The sentiment in the crypto market has improved from last week, although it still remains in the zone considered “neutral” by the market sentiment analysis service Omenics.

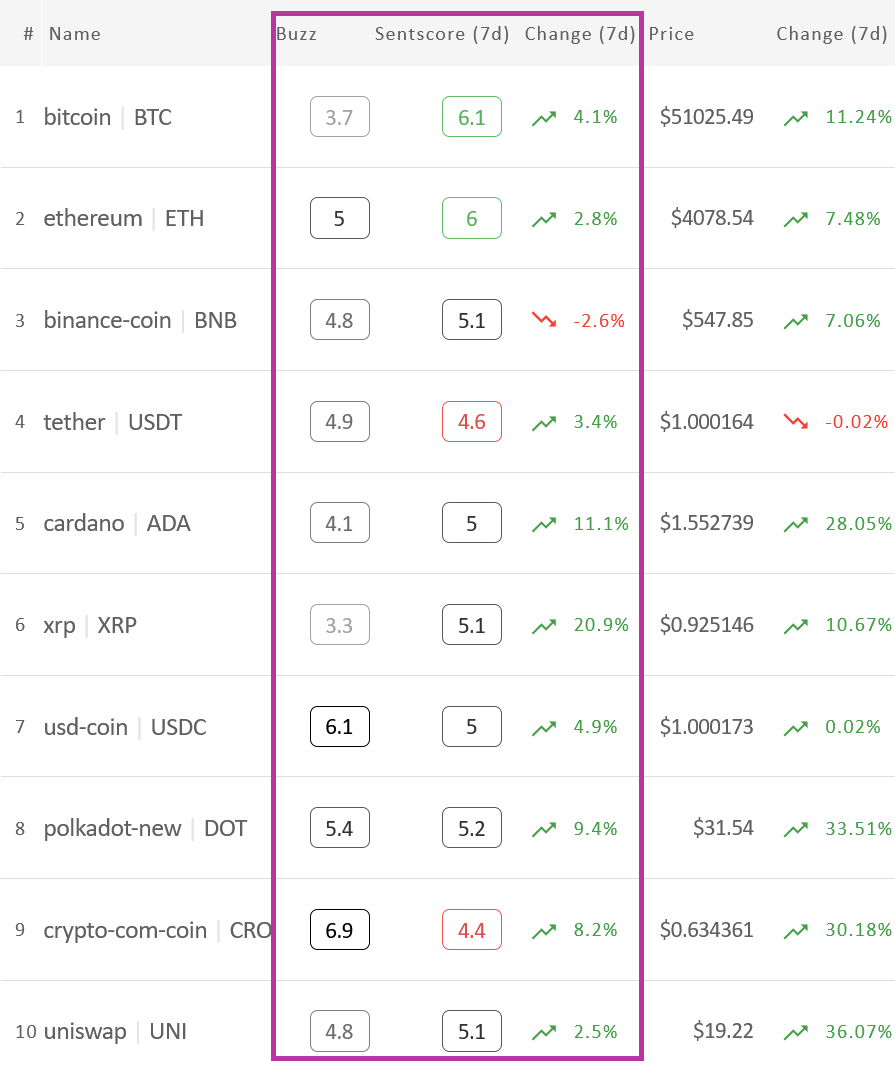

The 7-day moving average of the sentscore for ten major cryptoassets tracked by Omenics this week stood at 5.16, up from 4.85 last Monday. The increase in the average comes as a result of an improvement in the sentiment of nearly all of the coins tracked, with bitcoin (BTC) and ethereum (ETH) both moving from neutral to positive territory.

The overview of market sentiment this week shows that binance coin (BNB) is the only one out of the top 10 coins tracked by Omenics that has seen a worsening (insignificant, however) of its sentiment over the past week. Binance’s exchange token slipped from a sentscore of 5.2 last Monday to 5.1 today, the data showed.

All other coins had a higher sentscore today compared to last Monday, according to Omenics’ calculations.

Sentiment change among the 10 major coins*:

Interpreting the sentscore’s scale:

– 0 to 2.5: very negative

– 2 to 3.9: somewhat negative zone

– 4 to 5.9: neutral zone

– 6 to 7.49: somewhat positive zone

– 7.5 to 10: very positive zone

Zooming in to take a look at the 24-hour sentscores shows that BTC is currently topping the list with a score of 7, well into the zone that Omenics considers “somewhat positive.” Meanwhile, other coins also saw fairly strong sentiment scores, with ETH at 6.5 and polkadot (DOT) at 5.7.

The 24-hour view shows an even stronger average sentscore than the weekly view, indicating that the market is becoming increasingly bullish on these ten major cryptoassets. The average sentscore for the past 24 hours stood at 5.72, compared to a weekly average of 5.16.

