A theme in crypto that has gotten even more pronounced this year is the line that is being drawn between the centralized and the decentralized part of the market. And with regulators taking a firmer stance towards crypto all around the world, this difference has become even more important, in particular for crypto exchanges.

There is no denying that some centralized exchanges (CEXes) have found themselves facing tough choices as of late. Should they cater to regulators’ demands, or instead focus on keeping up with the lightning-fast innovation that is happening in crypto and give their customers what they want?

Among the CEXes that have gotten in trouble this year are of course all exchanges with ties to Mainland China, following Beijing’s reiteration of its ban on most things related to crypto.

But Chinese exchanges are not the only ones having to deal with aggressive regulators. The same has also happened to the major global exchange Binance, which for a number of years claimed it doesn’t have a physical headquarter. However, global regulators now seem to be winning the first battle with Binance, having essentially forced the exchange to declare where its physical head offices are located.

As would be expected, the regulatory pressure on centralized exchanges, particularly from China, has sparked a new round of interest in decentralized exchanges (DEXes). As history has shown, however, these decentralized alternatives cannot always escape regulatory scrutiny either.

For instance, Uniswap Labs, the development firm behind the Uniswap decentralized exchange, in July this year restricted access via app.uniswap.org to some tokens that it deemed too risky from a regulatory standpoint. Not surprisingly, the move sparked a backlash from users, with some questioning how decentralized the protocol really is.

Still, there is no doubt that DEXes can operate with much more flexibility than CEXes can. So, with the regulatory situation being what it is, let’s compare the performance of the biggest DEX tokens versus CEX-issued tokens.

Top 5 CEX Tokens in 2021

First, let’s look at the performance of the top 5 centralized exchange tokens by market capitalization:

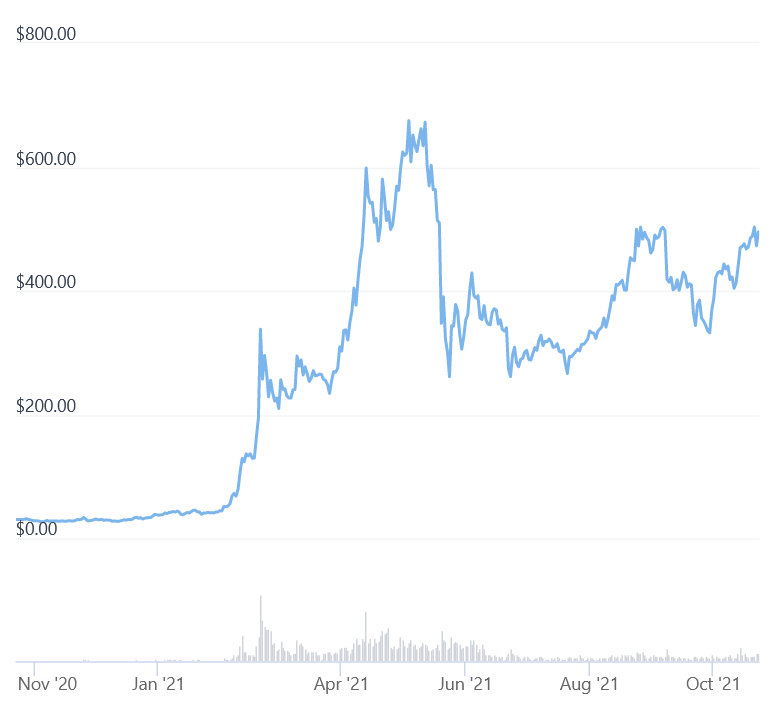

Binance coin (BNB)

With the largest market capitalization by far among CEX tokens, binance coin has risen by around 1,194% since the beginning of 2021. The strong performance means that BNB has outperformed nearly all other coins in the top 10 by market capitalization this year, with the exception of two of this year’s big winners, solana (SOL) and dogecoin (DOGE).

Much of the returns that BNB has generated this year came during the months of February, March and April, when all-time highs across much of the crypto market also pushed the usage of Binance’s exchange to new records.

Since BNB reached its all-time high in May, however, Binance has faced increased regulatory pressure, and tokens issued by competitors such as FTX and Crypto.com have outperformed it.

