Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Fantom (FTM)

Fantom FTM is a directed acyclic graph (DAG) smart contract platform providing decentralised finance (DeFi) services to developers using its own bespoke consensus algorithm. Together with its in-house token FTM, Fantom aims to solve problems associated with smart-contract platforms, specifically transaction speed, which developers say they have reduced to under two seconds.

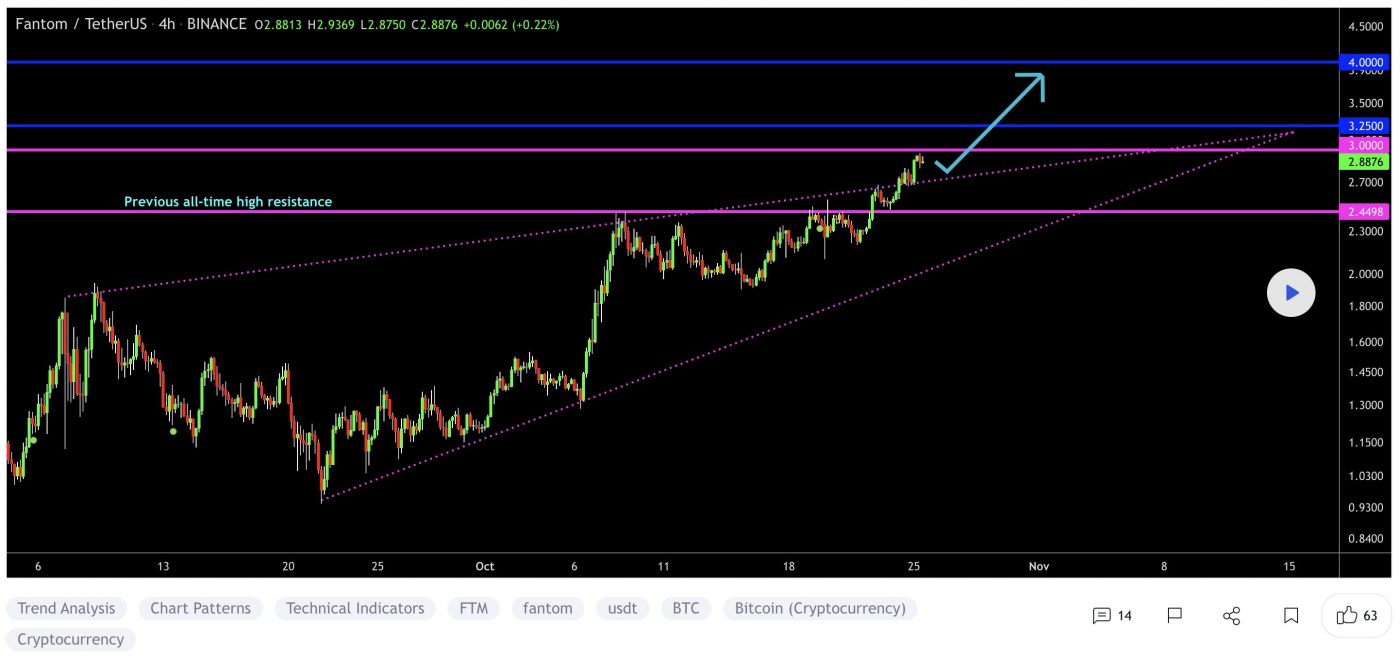

FTM Price Analysis

At the time of writing, FTM is ranked the 26th cryptocurrency globally and the current price is A$4.36. Let’s take a look at the chart below for price analysis:

During mid-October, FTM broke several swing highs that could be the signal for a new bullish trend.

Last week’s break of the most recent swing low could suggest some downside in the short term. It formed probable resistance near A$4.30 and may target the swing low and possible support near A$4.23.

The swing low and possible support near A$4.12 could be the second bearish target if the move down continues. The relatively equal lows near A$4.00 and possible support underneath near A$3.89 could provide more substantial support.

The last swing high near A$4.50 gives a near-term target if bullish continuation continues. However, resistance beginning around A$4.45 could cap this move. A break of this resistance might continue to probable resistance near A$4.58 and reach above the cluster of relatively equal new highs near A$4.77 and A$4.95.

2. Cocos-BCX (COCOS)

Cocos-BCX COCOS is a public blockchain platform aiming to create a complete run-time environment for games with multi-game system compatibility, providing game developers with a user-friendly platform for blockchain game development.

COCOS Price Analysis

At the time of writing, COCOS is ranked the 716th cryptocurrency globally and the current price is A$0.9379. Let’s take a look at the chart below for price analysis:

Mid-July marked a turning point for COCOS, with the price rocketing up almost 125% from its lows to probable resistance beginning near A$1.13.

The price is currently struggling with the area between A$1.05 and A$0.7245. This region could provide support after a close above, or resistance after a close below.

A retracement could reach into the daily gap and possible support around A$0.8532. A more bearish shift in the marketplace will likely aim for the relatively equal lows near A$0.8076, and the potential support just below that begins around A$0.7714.

Continuation to the upside will likely target the monthly high near A$1.10. However, probable resistance beginning at A$1.16 and A$1.24 could cap or slow down this move.

3. Linear (LINA)

Linear LINA is a decentralised delta-one asset protocol capable of instantly creating synthetic assets with unlimited liquidity. The project opens traditional assets like commodities, forex, market indices and other thematic sectors to cryptocurrency users by supporting the creation of “Liquids”, Linear’s synthetic asset tokens. LINA is an ERC-20 token built on the Ethereum network whose main purpose is as collateral for Liquids (using Buildr), and for community governance of the protocol.

LINA Price Analysis

At the time of writing, LINA is ranked the 279th cryptocurrency globally and the current price is A$0.07247. Let’s take a look at the chart below for price analysis:

During August, LINA also turned the corner, breaking a key swing high early to mid-month. This move could suggest a longer-term bullish trend.

The swing high near A$0.09436 stands out as a bullish target and marks an area of probable resistance. Further continuation could reach into possible resistance starting near A$0.1057.

Even if the bullish trend continues, a stop run at the recent swing low near A$0.07534 into possible support beginning near A$0.07185 is reasonable. If the price reaches further down, the swing low and possible support near A$0.06812 might provide another downside target.

The area near A$0.06722 could also provide support. However, a drop this far could suggest a stop run below the higher-timeframe relatively equal lows near A$0.06493 into possible support beginning around A$0.06349.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link