Crypto analytics firm Santiment says a diverging pattern indicates whales are accumulating massive amounts of Ethereum (ETH) while exchanges see their supply of the leading smart contract platform shrink.

The market insights agency tells its 122,600 Twitter followers that the ratio of Ethereum held by whales off of crypto exchanges compared to on exchanges is rising to all-time-high levels.

“The amount of Ethereum held by the top 10 NON-EXCHANGE whale addresses has now ballooned to 25.7 [million] ETH held.

Meanwhile, the top 10 EXCHANGE whale addresses continue falling, with only 3.57 [million] ETH. This ratio is the highest since the asset’s inception.”

Ethereum is currently priced at $3,245, meaning that the non-exchange whales hold more than $83.39 billion worth of ETH.

With $11.58 billion of ETH in their own bags, the exchanges hold less than 14% compared to the non-exchange whales.

Santiment next looks at the Bitcoin (BTC) chart and the prevalence of “bull market” versus “bear market” mentions across social media in order to gauge the overall crypto market pulse.

“Our social trends data confirms that the trading crowd feels very much as though crypto is in an official bear market.

Mid-May was the last time bearish sentiment was this prevalent, which is a very promising sign that weak hands are capitulating.”

Bitcoin last touched the $50,000 level back on December 27th, and even briefly dipped below $40,000 this past Sunday.

BTC is currently up 3.33% on the day and trading for $42,840.

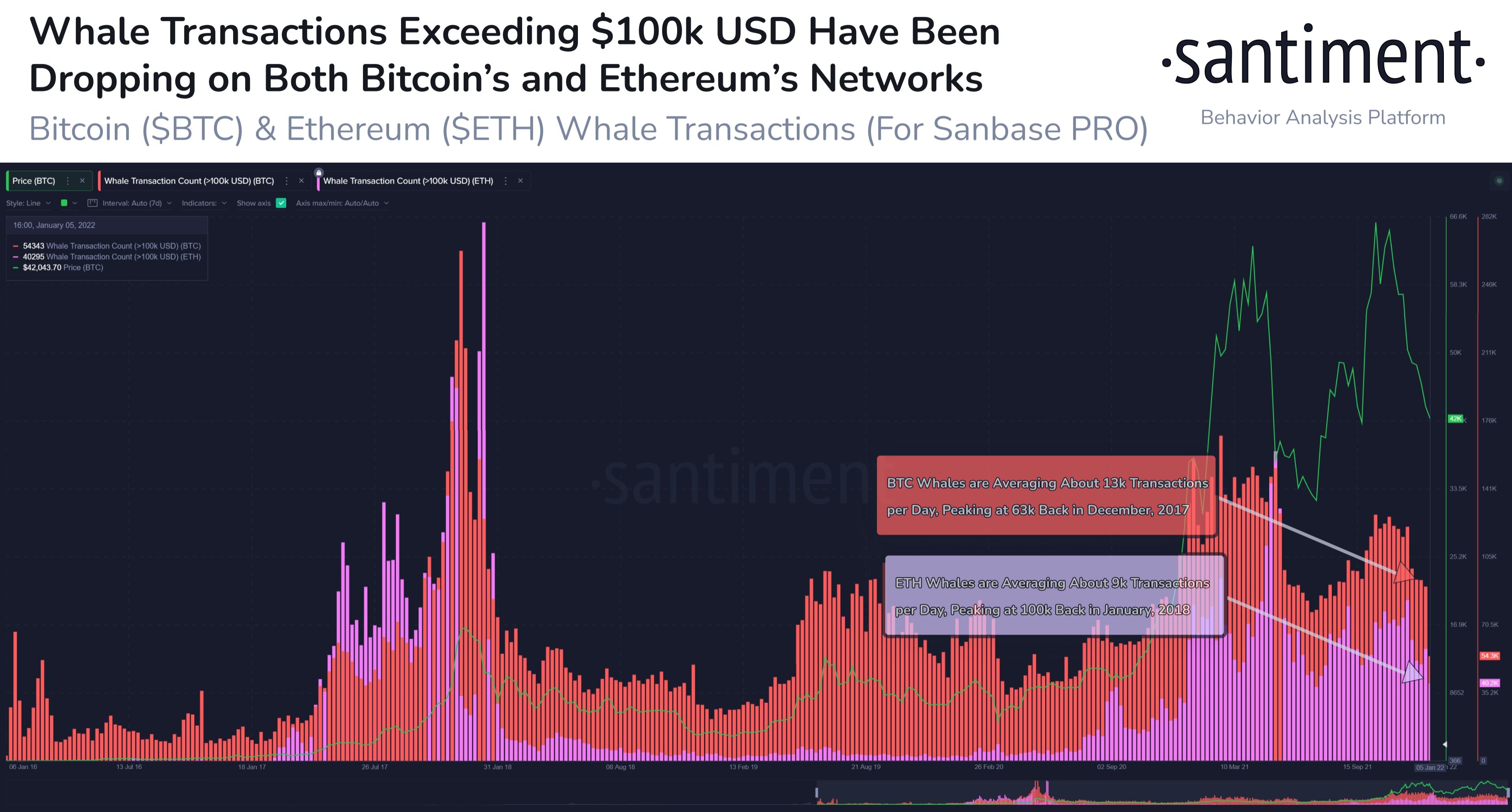

The crypto insights firm says that whale transactions worth more than $100,000 have declined significantly for both BTC and ETH.

“Major whale transactions aren’t quite coming at the frequency they were in October or November.

Our metrics indicate that the BTC network is getting around 13k transactions per day that exceed $100k in value.

ETH’s network is seeing about 9k per day.”

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Chawalit Banpot/monkographic

Credit: Source link