Welcome to this weekly series from the TradeRoom. My name is Dave and I’m the founder of The Crypto Den, an Australian-based crypto trading and education community aiming to give you the knowledge to take your trading game to the next level.

Crypto Market Outlook

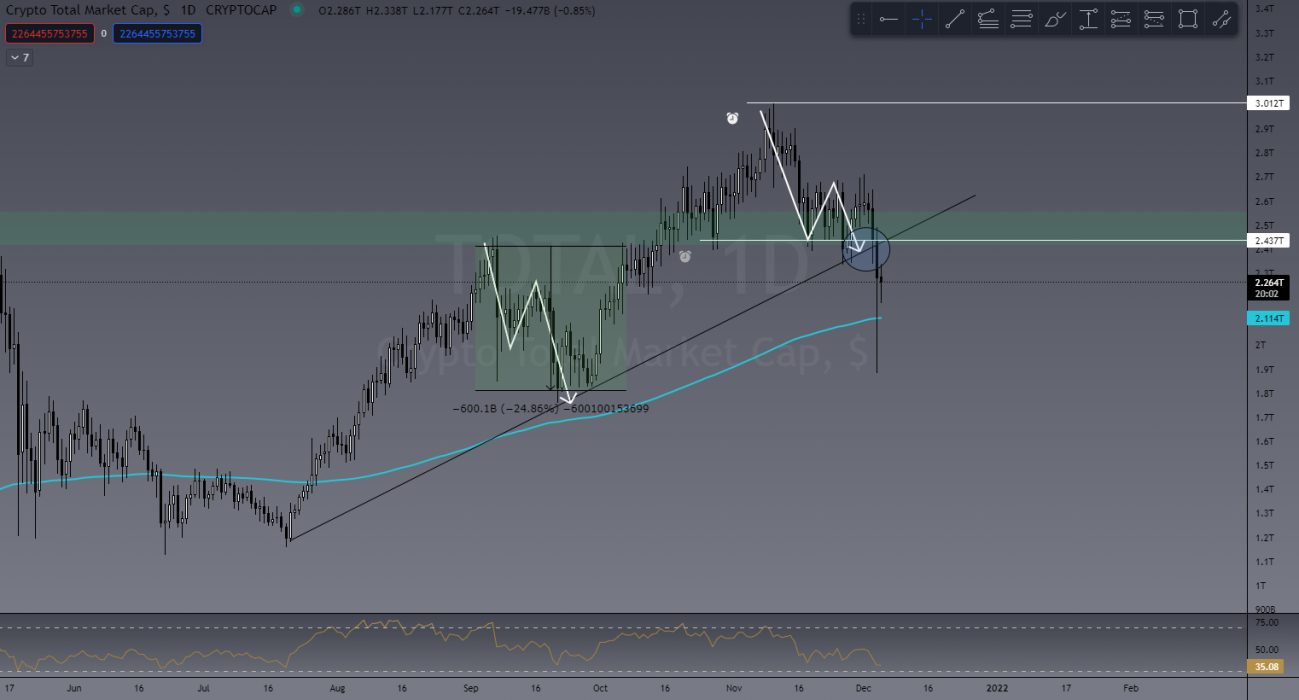

Wow! What a week! Well, we alluded to a decent drop in TOTAL crypto cap over the past couple of weeks, but even this Trader wasn’t expecting an ADDITIONAL US$440 billion to get wiped out of the market. We’ve since clawed back US$365 billion of that, showing some strong bullish buyback, bringing the current TOTAL market cap back to US$2.26 trillion.

Remember it was only a couple of months ago we were all excited that the TOTAL hit its ATH again of just under US$2.5 trillion, so it’s not all bad!

I had a target last week of US$51,500 for BTC. I was in an open short trade and BTC decided to blow right through that target and hit US$40,000. A US$13,000 daily candle! Now for me personally this was a good thing due to my open short trade, and I closed 50% of that trade at approximately US$45,000 and will let it play out from here.

Not so good for holders at the moment. If BTC fails to rally back above that daily 200 EMA (exponential moving average – blue line), then there could be a decent chance we see further downside. That said, I’m not feeling overly concerned just yet. I’m expecting a bullish push soon, although hedging my bets a little by keeping the remainder of my short trade open until the dust settles. ALWAYS wait for the dust to settle and a clear confirmation before entering a NEW position.

Ultimately I think we could see some more bearish action before a big bull run appears.

Last Week’s Performance

Well, last week we saw a lot of long positions get stopped out, some in profit, some not. This is why we teach you to use stop losses to mitigate risk! When BTC decides to nuke, the rest of the market follows.

For those of you in our TradeRoom it makes little difference if the market is going up or down because we can trade it both ways. So while some longs were getting stopped, we were scaling into shorts! Here are a couple of short trades from the week past.

LRC/USDT

You can see in the chart below where I’ve entered short twice on LRC and the reasons why are as basic as it gets. Support and Resistance. LRC was approaching ATH again while the rest of the market started to bleed. I waited for that first Lower High (LH) and entered short. Then I waited for the second LH and added to that position after confirming downtrending market structure. I closed 50% of the trade at US$2.17 and let the rest ride – currently at a 430% win on a 10x trade.

BTC/USD

In a chart I shared in the TradeRoom last week, I outlined that BTC had three attempts at breaking through resistance and failed. Once again waiting for a LH to confirm, I entered short. I closed 50% of that position at approx. US$45,000 and will hedge my bets by letting the rest ride.

