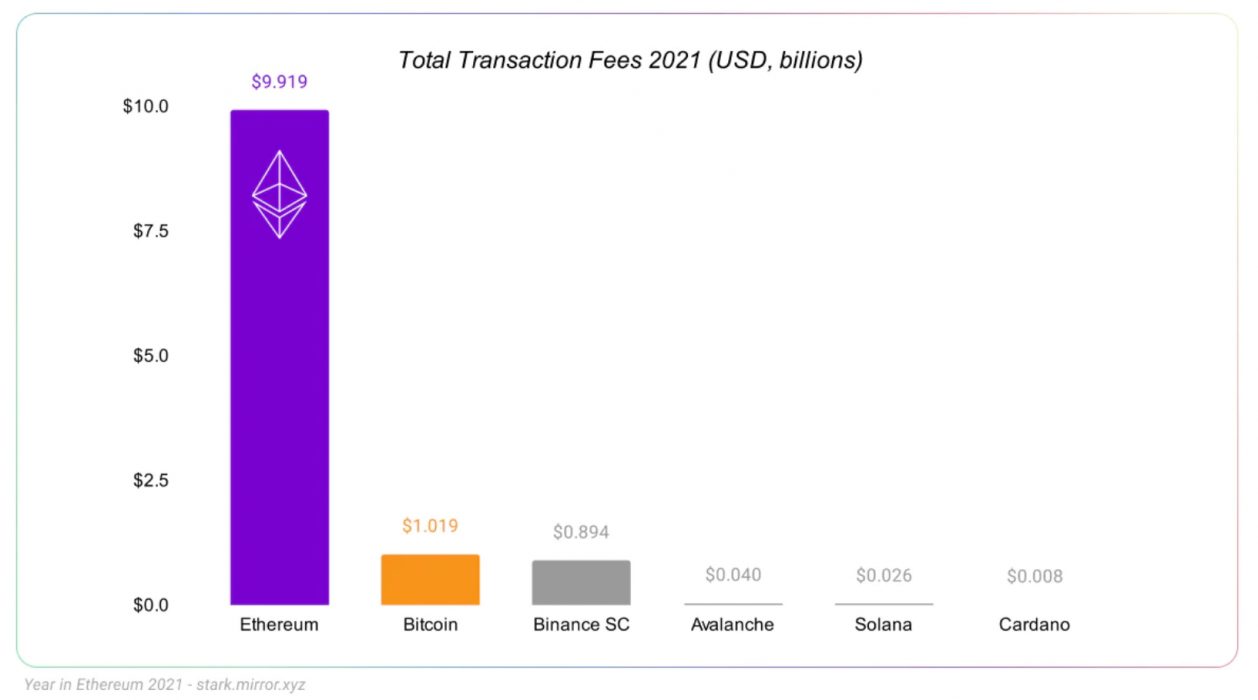

Ethereum, the world’s most in-demand blockchain, achieved some major milestones in 2021, including a massive US$10 billion in transaction fees captured from the network.

