The market depth for bitcoin (BTC) and ethereum (ETH) on the three exchanges Coinbase, Kraken, and Gemini has improved since the beginning of 2020, indicating that the two major cryptoassets are becoming mature, according to crypto analytics provider Coin Metrics.

The finding that the market for both BTC and ETH is maturing was described as important by the analysts, given that it gives large financial institutions with more sophisticated trading and execution strategies a chance to trade the assets with minimal slippage costs.

“Significant liquidity across many exchanges means that one particular market order will have less of an impact on the prevailing market price,” a report from Coin Metrics said. It added that more liquidity also improves the price discovery process, which in turn makes market manipulation “more expensive and unlikely.”

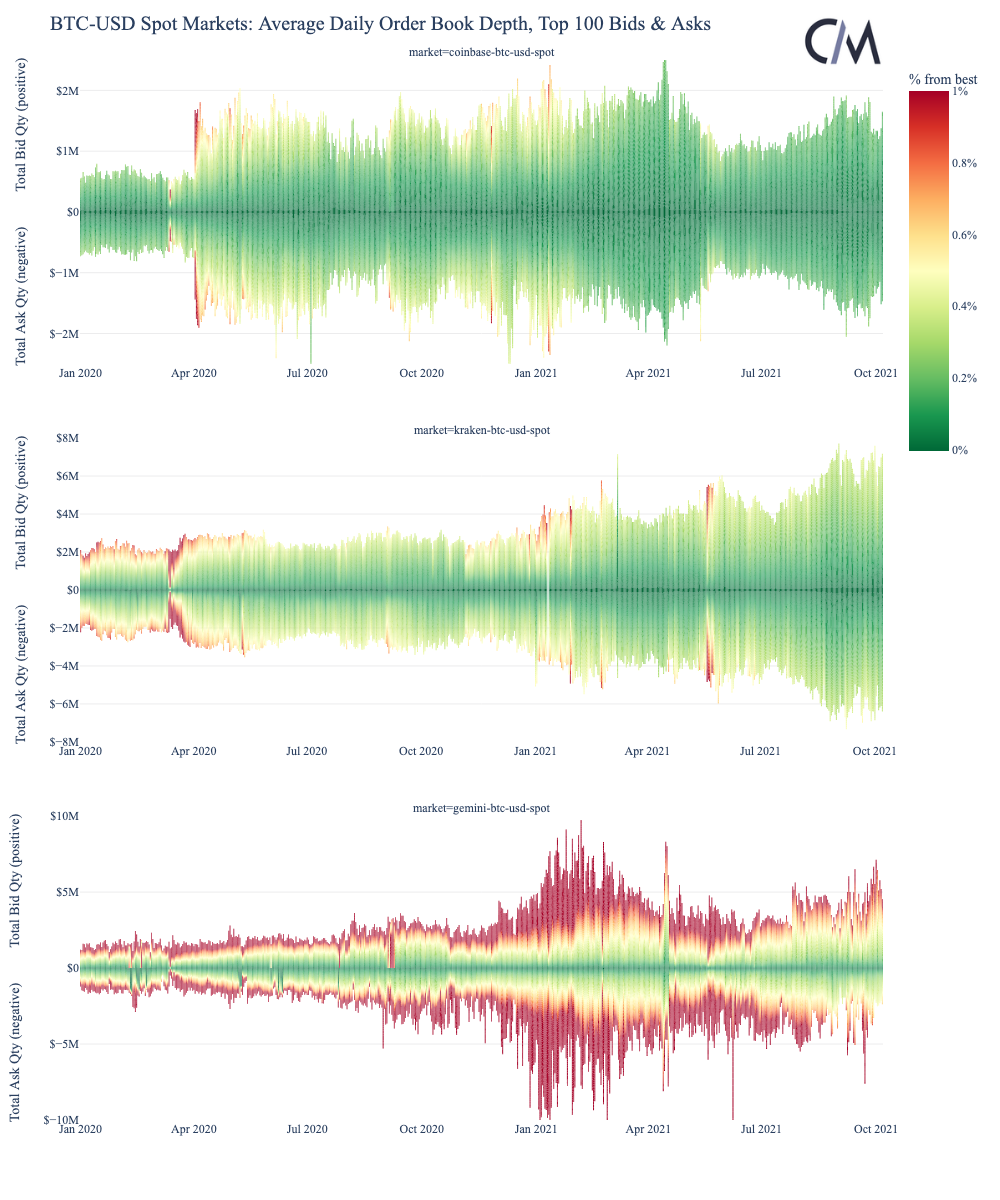

Looking at bitcoin specifically, Coin Metrics said that market depth “has generally been improving” on the three exchanges examined. It added that the quality of the market depth has also improved, using as an example that the top 100 bids and asks on Coinbase “have all been within 0.2% of the best bid/ask.”