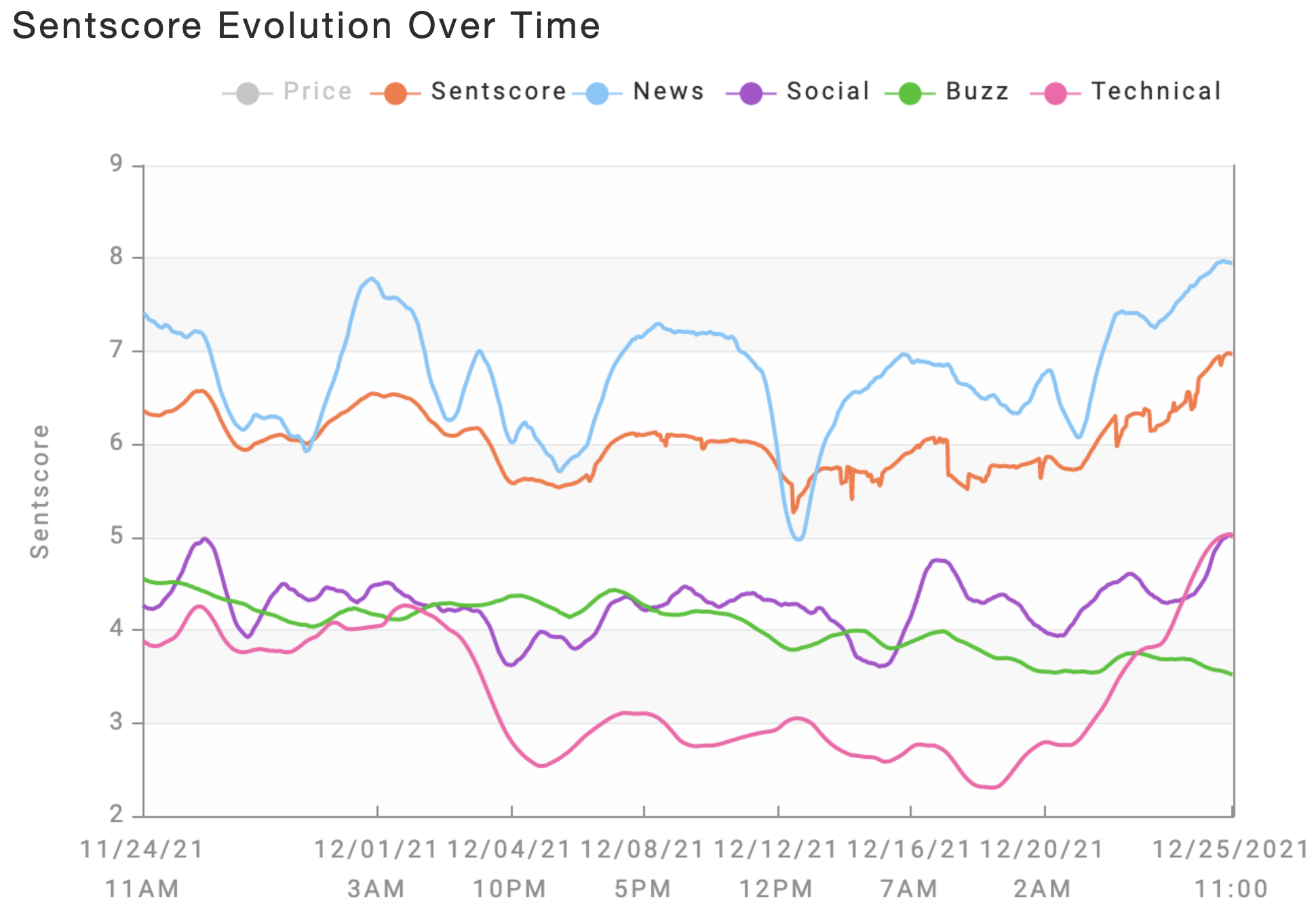

Daily Bitcoin sentscore change in the past month:

Taking a broader look to cover all of the 35 coins tracked by Omenics reveals that sentiment currently seems to be favoring the cryptoassets with the largest market capitalizations. This is evident by the fact that BTC and ETH were the only two coins with a 7-day sentscore above 6, while a relatively high proportion of the smaller-capitalization coins had sentscores of between 4 and 5.

The best among the coins outside the top 10 was yearn.finance (YFI) with a 7-day sentcore of 5.7, while nem (XEM) performed the worst with a 7-day sentscore of 3.8.

____

* – Methodology:

Omenics measures the market sentiment by calculating the sentscore, which aggregates the sentiment from news, social media, technical analysis, viral trends, and coin fundamentals-based upon their proprietary algorithms.

As their website explains, “Omenics aggregates trending news articles and viral social media posts into an all-in-one data platform, where you can also analyze content sentiment,” later adding, “Omenics combines the 2 sentiment indicators from news and social media with 3 additional verticals for technical analysis, coin fundamentals, and buzz, resulting in the sentscore which reports a general outlook for each coin.” For now, they are rating 35 cryptoassets.

Credit: Source link