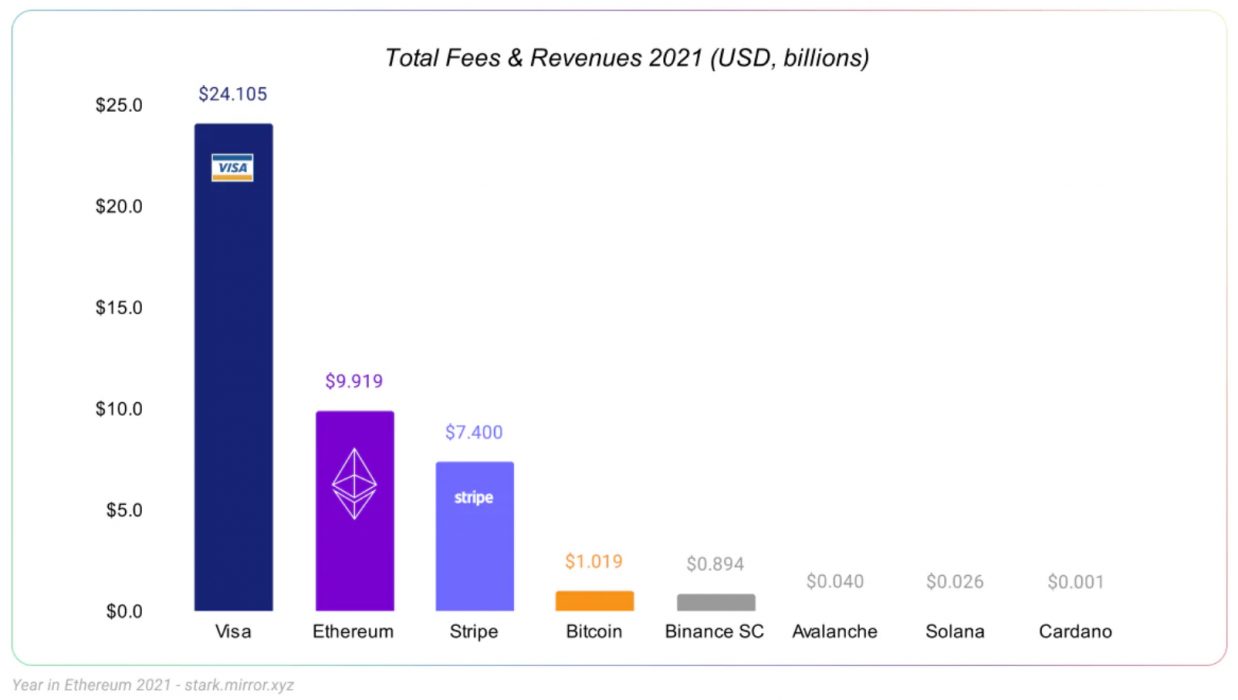

To put this in perspective, compare it to other global payment networks such as VISA, which processed around US$24 billion in transaction fees. In 2021, Ethereum surpassed Stripe into second position in the global transactions by dollar value.