Our current position is 316% profit on a 20x trade.

STORJ/USDT

STORJ was approaching a resistance level at its previous ATH price point. After it rejected, I again waited for that LH to form and entered short at US$2.92 and closed 100% of the trade at US$1.47 for a 490% ROI on 10x trade. You can see how this trade played out below:

IMPORTANT NOTES ON SHORTING:

These trades taken this week have been short trades using leverage. The reason for this is simply because the market had been trending DOWN and this is how we profit from a bearish market. This cannot be done in a SPOT trading market, where your only option would be to sell and wait for a new buy level.

Shorting a market should only be done by experienced traders and should NOT be taken by beginners. While the profits I’ve mentioned above seem very attractive, it takes time to learn and practise this craft before being profitable.

If you would like to learn how to do this, TODAY IS THE LAST DAY you can register for our current trading course. Our next LIVE course will be in February 2022.

This Week’s Trades

ADA/USDT

As I mentioned in last week’s article, I’m watching ADA pretty closely to come down and hit that US$1 level. Not only will I likely take longs here but will also buy in spot. This will ultimately depend highly on candlestick analysis in that area AND on what BTC is doing at the time. However, I still think this could present a good opportunity at this psychological level. If ADA breaks this level of support, then US$0.30 is on the table so it will be really important for US$1 to hold.

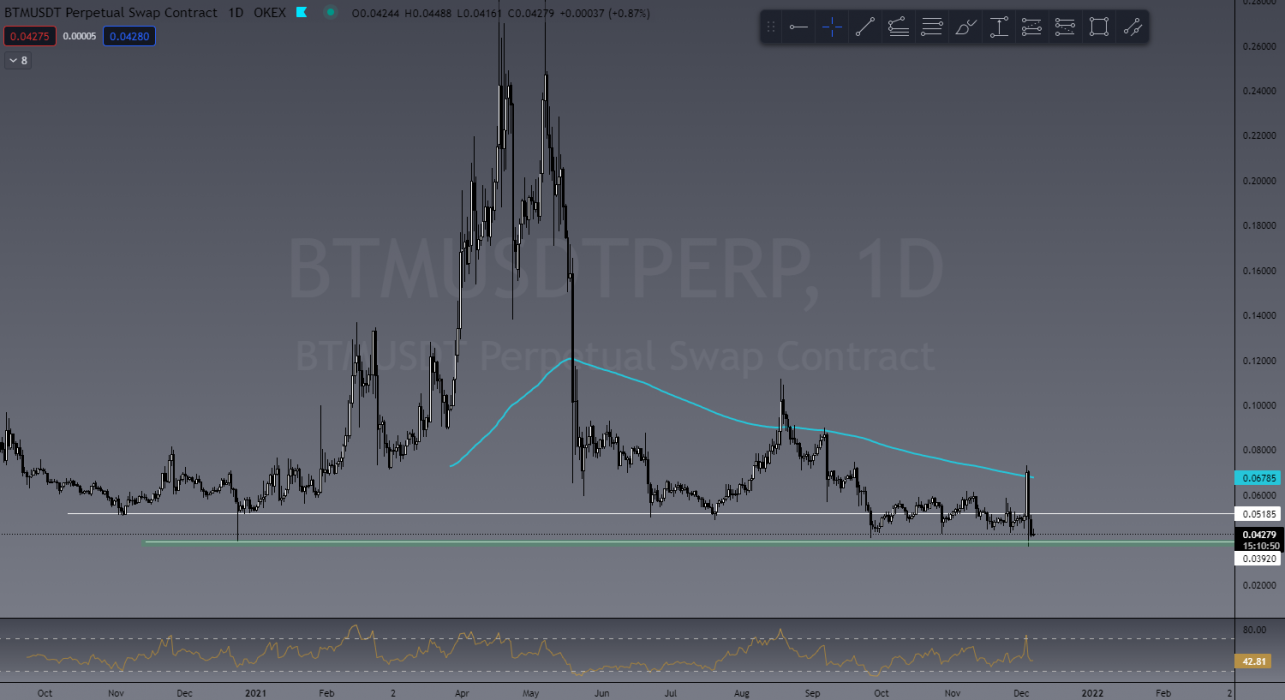

BTM/USDT

Another I’m watching pretty closely is BTM. Not a lot of price history for this one, but there could be opportunity here. This will depend heavily on BTC behaving as there are no more levels of support below the current price zone, meaning another drop will be forming all-time lows (ATL). From here there’s no data to base anything on so we use tools like market oscillators and Fibonacci to find key levels.

Invite to Join our TradeRoom

If you’d like to become a better trader, you’re invited to join our TradeRoom where we share daily charts and market analysis. In our community we strongly encourage and teach correct risk management strategies to keep our members safe in this new volatile crypto market.

Join our “Apprentice” plan now for your 7-day trial.

The Crypto Den was created in 2017 to help the rapidly growing crypto community learn and understand the fundamentals of digital currencies and how to trade them.

Since then we have taught thousands of members the basics of technical analysis and trading strategies to further progress and perfect their trading abilities.

In the TradeRoom you will be included in a supportive environment which encourages personal growth, education and community support.

It’s a place to share your trading ideas and follow other experienced traders’ feeds to help keep your finger on the pulse of such a volatile market!

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link