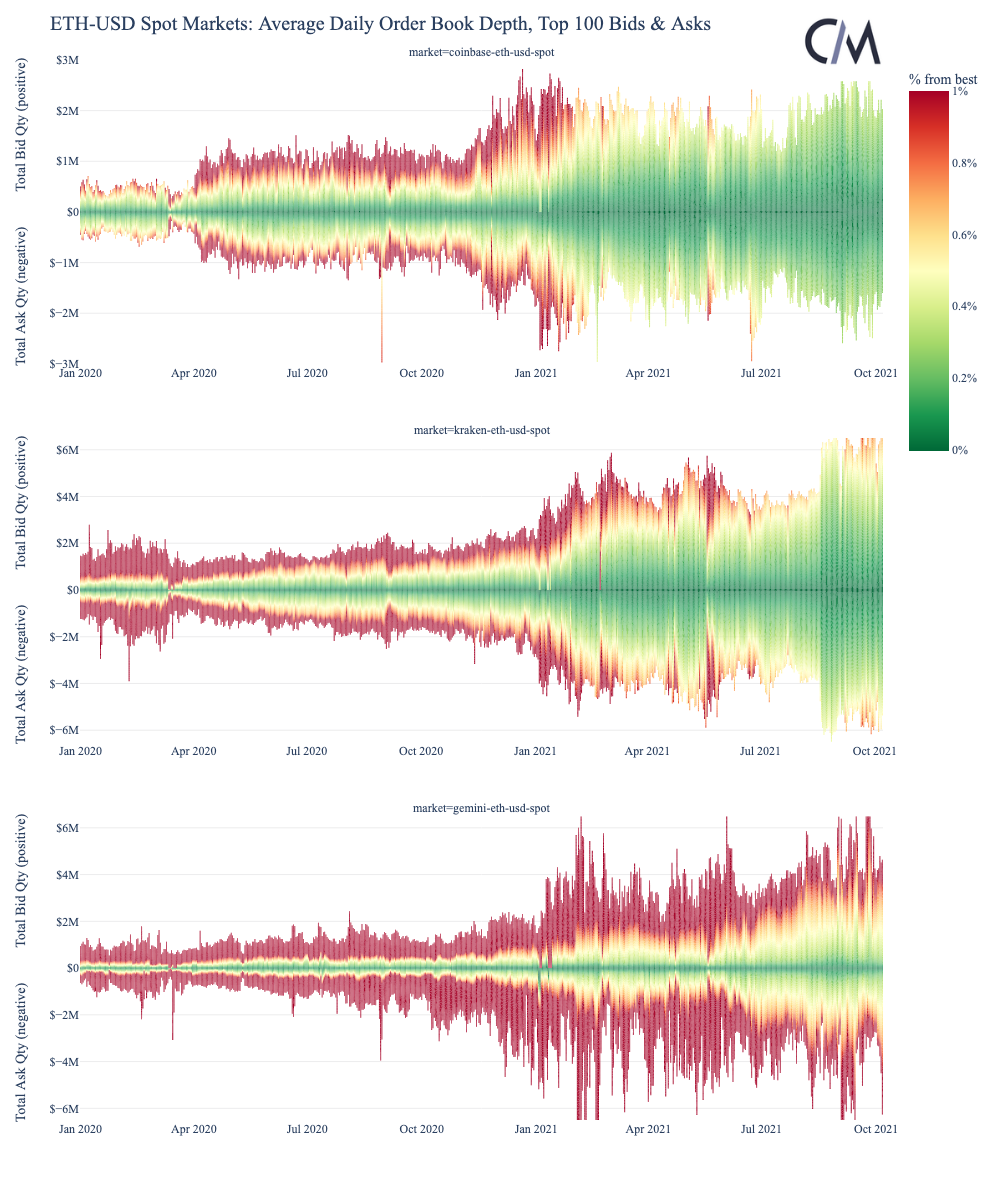

Similarly, the report said that ETH has also had “a transformative 2021,” with order book data indicating that the market for the second-most valuable cryptoasset is maturing.

“On Coinbase and Kraken there is now typically enough ETH on each side of the market available to absorb a USD 1m market order with less than 0.2% slippage,” the report said about the amount of liquidity in the ETH market.

Finally, the report also pointed out that liquidity on exchanges is something regulators look for to evaluate the risk of market manipulation and the overall maturity of a market.

“As regulators continue to weigh exchange-traded funds [ETFs] and other crypto investment products, order book depth on cryptoasset exchanges is essential data to pay attention to,” Coin Metrics concluded.

The insight that the market for BTC, in particular, is maturing could turn out to be just what is needed for the regulators, as the decision date on a number of ETFs in the US is seemingly nearing.

Posting on Twitter on Wednesday, Bloomberg’s ETF analyst Eric Balchunas pointed out that ETF issuer Ark Invest has just filed for a new bitcoin futures-backed ETF with the ticker ARKA, which Balchunas interpreted as a sign that the US Securities and Exchange Commission (SEC) is soon going to approve an ETF.

“ALSO notable, this is the second straight filing to not have the word “Canada” in it. It ONLY invests in futures, no BTCC or GBTC options,” Balchunas further said, adding that the rumor says the SEC wants a purely futures-based ETF.

Meanwhile, the same analyst also shared yesterday that Valkyrie, another of the issuers that have applied for a bitcoin futures ETF, has updated its prospectus by adding a ticker code, which he said “typically only happens when ducks in row ready for launch.”

“Can’t say this is done deal type evidence but a good sign IMO,” the ETF analyst added.

Meanwhile, Bitwise Asset Management has filed for a physically-backed BTC ETF with NYSE Arca.

“It would hold actual BTC, *not* futures. There’s already a separate BTC futures-based Bitwise ETF filing. But actual BTC is better. And we believe it’s finally possible,” Bitwise Chief Investment Officer Matt Hougan said, sharing their 100+ page analysis.

At 15:47 UTC, BTC was trading at USD 57,537 and was up by almost 3% in a day and 4% in a week. ETH reached USD 3,800 and was up by 9% in a day and almost 6% in a week.

____

Learn more:

– Experts Disagree on Prospects of Bitcoin ETF in 2021 as Deadline Nears

– Bitcoin Decouples from Stocks as Bullish Sentiment Returns

– SEC Approves Bitcoin-Related ETF as Market Awaits for ‘Real’ BTC ETF

– Ethereum Takes a Pause, as Bitcoin In Spotlight

Credit: Source link