When Miami’s Mayor Francis Suarez announced plans last November to convert a portion of the city’s treasury reserves into Bitcoin, it seemed inevitable that other cities would soon follow suit. The latest is one of Brazil’s largest cities, Rio de Janeiro, which, according to local newspaper O Globo, is looking to put 1 percent of its treasury into Bitcoin.

Rio de Janeiro Embraces Bitcoin

According to the O Globo report, Mayor Eduardo Paes was quoted as saying at Rio Innovation Week:

We are going to launch Crypto Rio and invest 1 percent of the treasury in Bitcoin.

Eduardo Paes, Mayor of Rio de Janeiro

It was also reported that plans were under way to transform the city into a hub for the broader crypto industry. Finance secretary Pedro Paulo explained that Rio was considering whether to offer residents a 10 percent discount on taxes if paid in Bitcoin.

We are studying the possibility of paying taxes with an additional discount if you pay with Bitcoin.

Pedro Paulo, secretary for farming and planning, Rio de Janeiro

Of course, even if it were an option, not everyone would be on board with the proposal:

Companies, Countries and Cities Converting Cash to Bitcoin

Since adopting a Bitcoin standard for its treasury in August 2020, MicroStrategy’s Michael Saylor has inspired a wide range of market participants to follow suit, although admittedly to a lesser degree.

After famously labelling his company’s reserves as a “giant melting ice cube”, and with record levels of inflation, a growing number of economic actors have decided to shift a portion of their cash into Bitcoin – best viewed as a long-term inflation-resistant savings technology.

From Tesla and Block (formerly Square) to billionaire Bill Miller and the country of El Salvador, all have implicitly acknowledged the risk of holding a rapidly depreciating asset that is fiat currency. Instead, they have turned to Bitcoin.

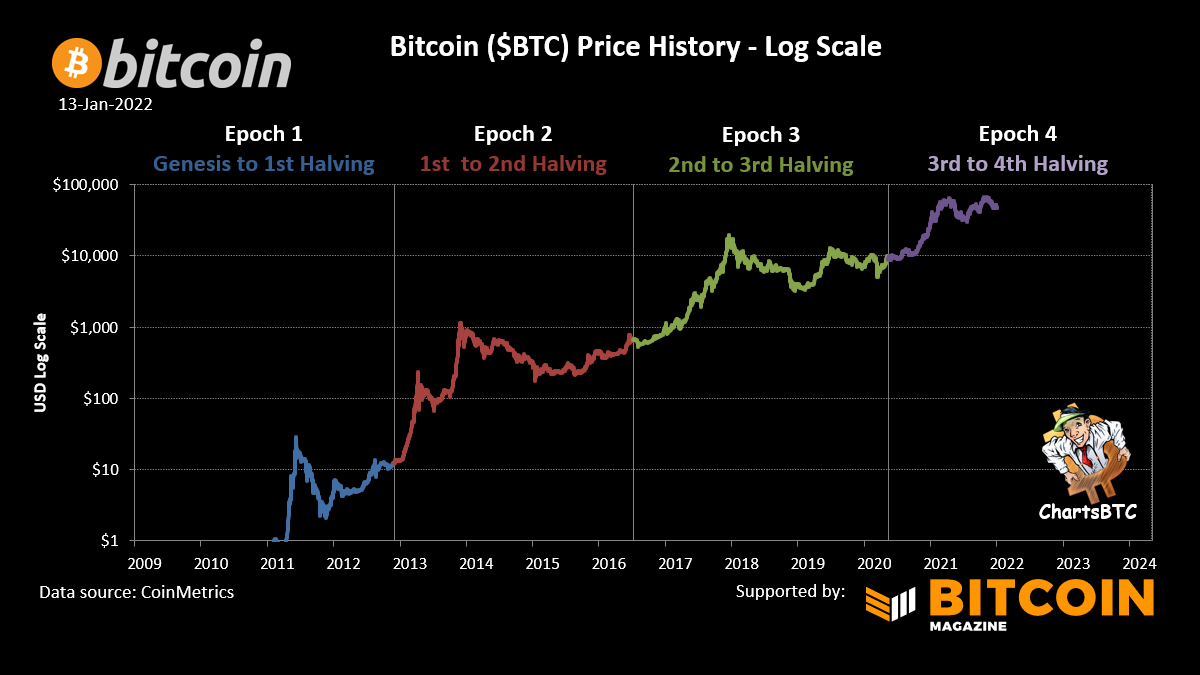

Detractors will point to Bitcoin’s short-term volatility and criticise those who wish to divest of depreciating fiat currencies. What most forget is that the smart money thinks in decades and that when you zoom out, it’s difficult to find a better asymmetric bet to protect your purchasing power.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link