As we saw USA approve the $1.9 Trillion Dollar stimulus package, the purchasing power of the US Dollar vs Bitcoin might be on further decline.

US Dollar vs Bitcoin Satoshi

If we take a look at the USD price vs the Satoshi (1 hundred millionth of a Bitcoin) we can clearly see every year its losing almost 99% of it’s purchasing value.

| Date | Price | Percent Change |

|---|---|---|

| 1 year ago | 12,577 sats | – 86.038% |

| 2 years ago | 25,698 sats | – 93.167% |

| 3 years ago | 10,967 sats | – 83.988% |

| 4 years ago | 81,334 sats | – 97.841% |

| 5 years ago | 238,159 sats | – 99.263% |

| 6 years ago | 340,290 sats | – 99.484% |

| 7 years ago | 158,380 sats | – 98.891% |

| 8 years ago | 2,257,851 sats | – 99.922% |

| 9 years ago | 20,366,599 sats | – 99.991% |

| 10 years ago | 108,932,462 sats | – 99.998% |

The $1,400 stimulus checks that are being dished out by the US Government could see this trend continue – south for the US Dollar vs Bitcoin.

US Dollar Purchasing Power

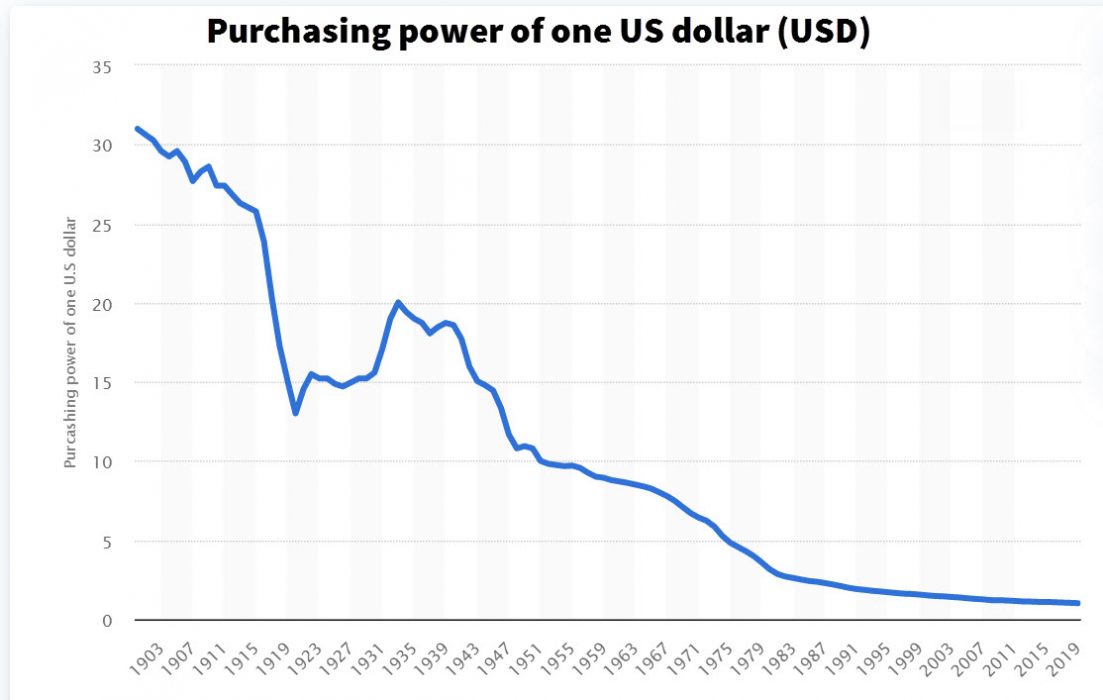

Since the year 1900 the US Dollar has lost approximately 97% of its purchasing power, according to data provided by Statista.

This essentially means when converted to the value of one US dollar back in 1900, goods and services that cost $1 would now cost $31. It is important to remember that the prices of individual goods and services inflate at different rates than currency, therefore the numbers must only be used as a guide.

Understanding Purchasing Power And Inflation

Key points:

- Purchasing power is the amount of goods or services that a unit of currency can buy at a given point in time.

- Inflation reduces the value of a currency’s purchasing power, having the effect of an increase in prices.

- Central banks try to keep prices stable through maintaining the purchasing power of the currency by setting interest rates and other mechanisms.

- As a general rule, countries attempt to keep inflation fixed at a rate of 2 percent as moderate levels of inflation are acceptable, with high levels of deflation leading to economic stagnation.

