Welcome to this weekly series from the TradeRoom. My name is Dave and I’m the founder of The Crypto Den, an Australian-based crypto trading and education community aiming to give you the knowledge to take your trading game to the next level.

Crypto Market Outlook

Merry Christmas everyone! I hope you all took some time away from the charts and crypto to spend it with loved ones!

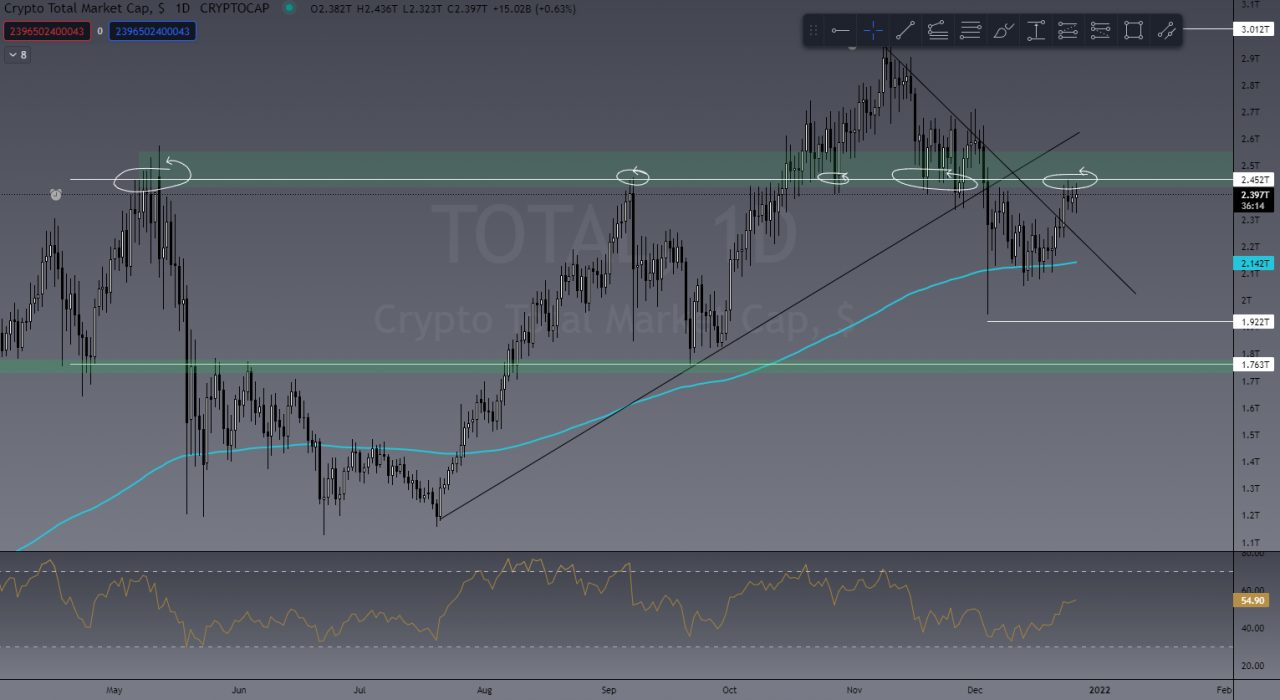

In last week’s article I mentioned that the TOTAL crypto cap needed to hold on that daily 200 EMA, which it did and then continued to break out from its new downtrend. It’s currently finding resistance at US$2.4 trillion.

