A report released by Ernst & Young (EY) detailing the views of hedge funds and other investors on alternative funds like crypto shows there has been strong growth in the sector, with 31 per cent of hedge fund managers planning to add crypto to their portfolios.

EY has released its yearly publication, the EY Global Alternative Fund Survey, which offers a comprehensive overview of the perspectives of alternative fund managers and the institutional investors who allocate to alternative asset classes, basically anything that’s not a stock, bond or cash.

Increase in Alternative Investment Opportunities

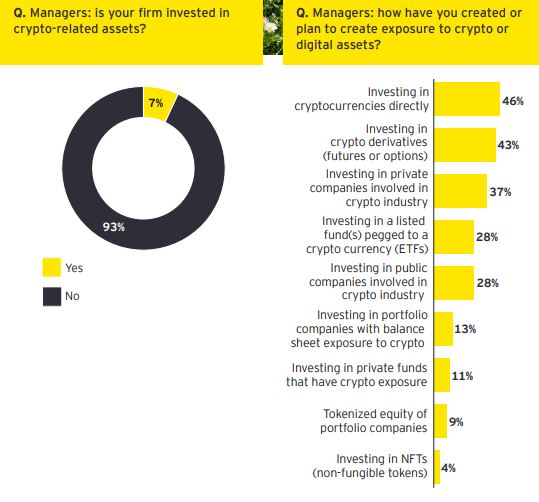

According to the study, only 7 percent of alternative fund managers and investors interviewed for the EY study said they or their firms already have “crypto-related assets” in their portfolios. However, there is a steady rise in the onboarding of various investment vehicles of the new asset class.

In 2021 alternative funds increase the successful momentum they built in 2020 by delivering strong returns resulting in increased investor confidence.

EY Global Alternative Fund Survey

The report also states that “cryptocurrencies and the digital asset ecosystem perhaps garnered the most mainstream public interest during 2021”. However, institutions are viewed considerably more cautiously, with regulatory uncertainty cited as the second-largest risk for investors behind crypto not aligning with their investment strategy.

Increase in Hedge Fund Participation

More alternative fund managers have become active participants, drawn by uncorrelated return profiles and continued investment in institutional-grade infrastructure to support the evolving asset class.

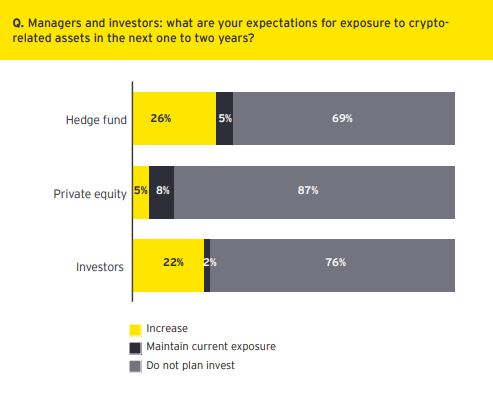

When looking at current and future exposure to crypto-related assets, 31 per cent of hedge fund managers, 24 per cent of alternative investors, and 13 per cent of private equity managers said they planned to add crypto to their portfolios or maintain their current exposure in the next one to two years.

According to the study, the largest managers were most likely to increase their exposure, with 36 per cent of hedge fund managers with over US$10 billion in Assets Under Management (AUM), and 32 per cent of managers with US$2–10 billion in AUM reporting that they expected to increase their crypto portfolios.

Retail Investors Join the Party

As such, allocations to hedge funds (28 percent) and private equity (27 percent) are now on par – a stark contrast to 2018 when hedge fund allocations (40 percent) outpaced private equity (18 percent) by a two to one margin.

The study also shows that 42 per cent of investment managers, seeking new growth opportunities, are turning to “retail” channels to grow as institutional allocations are slowly increasing.

Alternative fund managers have realised they need crypto, not only address but advance current and future investor priorities, which now extend to retail investors, regarding environmental and societal imperatives, while taking the necessary steps to attract, support and retain a diverse and decentralised workforce.

Also in a recent report, it showed more than one in four financial advisers say they will recommend cryptocurrencies to their clients in the next year.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link