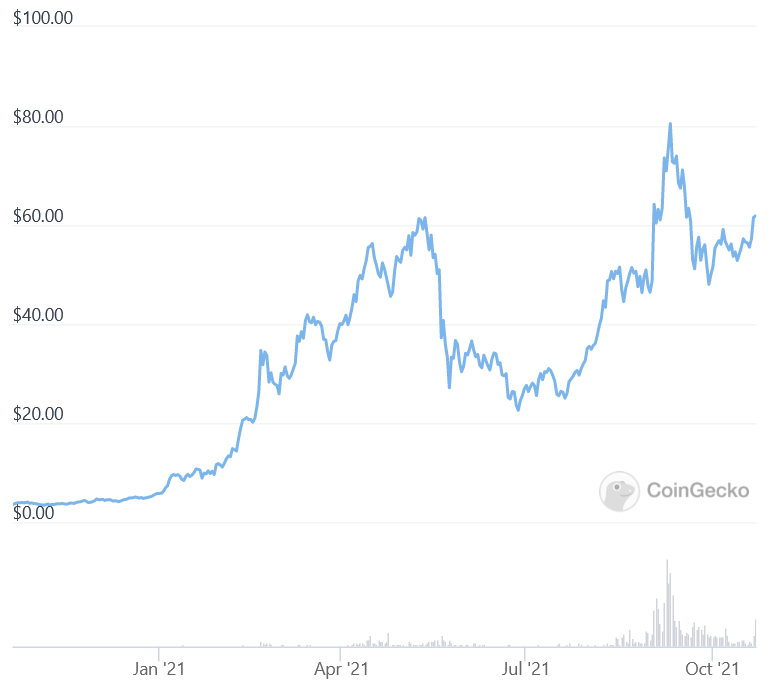

FTX token (FTT)

Issued by the major crypto spot and derivatives exchange FTX, FTT has also seen strong performance this year, with a year-to-date return of more than 1,040%.

The rise for FTX’s token has come as the exchange has become one of the most popular places to trade crypto. This is especially true on the derivatives side, where the 24-hour trading volume at the time of writing stood at over USD 10bn, second only to Binance, which had USD 65bn in volume.

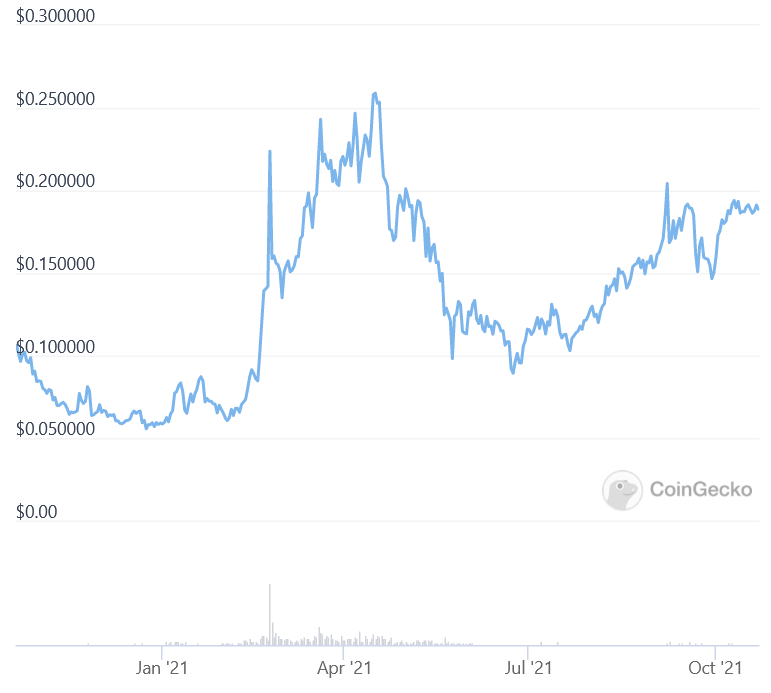

Crypto.com coin (CRO)

Issued as the native token of the Crypto.com blockchain, CRO serves as both an exchange token for Crypto.com’s trading platform, as well as a number of other functions within Crypto.com’s ecosystem.

Year-to-date, the CRO token, ranked 38th by market capitalization, has risen by 225%, and, at the time of writing, was trading at a price of USD 0.19, up from just USD 0.06 at the beginning of the year.