- Retirees must be particularly aware of purchasing power loss since they are living off of a fixed amount of money. They must make sure that their investments earn a rate of return equal to or greater than the rate of inflation so that the value of their nest egg does not decrease each year.

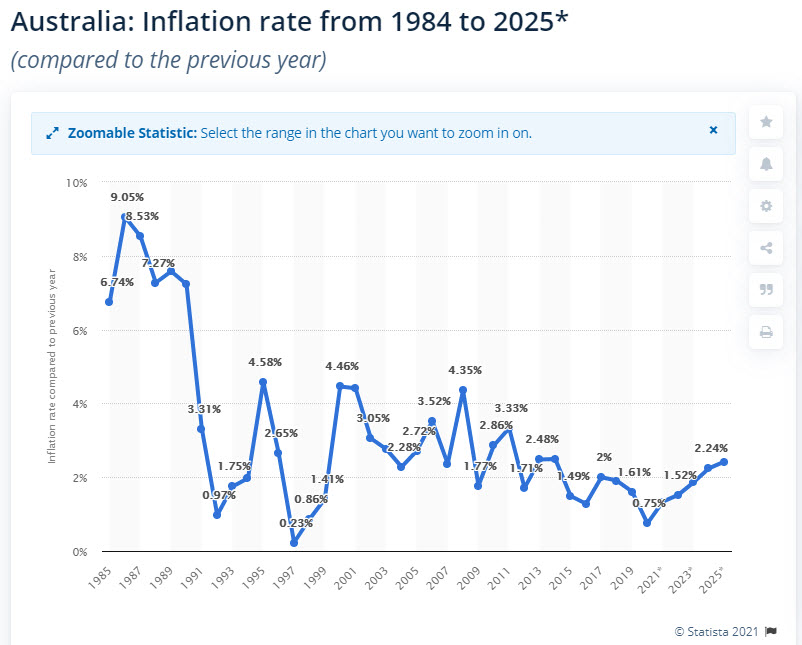

Australia has one of the world’s largest economies and is a significant global importer and exporter. It is also labeled as one of the G20 countries, also known as the Group of Twenty, which consists of 20 major economies around the globe. The Australian economy is highly dependent on its mining sector as well as its agricultural sector in order to grow, and it exports the majority of these goods to eastern Asian countries, most prominently China. Large quantities of exports have helped Australia maintain a stable economy and furthered economic expansion, despite being affected by several economic obstacles.

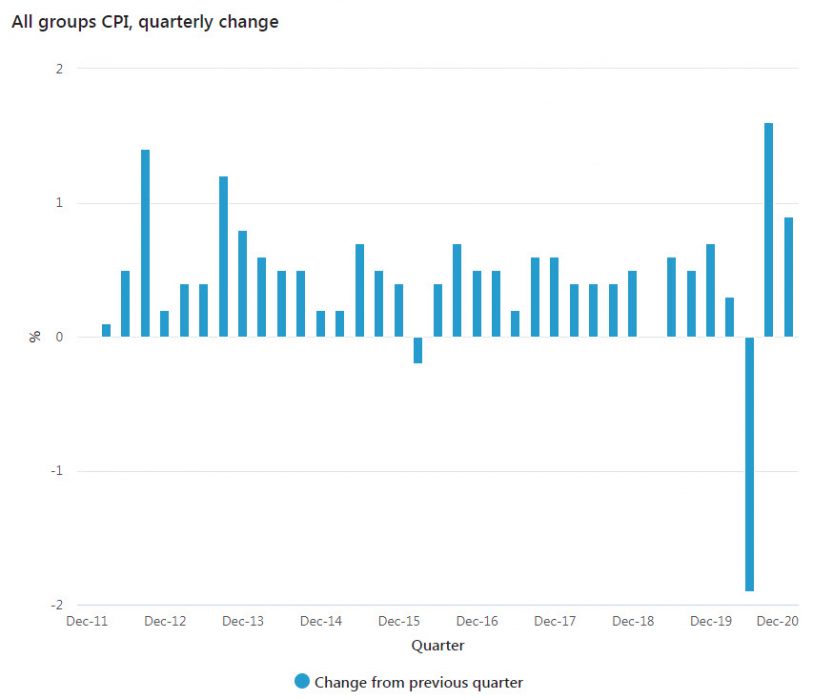

According to the Australian Bureau of Statistics the Consumer Price Index (CPI) for Australia has been rising pretty consistently for the past 10 years.

When a currency’s purchasing power decreases due to excessive inflation, serious negative economic consequences arise, including rising costs of goods and services contributing to a high cost of living, as well as high interest rates that affect the global market, and falling credit ratings as a result. All of these factors can contribute to an economic crisis.

Data sources used in this article:

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link