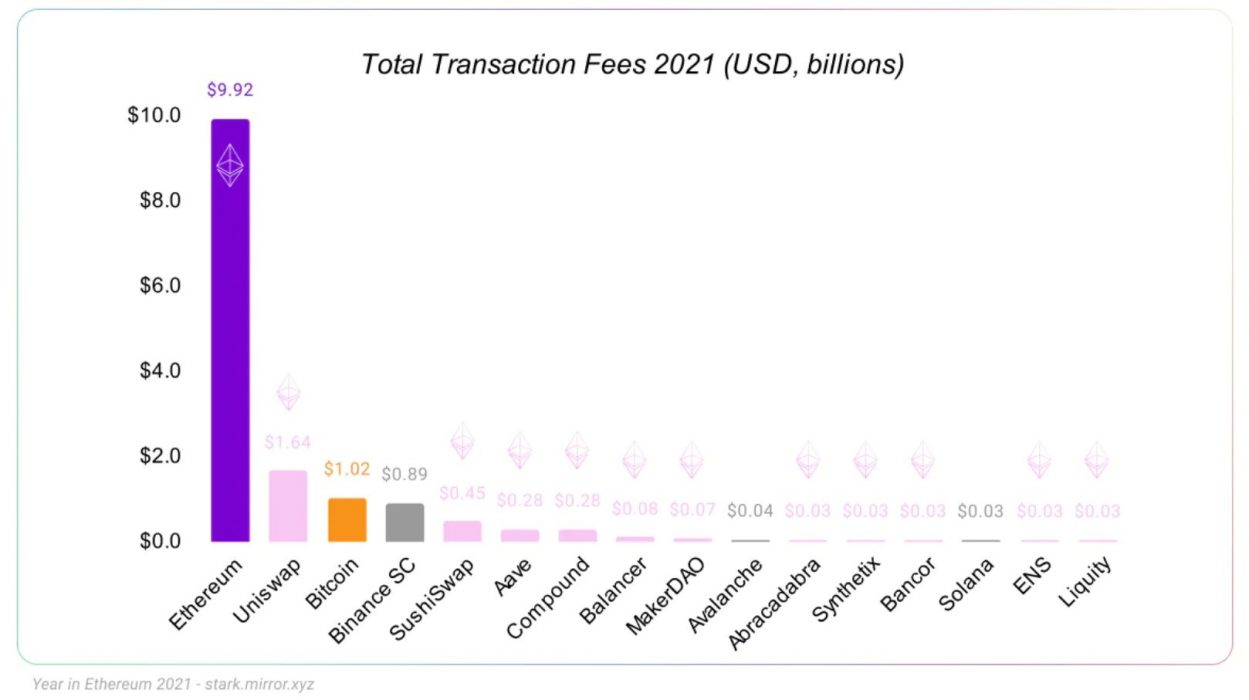

And if we compare the other crypto networks, which include both Layer 1 and Layer 2 networks, we can see both Ethereum and Uniswap taking higher fees than Bitcoin in 2021. However, this represents a combination of usage and decentralised platforms having much higher fees than their centralised alternatives.

Could We See a ‘Deflationary’ Supply of ETH in 2022?

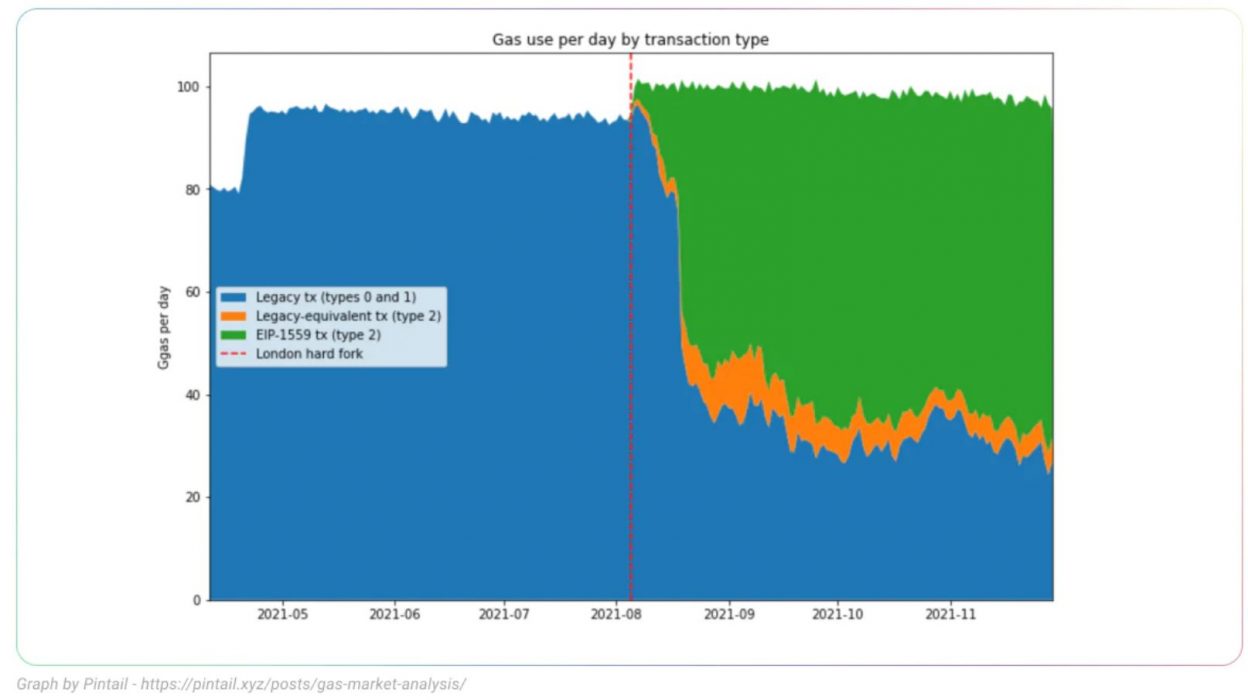

In August 2021, the Ethereum protocol underwent an upgrade called “London EIP-1559”, which changed the way ETH fees worked. Essentially, the miners were no longer incentivised to keep fees high, with the base fee being burned from supply (moved to a wallet), along with improved blockchain security.

