As bitcoin (BTC) reaches new all-time highs, the value of paper money has hit an all-time low against hard assets, as “inflation is everywhere,” according to Pantera Capital CEO Dan Morehead.

“It seems like the price of everything is surging up,” Morehead wrote in his monthly letter to investors, which in its entirety was dedicated to the topic of sound money and how inflation, today and throughout history, has shaped the world.

On the same note, the Pantera CEO continued by noting that it may seem odd that we have inflation during what he described as “a worldwide financial crisis.”

However, he explained that the situation is easier to understand when one first realizes that “the value of most things is relatively stable,” adding that “it’s just the value of paper money that is being debased at a rapid rate.”

“Paper money has hit an all-time low against most hard assets,” Morehead went on to say.

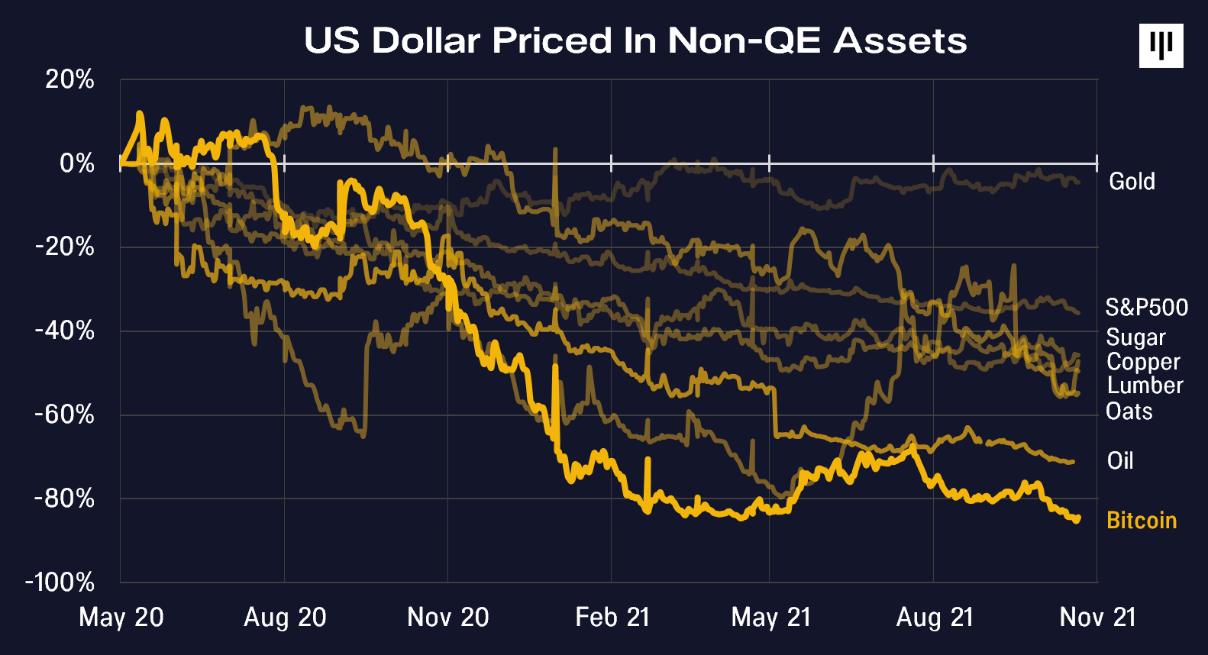

And although prices on hard assets have been rising, traditional investors who had hoped that their gold holdings would save them in the face of inflation have had a rather disappointing year, Pantera’s data showed.

Among the “non-[quantitative easing] assets” tracked by Pantera, gold saw the “least good” performance, as Morehead put it, explaining that the metal “is losing market share to digital gold.”

Further in the letter, the crypto hedge fund CEO went on to say that bitcoin so far appears to be the one among the major hard assets that has benefited the most from the debasement of paper money.

The cryptocurrency reached a new all-time high of more than USD 68,600 as recently as today, and based on its history, it is likely to continue much higher, Morehead explained:

“The last time bitcoin retook its all-time high after falling over 50%, it went 3.2x above that shortly thereafter. The average increase of the past three instances of making a new all-time high — 8.8x over a 166-day period.”

However, it is far from just bitcoin that is rising in price because of currency debasement, Morehead said, pointing at home prices, wages, and transportation as just some examples of the fact that “inflation is everywhere.”

Morehead’s observation that inflation is everywhere also resonates well with that of the major asset management firm Bridgewater Associates, which in a report from October said that the currently high inflation, in their view, has more to do with high demand than a lack of supply. Moreover, the firm also said that inflation is likely not transitory – as the US Federal Reserve holds – but rather that it is here to stay.

“The gap between demand and supply is now large enough that high inflation is likely to be reasonably sustained, particularly because extremely easy policy is encouraging further demand rather than constricting it,” the report said.

Meanwhile, the discussion about whether gold or bitcoin is the better inflation hedge was also brought up on CNBC today, where George Milling-Stanley, Chief Gold Strategist at State Street’s SPDR ETFs, said that the two assets can coexist.

“I think it is quite possible for these two assets to coexist quite happily in the market because they do completely different jobs,” Milling-Stanley said.

He added that gold “over the long term — and I stress this, over the long term,” can both improve returns and reduce volatility in a portfolio in a situation with “sustained high inflation” like in the 1970s.

_____

Learn more:

– Bitcoin Rally Healthy, Less Leverage Than in the Past, Say On-Chain Analysts

– Mt. Gox Payouts Nearing, But Is the Market Ready for It?

– Bitcoin Enters Price Discovery Mode, Lures Gold Investors

– Pantera CEO Trims Bitcoin Price Forecast For 2021, Sees ETH Outperforming

– USD 20,000 Weekly Moves in Bitcoin’s Price Likely This Year, Author Says

– Inflation Scares in an Uncharted Recovery

– This Is What Might Happen if the US Defaults on Debt

– Why Fiat Currency Is More Confusing Than Crypto

Credit: Source link