Turkey is in the grip of a crippling currency crisis as the Turkish lira continues its freefall. The sell-off was sparked after President Recep Tayyip Erdoğan demanded the Central Bank of Turkey cut rates for a third consecutive month from 19 percent to 15 percent.

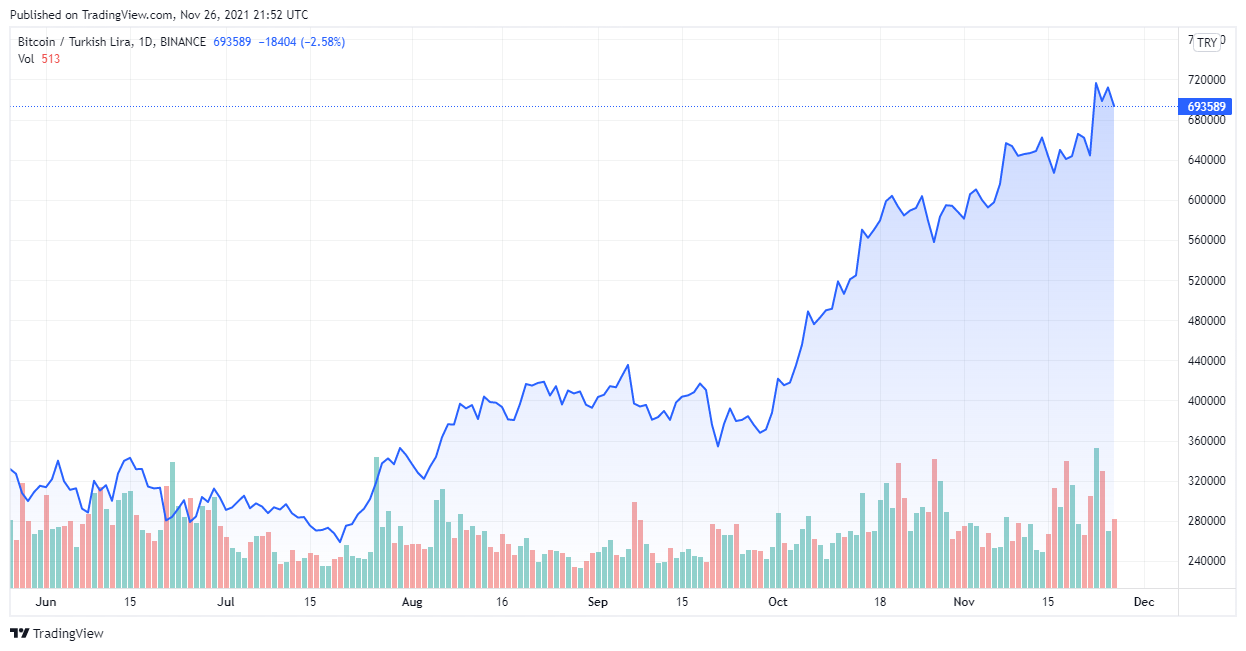

Shortly after, Bitcoin printed a fresh all-time high against the weakened lira, suggesting that perhaps, Bitcoin fixes this.

What is Happening in Turkey?

The Turkish lira has been steadily weakening against the US dollar for the past decade, but this week saw the currency collapse over 15 percent in a single day, a historic event for any G20 country.

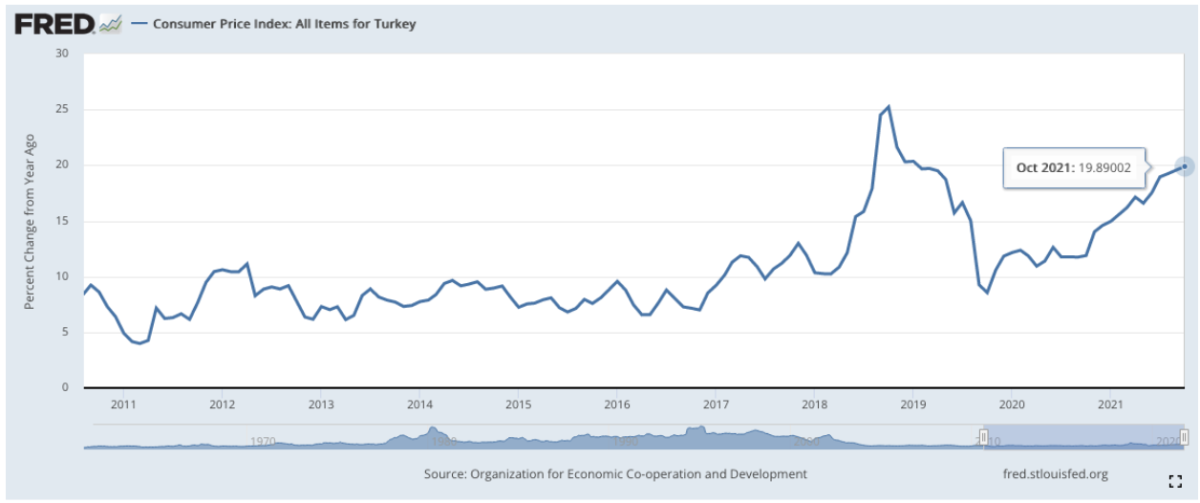

To make economic matters worse, Turkey’s Consumer Price Index (CPI) has been accelerating over the past two years and is now just under 20 percent.