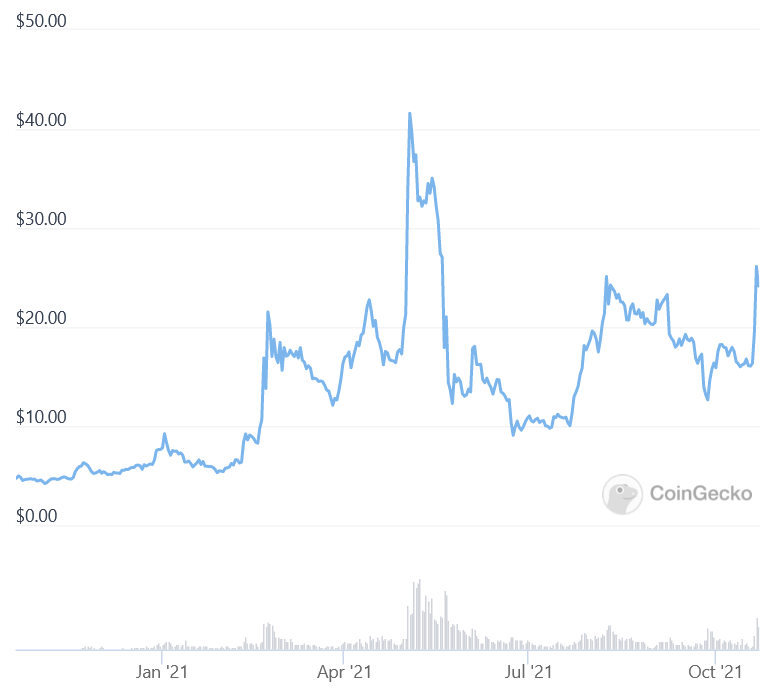

OKB

Described as a global utility token that, among other things, gives traders access to discounted trading fees on the issuing crypto exchange OKEx. The token is currently ranked as the 32nd most valuable cryptoasset by market capitalization, and saw its price more than double in a matter of just two days in May this year.

Since May, however, OKB has somewhat lagged other exchange tokens like BNB and FTT, although a sharp rise starting on October 19 has brought it closer to its competitors.

Worth noting is also that OKEx is among the exchanges with strong ties to Mainland China that have been forced to stop serving users in China due to the government’s fresh crypto ban. Still, the price of OKB has been surprisingly resilient and is actually up by around 45% since news of the ban broke on September 24.

So far in 2021, OKB is up 147%, trading at a price of USD 22.90, up from a low of just USD 9 on June 23 this year.

LEO token (LEO)

Issued by Bitfinex, a crypto exchange with a history going all the way back to 2012, LEO is an exchange token that was first launched in May 2019. Like most other exchange tokens, LEO gives trading discounts on Bitfinex. However, the token is unique in that it is constantly being bought back by the exchange, with the plan being to continue the buy-backs until no more tokens are circulating.

Year-to-date, LEO is up by 134%, trading at a price of USD 3.24 at the time of writing. And although this is a decent gain by any traditional measure, it still positions LEO as this year’s worst performer among the top centralized exchange tokens.

Top 5 DEX tokens in 2021

Now, let’s change our focus over to the more decentralized world, and look at how the top 5 tokens by market capitalization issued by DEXes have performed in 2021:

Uniswap (UNI)

Issued by the most popular decentralized exchange by trading volume, UNI was airdropped to early users of Uniswap in September of 2020 as the protocol’s governance token.

Like many of the other popular decentralized exchanges, Uniswap is a so-called automated market maker (AMM) where tokens are swapped between sufficiently large liquidity pools. As a result, these types of exchanges operate without an order book like traditional exchanges have.

In 2021, the UNI token has returned 467% to its holders and is ranked as the 14th most valuable cryptoasset by market capitalization. At the time of writing, the token was trading at USD 26.51, up from USD 5.15 at the beginning of the year.