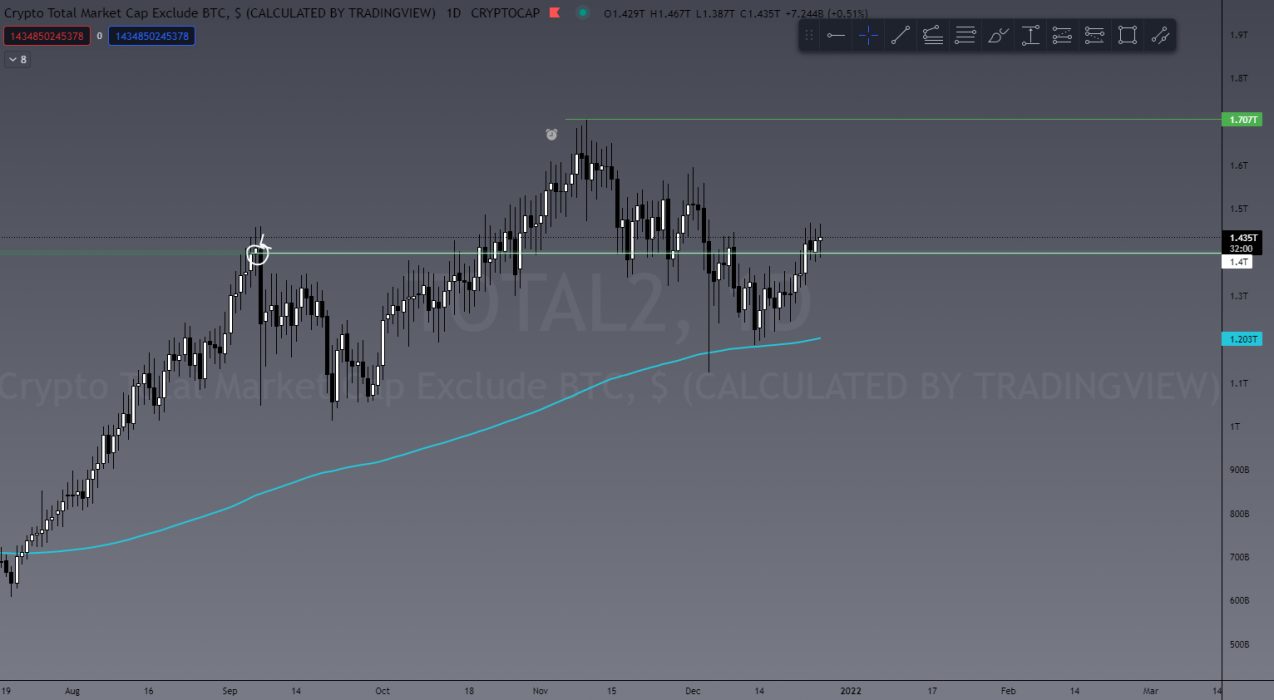

The TOTAL2 (ALTcoin market) has broken its US$1.4 trillion resistance, while the BTC.D (% of BTC dominance over the market) has dropped again significantly, underlining the fact that the capital flow has been in ALTS.

Something to note at this point is that BTC.D is now at a support level and could see a reversal, meaning capital flow will leave ALTS and go back into BTC.

What plays well with this possibility is that BTC seems to have broken out of the current local downtrend and performed a support/resistance flip on the 4H chart, and is currently being snagged on that daily 200EMA. Breaking through this level around US$51,800 will help confirm a bullish bias for me. The last thing we’d need to see is a clear and strong breach of the 618 retrace (Fibonacci level) of the US$52,000 – US$53,000 zone WITH VOLUME. Failing that, I see another test of US$45,000.

Last Week’s Performance

BTC/USDT

Following my short trade on BTC I wrote about last week, I’m now in a BTC long trade and currently sitting at around 100%. I waited for the breakout of the falling wedge and a retest of support before entering. Not a massive trade just yet, but waiting for confirmation is always the safest trade to take.

SHIB/USDT

It almost hurts me to even write this but traders see opportunity in anything – even overhyped, high supply coins. SHIB, for example, broke out of a falling wedge that started at the beginning of November. With the hype around this coin lining up with the technicals, it was a no-brainer entry. Although I didn’t enter on the initial pump, I waited for the safest entry. Price action broke out and then tested new support, which is where I entered my longs. This thing has crazy volatility, so it’s likely a riskier trade than most.