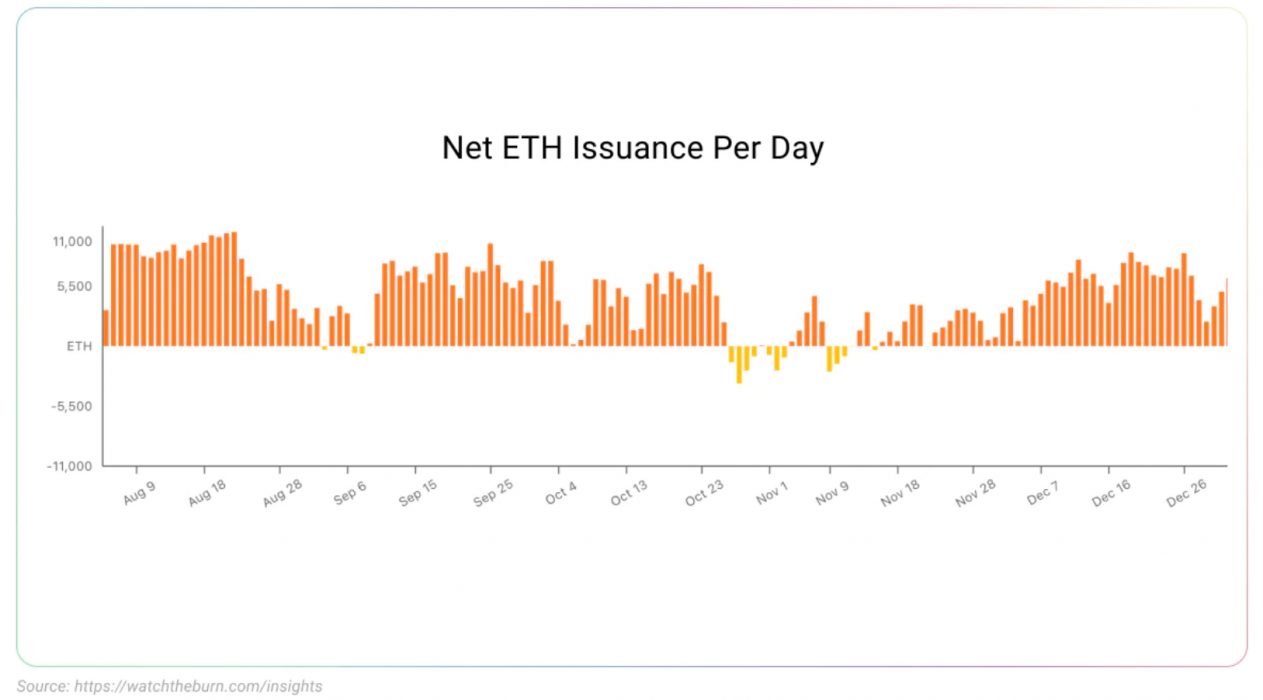

We have already seen some days show a negative net issuance of ETH on the network, which is shown live on watchtheburn.com. When the merge happens, it will interesting to see if that negative issuance becomes more frequent.

An estimated 43.7 percent of ETH is held by “whales” and it could become more attractive to them should a restricted supply issuance of ETH become a dominating factor.

Ethereum 2022 Upgrades

Ethereum plans to upgrade to version 2.0 during 2022, switching from proof-of-work to proof-of-stake. “The merge” will happen around Q2 this year when the version 1.0 blockchain simply gets turned off and version 2.0, “The Beacon Chain“, replaces it.

This upgrade will see a more eco-friendly Ethereum, maintaining high levels of decentralisation and security.

It is anticipated that the merge updates will not reduce gas fees significantly; we will have to wait until 2023 when Ethereum introduces sharding technology to reap the benefits of the high throughput and low fees. This technology will become available to Layer 2s so we may then finally be able to solve a lot of the scaling problems, something Ethereum will have to do if it wants to become the settlement platform of Web 3.0.

Find Out More

You can read the full Ethereum 2021 report written by Josh Stark and Evan Van Ness at the decentralised blogging platform called Mirror.

Crypto News Australia also recently published a guide on the best Ethereum Layer 2 projects worth keeping an eye on this year.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link