Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Ethereum (ETH)

Ethereum ETH is a decentralised open-source blockchain system that features its own cryptocurrency, Ether. ETH works as a platform for numerous other cryptocurrencies, as well as for the execution of decentralised smart contracts. Ethereum’s own purported goal is to become a global platform for decentralised applications, allowing users from all over the world to write and run software that is resistant to censorship, downtime, and fraud.

ETH Price Analysis

At the time of writing, ETH is ranked the 2nd cryptocurrency globally and the current price is US$4,326.81. Let’s take a look at the chart below for price analysis:

ETH‘s long-term range from November’s high could be coming to an end.

The 9, 18, and 40 EMAs flipped bullish at the beginning of October after late September’s retracement, showing strength as BTC rallied. Currently, the price is hovering just under the all-time high as bulls take some profits.

Two swing highs and the 9 EMA could mark $4180.87 to $4026.72 as an area of possible support. A deeper retracement will likely find some buyers around the 61.8% retracement near $3867.59.

The all-time high will likely see some profit-taking, but the area near the 27% extension, at $4650.12, could also provide some resistance. The 61.8% extensions of the last two swings converge near $4820.54, which could be the target for an all-time high break before a new setup emerges.

2. Ripple (XRP)

Ripple XRP is the currency that runs on a digital payment platform called RippleNet, which is on top of a distributed ledger database called XRP Ledger. While RippleNet is run by a company called Ripple, the XRP Ledger is open-source and is not based on blockchain, but rather the previously mentioned distributed ledger database.

XRP Price Analysis

At the time of writing, XRP is ranked the 7th cryptocurrency globally and the current price is US$1.05. Let’s take a look at the chart below for price analysis:

XRP‘s 87% climb during early August returned to the monthly open, sweeping lows several times down to $0.9233. Last week, the price bounced from the monthly open near $1.03 again, creating possible support near $1.10. A quick sweep of this recent swing low could reach into a support area near $0.9834, while a sharp downturn in the market is likely to run for the relatively equal lows near $0.9160.

If the price breaks through the closest significant resistance near $1.17, the swing high at $1.25 is a likely target. This move could reach the daily gap near $1.28.

Strong bullish momentum could propel the price to resistance near $1.3o. If this move occurs, the significant swing high near $1.33 provides a reasonable goal.

3. Terra (LUNA)

Terra LUNA is a blockchain protocol that uses fiat-pegged stablecoins to power price-stable global payments systems. According to its white paper, Terra combines the price stability and wide adoption of fiat currencies with the censorship-resistance of Bitcoin and offers fast and affordable settlements. Terra’s native token, LUNA, is used to stabilize the price of the protocol’s stablecoins. LUNA holders are also able to submit and vote on governance proposals, giving it the functionality of a governance token.

LUNA Price Analysis

At the time of writing, LUNA is ranked the 14th cryptocurrency globally and the current price is US$42.01. Let’s take a look at the chart below for price analysis:

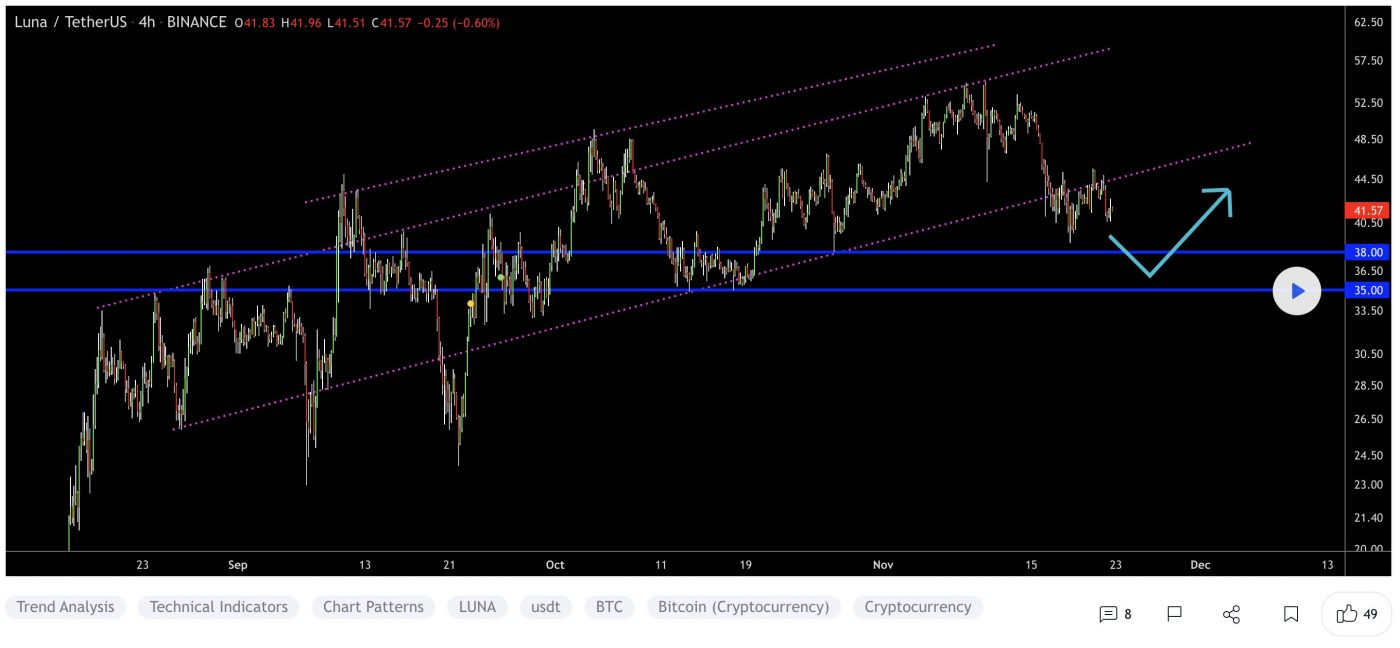

After breaking its October highs, LUNA began a range that has been whiplashing both bulls and bears.

Resistance beginning near $49.35 held the price down for the second half of November, although bulls have shown some strength near the 9 and 18 EMAs.

A quick drop to $40.37, or into the zone beginning near $44.87, could give bulls the fuel to push through the nearby resistance. If this resistance breaks, the high near $50.47 provides a reasonable target.

A break of this level could move further into uncharted territory with the nearest probable resistances projected around $58.28 and $60.57.

More patient bulls might be waiting far below the 40 EMA with bids near the higher-timeframe range’s 61.8% retracement, near $35.59.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Duration: 6-week course

From: November 15 to December 22

Date/Time: Twice a week, Mon and Wed at 7pm AEST

Location: Zoom webinar

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link