The first exchange-traded fund (ETF) backed by bitcoin (BTC) futures contracts went live today on the NYSE Arca exchange. The launch is considered a success by analysts, with trading volumes indicative of large interest from traders and BTC spiking above USD 63,000 for the first time since April. (Updated at 17:09 UTC: updates throughout the entire text.)

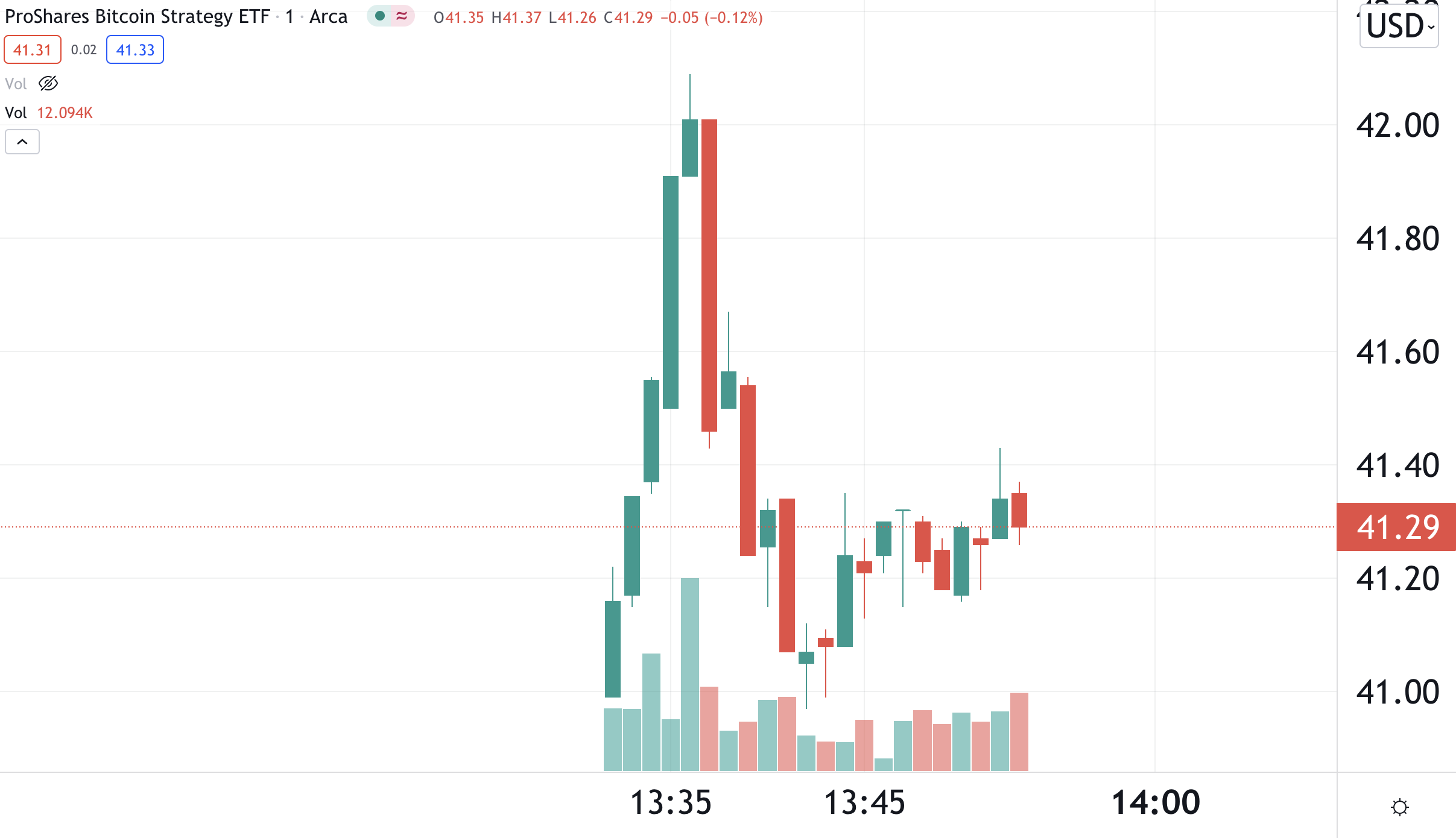

Launched by ETF issuer ProShares, the ETF with the ticker BITO went live today at 09:30 EDT (13:30 UTC), with representatives from ProShares ringing the opening bell at the New York Stock Exchange.

As the market opened, the ETF immediately shot up in price, rising by almost 1.4% within the first five minutes of trading. The first recorded trade for the ETF was made at a price of USD 40.99 per share, with the price rising above USD 42 before reversing to the downside.