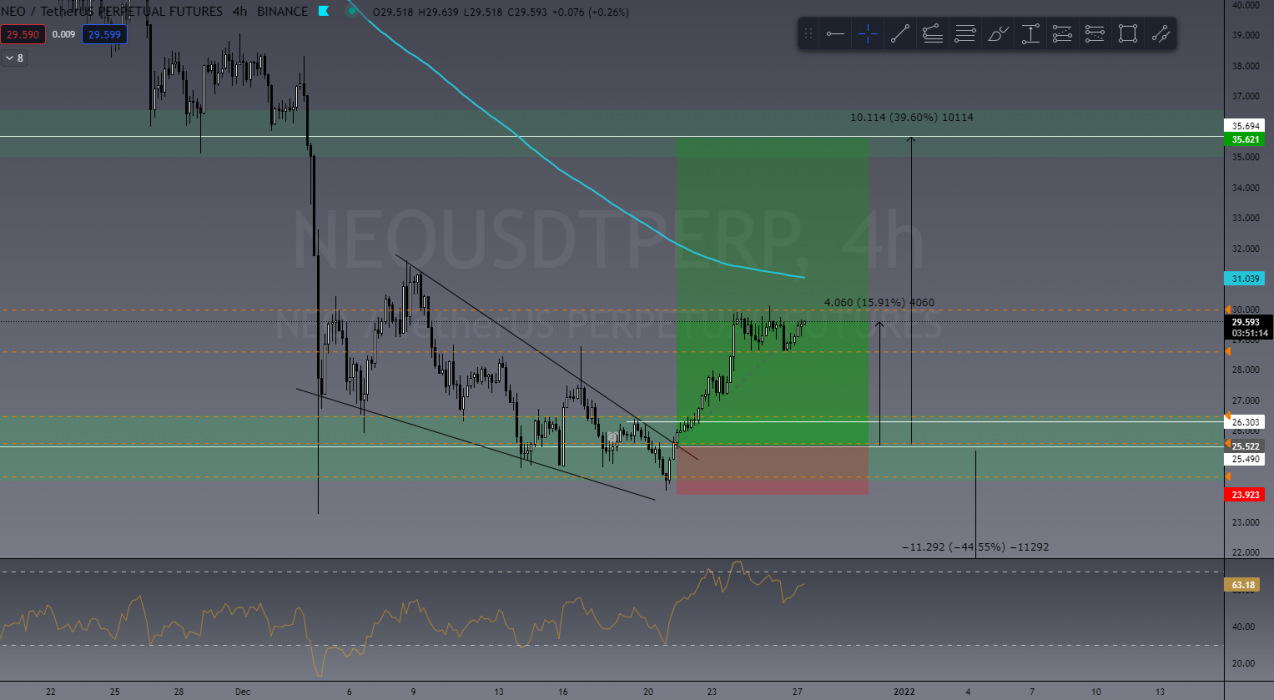

NEO/USDT

I took the NEO long that I also mentioned in last week’s article. I got the hammer and bullish engulfing I was hoping to see and entered on the breakout. It’s currently up 120% and I’m looking for that to double if BTC sees some bullish PA (price action).

SOL/USDT

One of my favourites to trade is SOL. Finding a bounce off trend forming ascending triangle (3 touch rule), I decided to enter. I added to my position after the triangle break and retest (we teach how to trade these patterns in our Trading Fundamentals course). Trade is still active, currently up 179%.

This Week’s Trades

FIL/USDT

I’m currently watching FIL because it hasn’t yet reacted to the market the way many other ALTs have. I’m seeing a really large bullish divergence and a downtrend break. What I’m waiting to see is a break and test of US$38.00, or a retest on trend for an entry.

MANA/USDT

I’m actually already in a MANA trade and wanted to add this to the list due to its crazy potential. If this US$4.00 resistance breaks, I see potential here for MANA to do 50% or more.

Invite to Join our TradeRoom

If you’d like to become a better trader, you’re invited to join our TradeRoom where we share daily charts and market analysis. In our community we strongly encourage and teach correct risk management strategies to keep our members safe in this new volatile crypto market.

Join our “Apprentice” plan now for your 7-day trial.

The Crypto Den was created in 2017 to help the rapidly growing crypto community learn and understand the fundamentals of digital currencies and how to trade them.

Since then we have taught thousands of members the basics of technical analysis and trading strategies to further progress and perfect their trading abilities.

In the TradeRoom you will be included in a supportive environment which encourages personal growth, education and community support.

It’s a place to share your trading ideas and follow other experienced traders’ feeds to help keep your finger on the pulse of such a volatile market!

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link