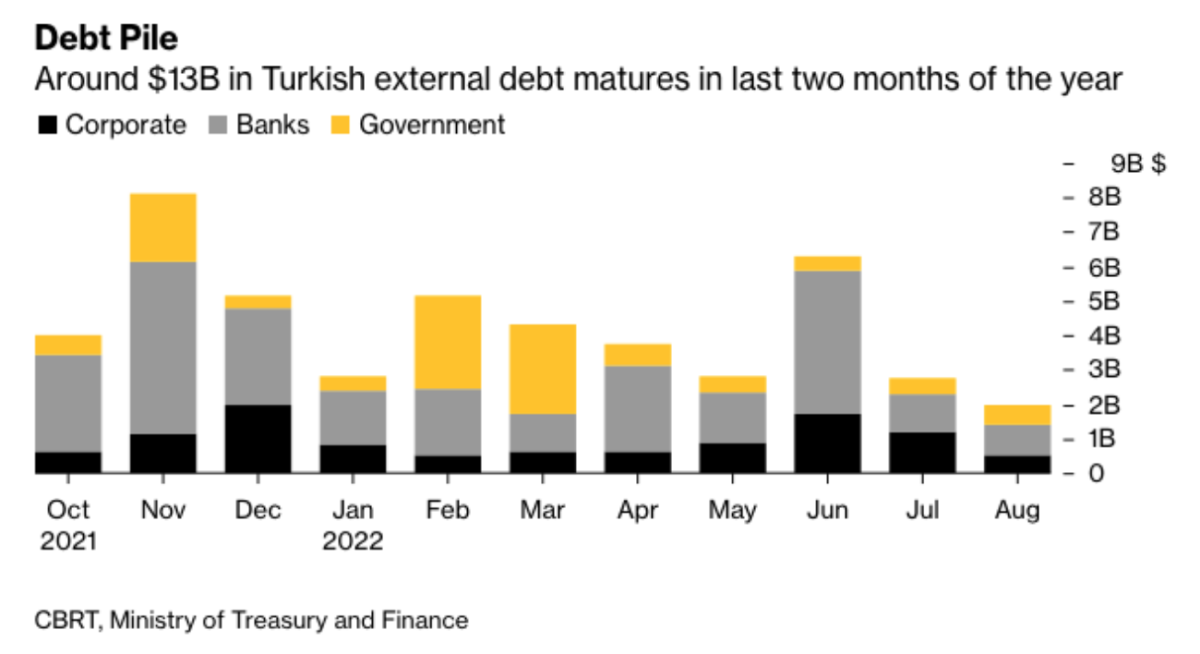

With growing inflation, reducing real rates and limited USD foreign exchange reserves, the picture is looking bleak for ordinary Turkish citizens. To make matters worse, US$13 billion in debt is set to expire this month and next.

Typically, during periods of high inflation, central banks will look to raise interest rates. However, Erdogan, who has fired three central bank chiefs in two years, has pushed for lower interest rates to increase economic growth and exports as well as decrease unemployment.

Yet it is the Turkish citizen who faces a severe decline of purchasing power at an unprecedented rate during a period of soaring prices and political instability.

A former Turkish central bank deputy governor, Semih Tumen, has criticised the policy for annihilating the purchasing power of ordinary Turks, describing the move as an “irrational experiment, which has no chance of success”.

Bitcoin Responds

Following the currency sell-off, Bitcoin did its thing, soaring against the Turkish lira to reach an all-time high of ₺735,432/BTC.

On November 26, as news of a new Covid-19 variant spooked markets, Bitcoin retreated by 7 percent, however in Turkey it remains up 70 percent over three months and 220 percent year-to-date.

Bitcoin has been viewed as an inflation hedge and this crisis in Turkey is no doubt an opportunity for it to shine. Earlier this year, Bitcoin rose as the Argentine peso collapsed, with the current CPI in the South American nation sitting at over 50 percent. And it’s not just developing nations experiencing inflationary periods – just two weeks ago, Bitcoin catapulted on news of the US’ highest CPI print in over 30 years.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link