Decentralized autonomous organization (DAO) OpenDAO launched on Christmas Eve with an airdrop targeting users of the major non-fungible token (NFT) marketplace OpenSea – and a massive rise of the DAO’s token was followed by a correction.

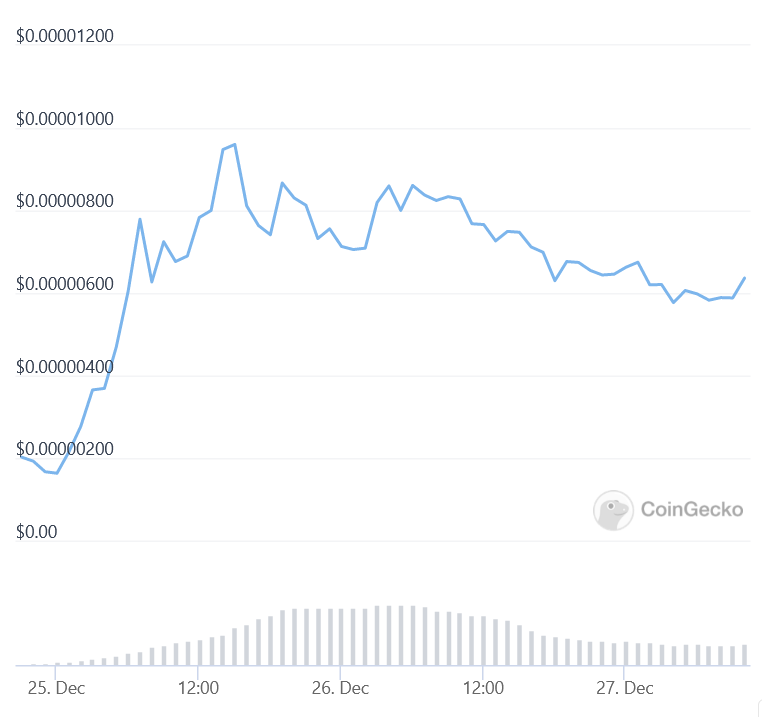

The project distributed free SOS tokens for anyone who had ever spent money on OpenSea based on their investment volume. Neither the OpenDAO project nor the SOS token are officially bound to OpenSea. Still, the coin skyrocketed within the first day of its debut, gaining 489%, according to data by CoinGecko.

However, the coin has since corrected sharply. At 8:33 UTC on Monday morning, SOS is down by 23.7% over the last 24 hours.

Additionally, at its peak, SOS reached a market capitalization of over USD 340m, which has since plunged to around USD 252m.

The project has also witnessed notable growth. Within the first two days, OpenDAO’s Discord server onboarded over 50,000 members, while its official Twitter account has garnered around 120,000 followers. Moreover, according to Etherscan data, SOS currently has over 203,000 holders.

Meanwhile, the airdrop constituted a 50% portion of the SOS token supply. “The distribution is based on the total number of transactions (30% weight) and transaction volume on ETH, DAI & USDC (70% weight) on OpenSea,” the project’s website detailed, adding that users have until June 30, 2022, to claim their tokens.

Another 20% of the SOS token supply is allocated to OpenDAO. The project’s website claims that it would use its treasury tokens to “compensate verified scam victims on OpenSea, support emerging artists and their original work, support NFT communities, support art preservation, and developer grant for participating in SOS ecosystem.”

Token airdrops are a common practice among decentralized finance (DeFi) projects that want to move toward decentralization and reward their early supporters by giving them a portion of the governance token – hence, allowing them to vote on decisions related to the protocol, thus shaping it. While airdrops are largely regarded as free money, they are a beneficial tool for projects as they allow them to find their ideal demographic, among other things.

Without airdrops, the projects would have a tough time distributing their tokens among their core contributors. Instead, speculators and short-term investors, who don’t—or can’t—work to improve the project, would buy the tokens, which explains why it is more likely that projects will keep airdropping in the crypto space.

____

Learn more:

– DeFi Trends in 2022: Growing Interest, Regulation & New Roles for DAOs, DEXes, NFTs, and Gaming

– Exec Wants Meta to Look to NFT, DAO and Blockchain Expansion Next Year – Report

– Fei-Rari Union Approved, Marking One the Largest DAO Mergers in DeFi History

– DAOs, Token Holders Could Face New Tax Liabilities, PwC Report Warns

Credit: Source link