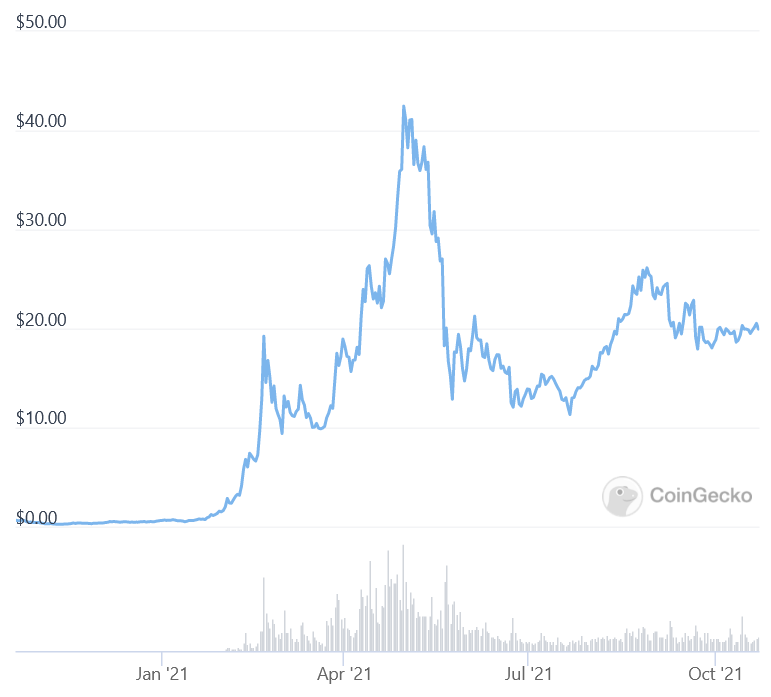

PancakeSwap (CAKE)

Another AMM, PancakeSwap, in a short amount of time, became the dominant DEX on Binance Smart Chain, where it supports the swapping of a large number of tokens under the chain’s BEP-20 standard.

The CAKE token, ranked 40th by market capitalization, is mainly used for yield farming and staking, but also offers certain governance rights on the protocol. At the time of writing, CAKE was up by a massive 2,980% year-to-date, to trade at a price of USD 20.12.

SushiSwap (SUSHI)

The AMM protocol SushiSwap was launched in September 2020 as nothing else than a fork of Uniswap, and it even got ahead of the original protocol in releasing its governance token, SUSHI.

Despite being a copy of the better-known Uniswap, SushiSwap has become very popular, having the third-highest 24-hour trading volume after Uniswap and PancakeSwap.

The SUSHI token is up 240% since the beginning of the year, having moved from a price of USD 2.87 on January 1 to USD 11.15 at the time of writing.

THORChain (RUNE)

RUNE, ranked 73rd in terms of market capitalization, is a token issued by the THORChain decentralized liquidity protocol. The token is used as a base pair and settlement asset in liquidity pools on the protocol, and is also used as an incentive mechanism to keep nodes on the network honest.

Since the beginning of 2021, RUNE has risen 560% and is currently trading at USD 8.51.

Synthetix Network Token (SNX)

SNX is the native token of the Synthetix protocol which offers users exposure to the price of a whole range of both crypto and non-crypto assets through a form of derivatives called “Synths.”

SNX is currently ranked 79th by market capitalization and has risen by just 17% since the beginning of the year. At the time of writing, the token was trading at a price of USD 9.88, versus USD 7.23 at the beginning of 2021.

Despite being in positive territory for the year, SNX’s muted performance made it this year’s worst performer among the DEX tokens covered by a wide margin.

Summary

Looking at the performance of the various CEX and DEX tokens above, we can see that the differences within the two categories were huge, with some tokens rising by several thousand percent, and others barely rising at all (by crypto standards, that is).

The average year-to-date performance of the top 5 CEX tokens was 548%, with FTX’s FTT token and Binance’s BNB token leading the group with gains north of 1,000% each.

Meanwhile, the average year-to-date performance for the top 5 DEX tokens came in at 851%, with PancakeSwap’s CAKE token standing out as the clear winner in this group with a gain of nearly 3,000% so far in 2021.

If we exclude the top performer in each group, however, the investment returns of CEX and DEX in 2021 have been more similar, standing at 386% for CEXs and 319% for DEXes.

With DEXes still being a less mature part of the entire crypto ecosystem, opportunities for strong growth still exist in the space, perhaps best represented by CAKE token’s meteoric rise this year.

Prices and categorization of tokens are based on CoinGecko’s ranking of the Top Centralized Exchange Tokens and the Top Decentralized Exchange Tokens, as of October 21 at 14:06 UTC.

___

Learn more:

– DYDX Soars as Protocol Sees Trading Volume Double That of Coinbase

– Forked DEX On Binance Chain Tests Uniswap & Legal Limits

– Decentralized Exchanges Set To Accelerate in 2021

– At Least 6,000 Coinbase Clients Robbed This Spring, Exchange Reimburses Losses

Credit: Source link