Worth noting is also that the bitcoin futures contracts traded on the Chicago Mercantile Exchange (CME) traded sharply higher almost immediately upon the ETF launch, likely as a result of speculation that the ETF will become a large new buyer in the bitcoin futures market.

At 13:47 UTC, shortly after the ETF went live, the CME bitcoin futures contract expiring in October traded at USD 63,855, nearly USD 1,000 higher than the spot price of bitcoin on Binance. Over the past hour, the futures market moved as much as 3.3% higher, while Binance’s spot price moved up by only 1.7%.

At 16:20 UTC, just under three hours into the trading day on Wall Street, the large difference between the spot and futures markets had been reduced, with the CME futures trading USD 400 higher than the spot price on Binance.

At the same time, the BITO ETF itself traded at a price of USD 40.92 per share, down by about 2.8% from the opening trade of the day. On Binance, bitcoin traded at USD 62,540, while bitcoin futures on CME traded at USD 62,940.

However, at 17:04, BTC was already above the USD 63,000 level, trading at USD 63,113.

The launch of a bitcoin futures ETF has received widespread attention in recent days, with some analysts suggesting that it could fuel rising premiums on bitcoin futures traded on the CME relative to spot prices as seen on crypto-native exchanges. As a result, the ETF has sparked renewed interest in the so-called bitcoin basis trade, where arbitrage traders take advantage of the price difference between bitcoin spot and futures markets.

According to Eric Balchunas, Bloomberg’s senior ETF analyst, the new ETF received a welcome like few others in the market today, already surpassing this year’s top ETF launch by volume, VanEck’s Social Sentiment ETF with ticker BUZZ.

Shortly after, Balchunas said that the ETF has now reached more than half a billion US dollars in trading volume, making it one of this year’s biggest ETF launched by volume.

In a comment shared with Cryptonews.com, Sebastian Markowsky, Chief Strategy Officer at the bitcoin ATM provider Coinsource, called the ETF “important for bitcoin adoption,” given how many financial institutions are not able to hold bitcoin directly.

“There is a huge pile of capital waiting to gain Bitcoin exposure by means of those products,” Markowsky said, adding that the importance of this capital gaining exposure “can probably not be overstated.”

Also commenting on the launch of the ETF, Simeon Hyman, global investment strategist at ProShares told Bloomberg TV today that he believes the ETF will allow many people to have bitcoin in their portfolios “in a reliable and robust way.”

Further, the investment strategist also defended the firm’s decision to back the ETF by futures contracts rather than ‘physical’ bitcoins, saying that there is “tremendous volume” in the CME futures market, and that it is “not a second-order choice” to back it with futures.

The bitcoin futures-backed ETF is both “a first-class way and a convenient way” to have exposure to bitcoin, Hyman said, adding that it is “a landmark in the broader bitcoin ecosystem.”

Meanwhile, Chief Investment Officer Scott Minerd at the financial services firm Guggenheim Partners told Bloomberg that he welcomes the ETF, particularly since it provides easier access to bitcoin exposure for financial institutions.

“You have to be in something that’s a tradeable vehicle like an ETF,” Minerd used as the main argument for why the ETF is needed. He added that holding bitcoin directly is not an alternative for many institutional players, both from a regulatory standpoint and because “if you just keep your bitcoin in your wallet, it can be stolen.”

Further, the investment manager, who has become well-known in the bitcoin world for his lofty bitcoin price targets ranging from USD 400k to 600k, reiterated his belief that “money is something that society creates,” not governments.

“If you want to be long cryptocurrencies, probably now is not a bad time,” the asset manager concluded by saying.

The launch of the first bitcoin ETF in the US was also the topic of Coin Metrics’ latest State of the Network report on Tuesday, where the crypto analysis firm said that on-chain signals show that “bullish conditions have returned” to the bitcoin market.

“A big catalyst in the recent run-up has been renewed talks of a bitcoin ETF finally getting approved in the US,” the report said, adding that the attention is now turning to the potential for an upcoming ‘physically’ backed spot ETF in the US.“Competition for the first US approved spot bitcoin ETF is at its highest level ever, with prominent firms including Bitwise announcing plans for an ETF over the last few weeks, and Grayscale reaffirming their plan to convert their Trust into an ETF. Q4 is poised to be a big quarter for bitcoin ETFs, with a long list of SEC ETF decisions (spot and futures-based) on the horizon,” the report said.

____

Reactions:

___

Learn more:

– Bitcoin Futures ETF to Start Testing Market on Tuesday Amid Pullback Talks

– Institutional Crypto Adoption: Three Factors to Watch

– Experts Disagree on Prospects of Bitcoin ETF in 2021 as Deadline Nears

– Bitcoin Rallies Above USD 60,000 on ETF Hopes

___

(Updated at 15:41 UTC with additional comments.)

Credit: Source link