Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Ripple (XRP)

Ripple XRP is the currency that runs on a digital payment platform called RippleNet, on top of a distributed ledger database called XRP Ledger. While RippleNet is run by a company called Ripple, the XRP Ledger is open-source and is not based on blockchain, but rather the previously mentioned distributed ledger database.

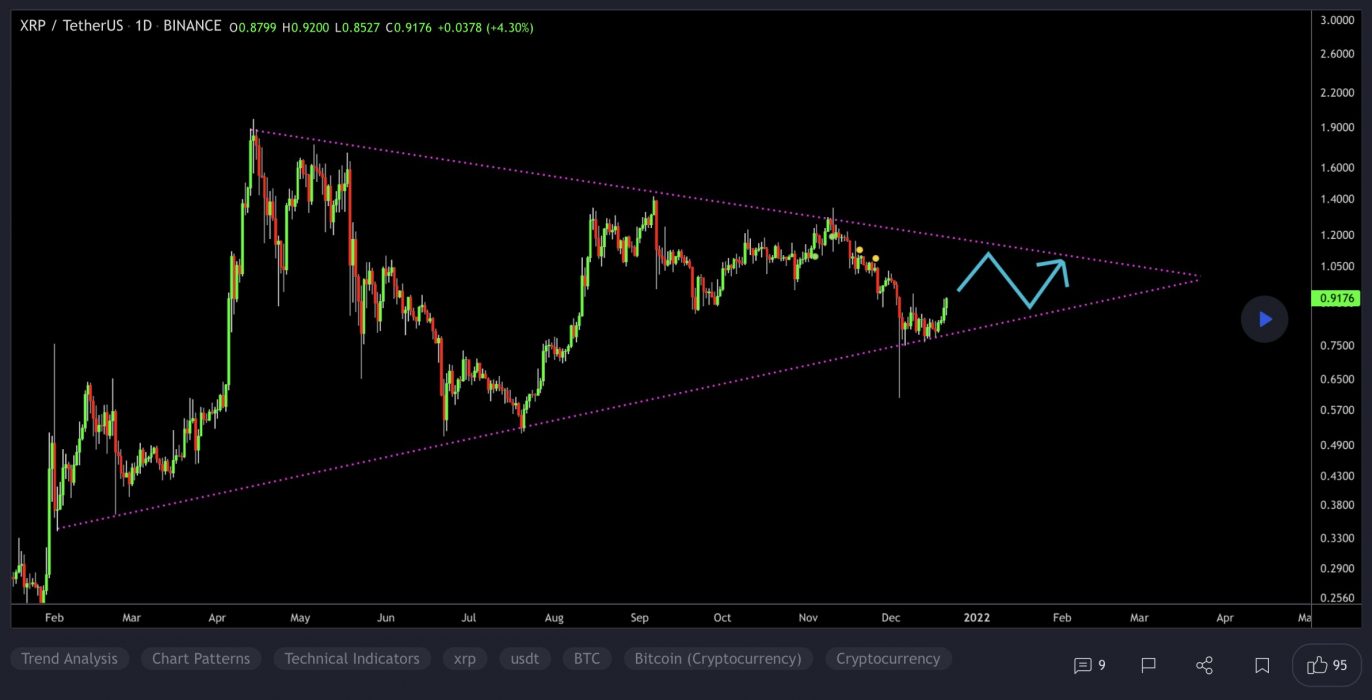

XRP Price Analysis

At the time of writing, XRP is ranked the 7th cryptocurrency globally and the current price is US$0.9425. Let’s take a look at the chart below for price analysis:

XRP‘s 80% climb during Q3 returned to the monthly open, sweeping lows several times down to $0.7822. Last week, the price bounced from the monthly open near $0.8243 again, creating possible support near $0.8050. A quick sweep of this recent swing low could reach into a support area near $0.7912, while a sharp downturn in the market is likely to run for the relatively equal lows near $0.7725.

If the price breaks through the closest significant resistance near $0.9556, the swing high at $0.9934 is a likely target. This move could reach a daily gap of near $1.12.

Strong bullish momentum could propel the price to resistance near $1.15. If this move occurs, the significant swing high near $1.22 provides a reasonable goal.

2. Litecoin (LTC)

Litecoin LTC is a cryptocurrency designed to provide fast, secure, and low-cost payments by leveraging the unique properties of blockchain technology. The cryptocurrency was created based on the Bitcoin protocol, but it differs in terms of the hashing algorithm used, hard cap, block transaction times, and a few other factors. Litecoin has a block time of just 2.5 minutes and extremely low transaction fees, making it suitable for micro-transactions and point-of-sale payments.

LTC Price Analysis

At the time of writing, LTC is ranked the 18th cryptocurrency globally and the current price is US$155.75. Let’s take a look at the chart below for price analysis:

After setting a low in late September, LTC kicked off a bullish trend that rallied nearly 83% by November to break the monthly highs.

The following 65% plummet found support near $148.36, sweeping under the 40 EMA into the 61.8% retracement level before bouncing to resistance beginning at $158.43.

This area could continue to provide resistance, possibly causing a retracement to the 9 EMA and 18 EMA near $168.12, where aggressive bulls might begin bidding. The level near $177.98, which has confluence with the 40 EMA, may see more interest from bulls loading up for an attempt on probable resistance beginning near $190.05.

However, if Bitcoin continues its sideways trend, much lower prices could be seen. The old support near $146.18 could provide at least a short-term bounce. If this level fails, the old highs near $139.44 might also give support and see the start of a new bullish cycle after retesting these support levels.

3. Cardano (ADA)

Cardano ADA is a proof-of-stake blockchain platform whose stated goal is to allow “changemakers, innovators, and visionaries” to bring about positive global change. The open-source project also aims to “redistribute power from unaccountable structures to the margins to individuals”, helping to create a society that is more secure, transparent, and fair. Cardano is used by agricultural companies to track fresh produce from field to fork, while other products built on the platform allow educational credentials to be stored in a tamper-proof way, and retailers to clamp down on counterfeit goods.

ADA Price Analysis

At the time of writing, ADA is ranked the 6th cryptocurrency globally and the current price is US$1.35. Let’s take a look at the chart below for price analysis:

ADA‘s nearly 70% drop from its November highs found a low near $1.20 during mid-December before closing over a short-term high.

This daily close over the high could signal a shift in market structure that might reach probable resistance near $1.42. A sustained bullish move may target the swing high at $1.50. If this stop run occurs, a run beyond the high into probable resistance near $1.62 and $1.78 is possible.

Bulls could buy a retracement to possible support near $1.27, just above the monthly open. A bearish turn in the marketplace may propel the price toward possible support near $1.22.

However, relatively equal lows near $1.18 and $1.13 provide an attractive target for bears if the market resumes its bearish trend. A run on these lows might find support between $1.10 and $1.03.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link