Major US-headquartered investment bank Morgan Stanley aims to offer three bitcoin (BTC) funds to its rich clients as early as next month, while it stressed that it’s time for investors to get educated about this nascent asset class.

The news about the funds that enable ownership of bitcoin were first reported by CNBC and Bloomberg and was confirmed to Cryptonews.com by a person familliar with the matter.

Per CNBC, only clients with “an aggressive risk tolerance” and who have at least USD 2m in assets held by the firm will be allowed to invest in these funds, while investment firms need at least USD 5m. Also, the bank is limiting BTC investments to as much as 2.5% of their clients’ total net worth.

Two of the funds on offer are from Mike Novogratz-led Galaxy Digital, while the third is a joint effort from asset manager FS Investments and NYDIG, a Stone Ridge-run subsidiary firm that provides crypto services to institutional investors.

Also today, Morgan Stanley Wealth Management’s Global Investment Committee said in a special report on cryptocurrency as an investable asset class that it’s time for investors to get educated and consider how and whether to get exposure to this burgeoning asset class in their portfolio.

“For speculative investment opportunities to rise to the level of an investable asset class that can play a role in diversified investment portfolios required transformational progress on both the supply and demand sides. With cryptocurrency, we think that threshold is being reached,” said the report, co-authored by Lisa Shalett, Chief Investment Officer and Head of the Global Investment Office at Morgan Stanley Wealth Management, and Investment Strategist Denny Galindo.

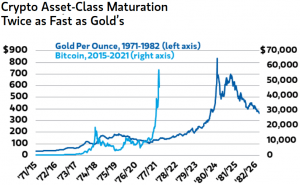

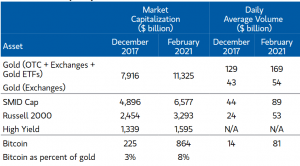

They drew a parallel with the gold adoption, saying that crypto as an asset class matured twice as fast as gold and has already crossed the critical thresholds of market liquidity, regulatory scrutiny, and institutional acceptance. Moreover, according to them, this is happening at a time “when managing cash and achieving portfolio diversification has become ever more challenging and meaningful.”

While stressing that they do not endorse any particular coin ownership and encouraging investors to approach it as a speculative asset class, the authors said that:

- “Our recognition of cryptocurrency as a likely permanent investment category is an acknowledgment of its potential to power decentralized, tamper-resistant, anonymous transactions on blockchains leveraged for myriad applications.”

- “Cryptocurrency represents a radical new invention lacking a known sponsor, a centralized standards-setting body, or an actual physical incarnation that continues to search for the “killer app” or best applications and could ultimately prove challenging to sovereign governments, climate advocates, and market regulators.”

- “Because cryptocurrency is coded, it enables property rights information and value to be embedded on the same token, features that facilitate optimized peer-to-peer transactions.”

“Given these provocative and innovative properties and myriad potential applications, investor interest is understandable,” they concluded.

However, Shalett and Galindo warned about the risks of investing in cryptoassets.

According to them, these include:

- There’s a lack of reliable and consistent market-wide information and there are ongoing challenges of data gaps and opacity.

- Valuation paradigms are also shifting.

- Cross-asset correlations might continue to remain unstable – BTC has already behaved like both a risk-on and risk-off asset.

- There are technological challenges, such as quantum computing that theoretically might endanger encryption, while coding errors are also possible.

- Another risk consideration is the threat and conflict that cryptocurrencies likely pose to clean/green energy and environmental, social, and governance investment mandates.

- The concentration of bitcoin’s global ownership.

- With strong vested interests in support of fiat currencies and the access to tax revenues they provide, the potential for a single large government to invalidate crypto as a currency or prohibit it for certain use cases is not zero.

“From our vantage point, coin trading remains in its infancy. Issues around finding true price discovery and best execution are still to be addressed. We have yet to convinced there and, therefore, advise clients to proceed with caution,” the authors concluded.

At the time of writing (17:28 UTC), BTC trades at USD 55,455 and is almost unchanged in a day. It’s up by 1.4% in a week and 14% in a month. The price rallied by more than 1,000% in a year.

___

Learn more:

– Morgan Stanley Exec Says Bitcoin is Coming for the US Dollar

– Central Banks Are Driving People to Bitcoin – Morgan Stanley Exec

– 1,400+ Firms Flock To Learn About Bitcoin, But ‘There Is No Playbook’

– Dalio Disses Dollar Debt, But Warns Gov’ts May Target Bitcoin & Gold

– A Debt-Fuelled Economic Crisis & Bitcoin: What to Expect?

– Three Developments For Bitcoin According to Citi

Credit: Source link